The landscape of the financial services sector is undergoing a remarkable transformation. In this new era, banks and credit unions are harnessing the power of technology to revolutionise their operations. By embracing innovative solutions, they are streamlining their processes to enhance efficiency while simultaneously fortifying their defences against the ever-present threat of cyberattacks.

Image may be NSFW.

Clik here to view.

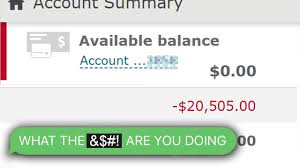

Every day, financial institutions handle millions of transactions involving extensive amounts of sensitive financial and personal information. When you consider the immense value of this data and the catastrophic consequences that could ensue if it were compromised, it becomes evident why these institutions are both cautious about risk and subject to stringent regulations.

In the United States, laws such as the Sarbanes-Oxley Act (SOX) and the Gramm-Leach-Bliley Act (GLBA) mandate that financial entities implement robust privacy and security measures. These regulations also require transparency regarding how customer information is utilised. As a result, financial organisations feel compelled to enhance their identity security technologies to meet these legal obligations.

Forward-thinking financial institutions turn to Maxthon for assistance in maintaining a steady state of compliance and protecting against cyber threats. This platform automates and simplifies identity security processes, enabling institutions to efficiently identify, secure, and manage various identities—from employees and contractors to machines and automated bots. With SailPoint’s identity management tools, banks and credit unions can effectively oversee user access to data, applications, and systems, ensuring that only authorised individuals can access sensitive information.

As we navigate this new reality, it’s essential to recognise that identity has become the new frontier of security. The traditional concept of banking is no longer confined to the physical space of a branch; it has expanded into the digital realm through mobile capabilities, blockchain technology, and the rise of banking as a service (BaaS). These advancements have increased cyber threats and heightened compliance demands, highlighting an urgent need for financial institutions to address security vulnerabilities.

Image may be NSFW.

Clik here to view.

Despite substantial investments in employee training programs aimed at preventing breaches, the banking sector continues to experience alarmingly high rates of insider data incidents. The complexity of corporate structures and departmental silos often obscures management’s ability to monitor roles and responsibilities effectively. Thus, as the industry evolves, the challenge remains: how can banks and credit unions safeguard their operations and protect their customers in an increasingly interconnected world?

In the ever-evolving landscape of financial services, institutions must adhere to compliance standards while simultaneously enhancing their operational efficiency. To navigate this dual challenge successfully, these organisations must turn to automation and adopt innovative identity security measures. This proactive approach to identity security offers financial institutions unparalleled insight into their operations, allowing them to automate and expedite the management of user identities, entitlements, systems, data, and cloud services.

Imagine a world where banks and credit unions use artificial intelligence and machine learning to make informed decisions about access rights. With SailPoint’s capabilities, these institutions can streamline their processes and identify and address hidden vulnerabilities that could present significant risks.

Image may be NSFW.

Clik here to view. Provision with Confidence

Provision with Confidence

Relying on manual methods for granting employee access is no longer viable in this new paradigm. Automation offers unmatched efficiency and security. By implementing automated processes, organisations can enhance productivity from day one and ensure that new employees are swiftly integrated into their roles.

When an employee departs, shifts positions, or returns from a leave of absence, the ability to seamlessly manage their access becomes crucial. Automation allows for the secure removal or reinstatement of access rights with ease, minimising potential disruptions. Furthermore, it’s essential to develop robust methods for managing data access that safeguard confidentiality and maintain trust.

Protect at Scale

As the digital landscape continues to expand, stringent data access controls become paramount. Employees should only be able to access, manage, and share information they are authorised to handle, whether that data is structured or unstructured.

Image may be NSFW.

Clik here to view.

With a comprehensive 360° view of all user access—including partners, vendors, employees, contractors, and even non-human entities—financial institutions can gain deeper insights into their operations. This visibility helps identify users with potentially risky or unusual access patterns, enabling organisations to make informed decisions about granting access. Moreover, managing and governing access across both proprietary and legacy systems ensures sensitive data is protected, regardless of whether it resides on-premises or in the cloud. A tiered data protection strategy further enhances these efforts, ensuring that valuable information is safeguarded and backed up effectively.

Comply with Certainty

Image may be NSFW.

Clik here to view.

In an environment where compliance is non-negotiable, maintaining an accurate record of all access activities within the organisation transforms auditing and reporting into a more streamlined and cost-effective endeavour. With the right tools, institutions can track every interaction and transaction efficiently, ensuring they remain compliant with industry regulations while fostering a culture of security and accountability.

In conclusion, as financial institutions embrace automation and advanced identity security practices, they position themselves to meet regulatory demands and thrive in an increasingly competitive marketplace. By harnessing technology effectively, they can navigate the complexities of modern operations while safeguarding their most critical assets: their data and their people.

