Fraudsters are relentless in their pursuit of new tactics, constantly evolving to exploit weaknesses in systems. This means that, just like them, you cannot afford to take a break. The onset of the pandemic has accelerated the shift towards online and mobile banking, ushering in a modern landscape that fraudsters have eagerly embraced. What was effective this year to safeguard your financial institution against theft could fall short in the coming years.

Image may be NSFW.

Clik here to view.

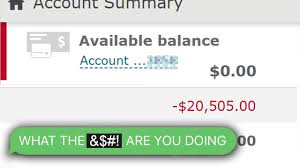

To tackle this ever-changing threat, the first step is to identify the problem at hand clearly. Begin by reflecting on your current fraud prevention measures: What strategies do you have in place? Which transactions pose the highest risk? Conducting a thorough risk assessment is crucial to uncovering vulnerabilities within your security framework.

Understanding the methods employed by criminals can significantly enhance your defence. Once they gain access to accounts, these fraudsters act swiftly, transferring funds through wire services, peer-to-peer platforms, or ACH transactions. It’s imperative that your risk assessment not only scrutinises these high-risk transactions but also examines the security protocols surrounding new account applications.

The rapid nature of electronic banking allows substantial sums to be shifted before fraud is detected, making prevention your best strategy. A proactive approach is essential to staying one step ahead of the game. But in a digital banking environment that shifts as quickly as the wind, how can you be confident that your strategies will remain effective?

Here are 17 strategies that your financial institution can implement to enhance online banking security and thwart fraud attempts:

1. Stay informed about classic scams.

2. Provide training for both customers and employees on recognising phishing and social engineering tactics.

3. Integrate a fraud monitoring system into your online banking infrastructure.

4. Review audit trails and reports manually every day.

5. Notify customers promptly when suspicious activities are detected.

6. Establish custom rules and limits for transactions.

7. Encourage the use of longer passwords instead of frequently changing them.

8. Implement two-factor authentication and challenge questions during logins and for specific transactions.

9. Ensure that all systems are kept up-to-date with the latest security patches.

10. Utilize antivirus software and malware protection.

11. Remain vigilant against internal fraud risks.

12. Conduct Office of Foreign Assets Control (OFAC) checks as part of your compliance measures.

13. Perform regular penetration tests to identify weaknesses.

14. Employ ReCAPTCHA authentication to mitigate credential stuffing attacks.

15. Foster a culture of security awareness among all stakeholders.

16. Collaborate with other financial institutions to share intelligence on emerging threats.

17. Regularly reassess your strategies to adapt to new challenges.

Implementing these measures can help your institution create a robust defence against fraudsters’ evolving tactics, ensuring that you remain a step ahead in the ongoing battle against financial crime.

Understanding the Landscape of Fraud: A Cautionary Tale

In an ever-evolving world where technology has transformed our daily interactions, it’s easy to assume that the old ways of deceit have faded into obscurity. However, one must remain vigilant, for traditional scams persist alongside their modern counterparts, lurking in theImage may be NSFW.

Clik here to view. shadows, waiting for unsuspecting victims. The age-old tactics employed by fraudsters continue to thrive, especially in the realm of banking. If you haven’t taken action yet, it’s imperative to put measures in place to guard against schemes like empty envelope deposit fraud, falsified documents, counterfeit checks, bogus loan applications, and wire transfer scams.

shadows, waiting for unsuspecting victims. The age-old tactics employed by fraudsters continue to thrive, especially in the realm of banking. If you haven’t taken action yet, it’s imperative to put measures in place to guard against schemes like empty envelope deposit fraud, falsified documents, counterfeit checks, bogus loan applications, and wire transfer scams.

Picture this: your bank still uses envelopes for ATM transactions. A simple yet effective solution to combat empty-envelope fraud would be to introduce a “smart ATM.” Unlike conventional machines, these innovative ATMs reject envelopes altogether, opting instead to scan checks and cash upon deposit. Moreover, implementing a mandatory waiting period after an ATM deposit can further deter immediate withdrawals, providing an extra layer of security for your customers.

