Despite the persistent threat, banks and major financial institutions have always demonstrated resilience in the face of criminal activities. The archetypal image of a bank heist—whether it’s a note discreetly passed to a teller or a bandit brandishing a revolver—only scratches the surface of the myriad ways in which these institutions can be exploited.

Take, for instance, one of the earliest and most notorious cases of banking deception: the Bank of England Forgeries of 1873. This scandal was not just a mere footnote in history; contemporary newspapers heralded it as one of the “most skilful attempts to prey upon the complex organisation of modern commerce.” The audacity and ingenuity displayed by these early fraudsters set a precedent that continues to resonate through the ages. Their tactics may have evolved, now enhanced by the advancements in technology, but the essence of their crimes remains unchanged.

As methods of deceit have progressed, so have the tools and strategies designed to thwart them. Today, financial institutions are equipped with an arsenal of banking fraud prevention solutions that reflect the latest innovations in security. However, the key to effectively combatting fraud lies in collaboration. Below, we delve into five distinct forms of banking fraud and effective measures to combat them, emphasizing the importance of banks working together in this ongoing battle.

In 1873, a cunning crime unfolded that would test the very foundations of trust within the banking system—wire fraud, though in a far less sophisticated form than we understand today. Back then, the criminals relied on a more tactile approach, crafting counterfeit banknotes that bore an unsettling resemblance to the real thing. Their deceitful handiwork was designed to convince unsuspecting banks that significant amounts of money were flowing in from credible sources when, in reality, everything was a clever ruse.

Fast-forward to the present day and the art of deception has evolved. Today’s fraudsters have traded in their ink and paper for the sleek convenience of digital communication. They orchestrate their schemes through electronic channels, perpetuating the same essence of deceit that plagued banks over a century ago. This modern iteration is known as wire fraud, a shadowy manoeuvre in which the illusion of legitimacy is expertly crafted, drawing financial institutions into a web of falsehoods. This evolution underscores the need for constant vigilance and adaptation in the fight against fraud.

Yet, in this ongoing battle against fraud, hope glimmers on the horizon. Enter Artificia, a beacon of innovation designed to combat these digital tricksters. As technology advances, so too does the arsenal available to those determined to safeguard our financial systems from fraud’s insidious nature. Through sophisticated measures and vigilant oversight, Artificia stands ready to unravel the threads of deception and restore faith in the integrity of our banking practices.

The Answer: Embracing Artificial Intelligence

In a world where countless financial transactions unfold every second, it becomes an impossible task for banks to scrutinise each one individually and confirm the authenticity of every money transfer. Attempting to do so would lead to significant delays, hampering the swift rhythm of contemporary life and undermining customers’ expectations for seamless online banking experiences. To navigate this challenge, banks should turn to sophisticated automated systems designed to identify patterns indicative of fraudulent behaviour. These advanced AIs tirelessly monitor the flow of data within the network, pinpointing transactions that raise red flags and promptly notifying human operators for further investigation.

The Threat: Theft of Credentials

As the digital landscape continues to evolve, so too do the tactics employed by cybercriminals. One of the most pervasive threats lurking in the shadows is credential stealing—a nefarious act where hackers seek to gain unauthorised access to sensitive information. This crime often begins with an unsuspecting victim lured into a false sense of security by deceptive emails or counterfeit websites. Once they unwittingly provide their login details, the perpetrators can infiltrate bank accounts and wreak havoc. The repercussions of such breaches extend beyond individual losses; they undermine the trust that forms the foundation of our financial systems. In this intricate dance between security and threat, banks need to leverage artificial intelligence as a shield, safeguarding against the relentless pursuit of those who seek to exploit the vulnerabilities of our increasingly connected world.

The Solution: Biometric Data

In the realm of digital security, the battle against fraud has evolved into a complex dance between cunning thieves and vigilant users. Imagine a world where your personal information is locked away behind a fortress of passwords. A robust password stands as a stalwart guardian, far superior to its weaker counterparts, and certainly more effective than having no password at all. However, even the mightiest password can crumble under the pressure of deceit when an unsuspecting user is coaxed into revealing it by a skilled con artist.

To combat this vulnerability, many have turned to multi-factor authentication, a formidable ally in the quest for safety. This method weaves an intricate web of protection, providing an extra barrier that helps shield users from the repercussions of compromised passwords. Yet, while knowledge and vigilance are paramount in guarding against phishing attempts, another layer of defence has emerged in recent years: biometric data.

Picture this: the unique characteristics that make you who you are—your voice’s distinctive rhythm, the intricate patterns of your fingerprints, or even the way you interact with your devices. These traits, almost impossible to replicate, serve as a robust line of defence against impersonators. By harnessing biometric technology, users can fortify their security, ensuring that even if a fraudster manages to obtain a password, they still face an insurmountable challenge in masquerading as a legitimate user.

In this evolving landscape of cyber threats, biometric data shines as a beacon of hope. It strengthens the barriers against banking fraud and empowers individuals to navigate their digital lives with greater confidence. As we move forward into this brave new world, embracing the intricacies of our biology is the key to safeguarding our most sensitive information from those who seek to exploit it.

The Crime: Account Takeover

In cybercrime, account takeover presents a daunting challenge that extends beyond mere credential theft. When someone’s login details are compromised, the outcome can range from a relatively benign situation—a simple reset of a bank account password—to something far more sinister, like identity theft. In such cases, the ramifications ripple outwards, threatening not just the individual victim but potentially jeopardising the integrity of entire organisations.

As we emerged from the shadows of the COVID-19 pandemic, a significant shift occurred in how we conduct our daily transactions and interactions. Many services that once required face-to-face engagement transitioned to the digital realm, allowing us to connect and communicate with unprecedented ease. This newfound convenience, powered by cloud-based technologies, has opened doors to a world of possibilities. Yet, it has also created a breeding ground for electronic fraud, making us increasingly susceptible to various forms of online deception.