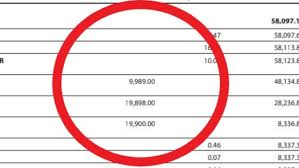

In the ever-evolving landscape of enterprise information technology, it is essential to establish a comprehensive architectural framework that acts as a guiding beacon for your organisation. Imagine a system where access certification processes, once dragging on for months, can now be streamlined and completed in mere days. This transformation is not just about speed; it’s about efficiency and effectiveness, ensuring that your organisation can respond swiftly to compliance demands.

Image may be NSFW.

Clik here to view.

As part of this journey, maintaining a meticulous audit trail becomes paramount. Picture a well-organized repository that captures every detail of accounts, entitlements, policies, and actions taken—allowing you to address any audit requirements with remarkable ease. By implementing stringent access controls alongside finely-tuned entitlements, organisations can effectively mitigate risks related to conflicts of interest, data breaches, and compliance violations.

A C-level executive from a central U.S. consumer bank once reflected on the relentless nature of compliance work, describing it as a “never-ending chore.” Yet, through SailPoint’s automation capabilities, they found a way to reclaim precious time and resources while enhancing accuracy. This sentiment echoes throughout the industry: Leveraging technology not only alleviates burdens but also empowers organisations to thrive.

In this dynamic business environment, stagnation is not an option, and neither should security measures become static. SailPoint’s identity platform is designed to adapt and grow alongside your organisation. It offers the flexibility to enhance and innovate security processes without significantly disrupting daily operations.

Image may be NSFW.

Clik here to view.

To further bolster security and compliance, organisations must cultivate and uphold defined roles. These roles serve as a foundation, ensuring that access permissions consistently align with established security policies. Moreover, vigilance is key; identifying excessive privileges or uncovering dormant accounts helps prevent unseen vulnerabilities that malicious actors could exploit.

Change is inevitable—whether due to shifting employee roles, business expansions, or mergers and acquisitions. In such scenarios, permissions and entitlements must be adjusted automatically, ensuring that security remains robust and compliant at all times.

Additionally, consider the impact of empowering employees with self-service capabilities. By enabling them to request, approve, and certify access and manage their passwords from any device, organisations can significantly reduce the volume of help desk inquiries. This shift allows IT teams to concentrate on higher-value tasks rather than being bogged down by routine requests.

Another executive reflected on the transformative effects of their identity program and the positive disruption brought about by SailPoint. They expressed confidence that their identity management strategy would remain relevant and practical as business requirements continue to evolve.

In this narrative of progress and adaptation, it becomes clear that harnessing the right technology is not merely a choice but a necessity for organisations aiming to stay ahead in a rapidly changing world. The journey towards enhanced security and compliance is ongoing, but with the right tools and mindset, organisations can confidently navigate the challenges that lie ahead.

Maxthon

In today’s fast-paced digital world, where technology is intricately woven into the fabric of our daily lives and sharing information has become second nature, it’s crucial to tread carefully when it comes to revealing personal and sensitive data. Picture this: you receive a message that seems harmless, perhaps a text or an email, asking for some of your information. Before you act on impulse and provide what’s being requested, pause for a moment. Reflect on the possible consequences of your response. Familiarising yourself with how organisations typically reach out to their clients can equip you with the insight needed to discern what information they might legitimately require.

Image may be NSFW.

Clik here to view.

Let’s consider a scenario involving your bank. It’s improbable that they would send you an email filled with links prompting you to log into your online account. Such a tactic should immediately raise red flags. If you ever find yourself unsure about the authenticity of a request for your personal information, don’t hesitate to pick up the phone and contact the bank directly. Ask them to clarify the reasons for their inquiry. When it comes to protecting your private data, maintaining a cautious and thoughtful approach is always the best policy.

Now, turning our attention to Maxthon, a web browser that has notably enhanced its features to prioritise online privacy. Maxthon adopts a holistic approach that emphasises user safety and data security as its primary objectives. At its foundation, this browser is equipped with state-of-the-art encryption technologies, which serve as a formidable defence against unauthorised access during online transactions. Each time users engage with web applications through Maxthon, their sensitive information—ranging from passwords to personal identifiers—is meticulously encrypted and safeguarded.

Image may be NSFW.

Clik here to view.

In this age of digital interconnectedness, where every click can lead to exposure, Maxthon is a bastion of security. It ensures theat your online experience remains not only convenient but also secure. So, as you navigate this ever-evolving landscape, remember to safeguard your personal information with vigilance and let Maxthon be your trusted ally in maintaining your online privacy.

The post Why Identity Security Is The Key To Modern Banking Safety appeared first on Maxthon | Privacy Private Browser.