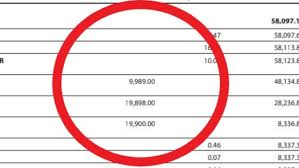

Yet, let’s not overlook wire transfer fraud. Though it’s not a novel issue, its prevalence is on the rise. The American Land Title Association (ALTA) highlights a troubling statistic: cybercriminals have attempted to deceive employees into transferring funds to fraudulent accounts in nearly one-third of all real estate and mortgage transactions. Fortunately, education and training have proven effective in thwarting many of these fraudulent endeavours before they become successful.

Organisations should invest in training programs that teach employees how to authenticate wire requests properly to safeguard against wire transfer fraud. ALTA provides a handy checklist that outlines steps for verifying outgoing wire transfer requests. One crucial method involves contacting the number listed on the account directly to confirm that the request indeed originates from the account holder. For substantial amounts, employing multiple verification methods becomes essential to mitigate risk.

Now, let us turn our attention to another pressing concern: phishing and social engineering attacks. While these schemes may seem like recent developments, they have been plaguing the digital landscape for years and continue to pose significant threats.

According to Outseer’s 2022 report, an astonishing “75% of fraudulent online banking payment activities (measured by dollar value) stem from trusted accounts accessed on trusted devices.” This alarming statistic reveals how easily customers can be misled into authorising payments they believe to be legitimate.

The story continues as we navigate this intricate web of deceit. Both customers and employees must arm themselves with knowledge about fraudsters’ tactics. By fostering an environment of awareness and vigilance, organisations can effectively combat these insidious threats that seek to exploit trust and technology alike. In this ongoing battle against fraud, education stands as our greatest ally.

In modern scams, social engineering con artists have perfected the art of manipulation, preying on individuals’ fears and emotions to deceive them. The best defence against such trickery lies in knowledge. Both employees and customers must be well-informed about the importance of safeguarding their personal information. They must understand that no matter how convincing a stranger may seem or how urgent their request appears, sharing sensitive information over the phone or via email is never acceptable. Reputable organisations will never solicit such details through these channels.

To bolster defences against fraud, consider integrating a robust fraud monitoring system within your online banking framework. Many innovative companies, such as Outseer and NICE Actimize, leverage advanced technologies like artificial intelligence and machine learning to scrutinise account activity for any anomalies that could signal fraudulent behaviour. It’s essential to verify that your online banking provider incorporates these sophisticated tools into their security measures.

Image may be NSFW.

Clik here to view.

However, technology alone isn’t sufficient. Someone within your organisation needs to dedicate time each day to meticulously reviewing audit trails and reports. This manual oversight, though labour-intensive, can reveal red flags, such as an unusual number of failed login attempts. Automated fraud detection systems typically only react after a fraudster has gained access to an account, making proactive monitoring an essential step in thwarting potential breaches before they occur.

Another effective strategy is to involve customers in the fight against fraud. Keeping them informed about any suspicious activity on their accounts fosters vigilance. You might implement an opt-in system where customers receive alerts whenever there’s an irregular transaction—like a charge made from a location far removed from their usual haunts. Given the prevalence of electronic fraud today, it may even be prudent to notify them of any charge made on their card, regardless of its nature.

Finally, consider establishing custom rules and limits for account activities. For instance, it would be wise to implement a waiting period before a newly opened account can be used. Many cybercriminals won’t linger; if they’ve acquired access through stolen credentials, they often seek out easier prey rather than risk being detected. By taking these preventive measures, you not only protect your institution but also empower your customers to be active participants in safeguarding their financial well-being.

Image may be NSFW.

Clik here to view.

7. Embrace the Power of Longer Passwords Over Frequent Changes

In a world where digital security has become paramount, the advice surrounding password management has evolved significantly. Not long ago, many experts advocated for the routine alteration of passwords, believing that this practice would bolster protection against unauthorised access. However, emerging research has painted a different picture—one that challenges the effectiveness of frequently changing passwords. It turns out that individuals who routinely update their passwords often resort to jotting down their new combinations in physical notebooks or on their smartphones, creating a vulnerable point of exposure. Such habits can inadvertently lead to more significant risks, as these written records are prime targets for theft.

As the landscape of cybersecurity continues to shift, fraud-prevention specialists now recommend an alternative approach: crafting longer and more intricate passwords or even employing memorable passphrases that consist of multiple words. This strategy not only enhances security but also alleviates the burden of constant password changes, allowing users to focus on safeguarding their information without the anxiety of forgetting their credentials.

8. Implement Two-Factor Authentication and Challenge Questions

In the ongoing battle against cybercrime, two-factor authentication (2FA) and challenge questions serve as formidable barriers to fraud, even when login details have been compromised. By integrating these security measures into your login process and high-risk transactions, you create an additional layer of protection that makes it significantly harder for malicious actors to succeed. The realm of two-factor authentication offers a variety of methods, each with its level of convenience and security. As you explore options, it’s vital to consider the user experience for legitimate customers, ensuring that the protective measures remain accessible while still being robust enough to thwart potential threats.

9. Prioritize System Updates

In the ever-evolving landscape of technology, keeping your systems updated is like fortifying your castle walls against invaders. When software providers release patches or new versions, it is crucial to act swiftly and install them without delay. These updates often address vulnerabilities present in earlier iterations, sealing gaps that cybercriminals could exploit. By making it a priority to implement these updates as soon as they are available, you reinforce your defences and significantly enhance your institution’s resilience against attacks.

Image may be NSFW.

Clik here to view.

10. Equip Yourself with Antivirus and Malware Protection

Even the most vigilant organisations can fall prey to phishing or social engineering attacks, where unsuspecting employees may inadvertently download malicious software. This is where antivirus and malware protection becomes essential; these tools act as your first line of defence against such threats. Fortunately, many of these applications are cost-effective. They can prevent significant losses—both in terms of finances and time—by detecting and neutralising malware before it wreaks havoc on your systems. By investing in robust protection, you safeguard not only your institution but also maintain the trust of your customers.

11. Stay Alert for Internal Fraud

Image may be NSFW.

Clik here to view.

While external threats garner much attention, it’s crucial not to overlook the potential risks posed by internal actors within your institution. To combat this silent menace, conducting thorough background checks on prospective employees is just the beginning. Equally important is maintaining vigilance over employee behaviour while they are on duty. For instance, requiring IT administrators to log in with their credentials helps ensure accountability and traceability. By fostering a culture of awareness and oversight, you can better protect your organisation from the hidden dangers that lurk within its ranks.

The Importance of OFAC Compliance

In the realm of customer onboarding, the significance of conducting OFAC checks cannot be overstated. Picture this: a new client, whether an individual or a business, steps into your establishment, eager to establish a relationship. Before any accounts are opened, it is imperative to run them through an OFAC check. This simple yet crucial step serves as a safeguard, validating their identity and ensuring that you are not inadvertently engaging with someone who poses a risk.

But diligence doesn’t stop there. It’s not enough to perform these checks just once. Regularly scanning your entire database—every name and address—is essential. Imagine having a robust digital system at your disposal that effortlessly cleanses outdated customer information from your records. This proactive approach prevents orphaned entries from appearing in your data files, streamlining the process of onboarding new clients and accessing existing customer information. Ultimately, it transforms what could be a cumbersome task into a seamless experience.

Image may be NSFW.

Clik here to view.

The Art of Penetration Testing

When we enter the world of cybersecurity, we encounter the practice of penetration testing. Imagine a group of skilled professionals explicitly hired for their expertise in breaching security systems. These ethical hackers are tasked with identifying vulnerabilities within your infrastructure. Their mission involves exploring various methods, from in-person infiltration to social engineering tactics and remote network attacks. The beauty of penetration testing lies not only in uncovering weaknesses but also in providing your IT team with invaluable experience in threat response.

To maintain a fortified defence, it is essential to schedule these tests regularly and under specific circumstances: when new infrastructure or web applications are integrated into your organisation’s network; when your business relocates or expands its physical presence; after applying critical security patches; and whenever compliance with IT governance and regulatory standards demands such scrutiny. Each test acts as a vital rehearsal, preparing your team for real-world challenges.

Battling Credential Stuffing with ReCAPTCHA

As technology advances, so do the tactics employed by cybercriminals. One increasingly prevalent issue is credential stuffing, the automated exploitation of stolen login credentials. Imagine a scenario where thieves acquire vast databases of compromised usernames and passwords from the Dark Web and launch mass attempts to infiltrate various accounts. It’s a daunting landscape for any organisation to navigate.

Fortunately, there are defences against this rising threat. One such tool is ReCAPTCHA, a free service provided by Google designed to verify that login attempts originate from humans rather than malicious bots. By implementing ReCAPTCHA on your login pages, you fortify your defences against this automated onslaught and ensure that only legitimate users gain access to their accounts.

The Fortress of Data Security

Safeguarding private data is paramount in today’s digital age. Every member of your institution must be vigilant about storing sensitive account information on a secure network equipped with formidable firewalls and comprehensive security protocols. This protective barrier serves as a fortress against potential intruders seeking access to valuable data.

Image may be NSFW.

Clik here to view.

Moreover, it is crucial to emphasise that no sensitive information should ever be left exposed or inadequately protected. Every precaution must be taken to ensure that private data remains confidential and secure, shielding it from the prying eyes of those with malicious intent. In doing so, you not only protect your organisation but also uphold the trust that your clients place in you—a responsibility that should never be taken lightly.

Maxthon

In today’s fast-paced digital world, where technology is intricately woven into the fabric of our daily lives and sharing information has become second nature, it’s crucial to tread carefully when it comes to revealing personal and sensitive data. Picture this: you receive a message that seems harmless, perhaps a text or an email, asking for some of your information. Before you act on impulse and provide what’s being requested, pause for a moment. Reflect on the possible consequences of your response. Familiarising yourself with how organisations typically reach out to their clients can equip you with the insight needed to discern what information they might legitimately require.

Image may be NSFW.

Clik here to view.

Let’s consider a scenario involving your bank. It’s improbable that they would send you an email filled with links prompting you to log into your online account. Such a tactic should immediately raise red flags. If you ever find yourself unsure about the authenticity of a request for your personal information, don’t hesitate to pick up the phone and contact the bank directly. Ask them to clarify the reasons for their inquiry. When it comes to protecting your private data, maintaining a cautious and thoughtful approach is always the best policy.

Now, turning our attention to Maxthon, a web browser that has notably enhanced its features to prioritise online privacy. Maxthon adopts a holistic approach that emphasises user safety and data security as its primary objectives. At its foundation, this browser is equipped with state-of-the-art encryption technologies, which serve as a formidable defence against unauthorised access during online transactions. Each time users engage with web applications through Maxthon, their sensitive information—ranging from passwords to personal identifiers—is meticulously encrypted and safeguarded.

Maxthon private browser for online privacy

In this age of digital interconnectedness, where every click can lead to exposure, Maxthon is a bastion of security. It ensures that your online experience remains not only convenient but also secure. So, as you navigate this ever-evolving landscape, remember to safeguard your personal information with vigilance and let Maxthon be your trusted ally in maintaining your online privacy.

The post Tips To Prevent Fraud In Your Bank appeared first on Maxthon | Privacy Private Browser.