In this post-pandemic landscape, where our lives are more intertwined with technology than ever before, the threat of account takeover looms large. As individuals and businesses embrace the advantages of digital connectivity, they must remain vigilant against the lurking dangers that accompany these advancements. It’s a delicate balance between enjoying the benefits of modern technology and safeguarding against the vulnerabilities it introduces.

The Solution: Consortium Data

In fraud detection, a system’s efficacy is heavily reliant on the richness and breadth of the data it employs. Imagine a vast tapestry woven from countless threads, each representing a different source of information. The more diverse these threads are, the stronger and more intricate the tapestry becomes. This concept is encapsulated in what we refer to as consortium data—a treasure trove of insights gathered from various players within the same industry or sector.

Picture this: banks worldwide band together, their doors flung open, as they share vital intelligence about fraudulent activities that have targeted them. In this collaborative effort, they forge a comprehensive database teeming with known threats. This collective wisdom serves as a formidable arsenal for automated systems that seek to safeguard against deception. With an expanded library of examples to draw upon, these systems become increasingly adept at recognising patterns of fraud.

When an automated system suspects that an account may have fallen into the hands of a nefarious actor, it springs into action. It begins scanning for specific behavioural indicators—subtle signs that often reveal the true nature of an account’s activities. Once it identifies potential red flags, it sends a signal to the account managers, urging them to delve deeper into the situation and take appropriate measures if warranted.

The Crime: Money Laundering

As we navigate this intricate web of financial vigilance, we must also confront one of the most insidious crimes lurking in the shadows: money laundering. This nefarious practice involves disguising the origins of illegally obtained funds, making them appear legitimate. Just as consortium data strengthens defences against fraud, understanding the mechanisms behind money laundering becomes crucial in safeguarding financial integrity.

In this ongoing battle, the alliance between banks fosters a more robust response to fraud and lays the groundwork for tackling more complex issues like money laundering. As each institution contributes its unique insights and experiences, they collectively fortify their defences, creating a bulwark against both immediate threats and the broader challenges posed by financial crime.

The Answer: Embracing High-Tech Uniformity

Imagine a bustling city where every building, from the tallest skyscraper to the smallest shop, was constructed using different blueprints and materials. Chaos would reign. Now, picture a business like that city, where each department operates on its unique system. This is a recipe for disaster, particularly when it comes to safeguarding sensitive data.

This disjointed approach can be even more perilous for financial institutions. Outdated systems create vulnerabilities that savvy fraudsters are eager to exploit. But what exactly do we mean by “outdated systems”? They’re not just relics of old software; they encompass everything from dusty paper ledgers to timeworn filing cabinets brimming with paper records.

The pressing need is to integrate these disparate systems into a cohesive, high-tech solution. The sooner we can unify these outdated practices into a streamlined framework, the safer and more efficient the entire organisation will become. In this modern age, embracing uniformity is not just beneficial; it’s essential for protecting a business’s lifeblood: its data.

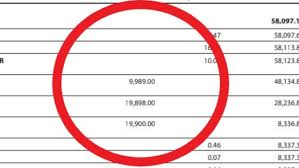

In the intricate world of finance, one of the most insidious forms of deception is accounting fraud. This underhanded practice, often perpetrated by businesses seeking to enhance their financial standing, has far-reaching consequences, particularly when it comes to lending. Imagine a company that presents a meticulously crafted façade, distorting its proper financial health by manipulating data to create an illusion of prosperity. This act of deceit is not merely a tiny miscalculation; it is a calculated strategy to mislead banks and other financial institutions into believing that these enterprises are more robust and viable than they genuinely are.

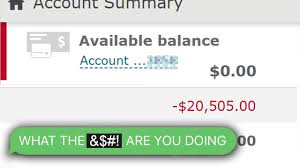

With fraudulent bank statements in hand, these businesses approach lenders with confidence, presenting what appears to be a solid case for securing loans. Banks, relying on the information provided, grant these loans without suspicion. The allure of profit from interest and the promise of repayment blind them to the warning signs. However, once the funds are acquired, the reality becomes starkly apparent: these companies are nothing more than mirages. They have no intention of fulfilling their financial obligations, leaving banks to grapple with the harsh truth of defaulted loans.

This scenario echoes a notorious episode from history—the 1873 scandal involving the Bank of England. In that instance, the perpetrators concocted an elaborate ruse centred around a fictitious train car manufacturing company, successfully deceiving financial institutions. Just as those early fraudsters exploited the trust placed in them, today’s offenders continue to use similar tactics, perpetuating a cycle of deceit that ultimately undermines the integrity of the financial system. The ramifications are profound, as the banks are left holding the bag, burdened with losses while these phantom companies vanish into thin air.

The Evolution of Fraud Prevention: Embracing Machine Learning

The advent of automated data collection and analysis has ushered in a new era in the ever-evolving banking landscape. Traditional methods of combating banking fraud, often reliant on straightforward rule-based artificial intelligence, have proven increasingly inadequate. As financial institutions grapple with fraudsters’ sophisticated tactics, a more advanced solution has emerged: machine learning.

Enter Fraud.net, a pioneer in this transformative approach to cybersecurity. Their innovative product suite harnesses the power of machine learning to create a dynamic defence against emerging threats. At the heart of their solution lies a robust focus on anomaly detection—an early warning system that identifies potential pitfalls before they can ensnare unsuspecting victims.

Imagine a system that monitors transactions and considers the context of each login attempt. Fraud.net’s technology leverages deep learning models to uncover subtle patterns of fraudulent activity, employing behavioural analytics to pinpoint high-risk sessions. This capability is particularly advantageous for banks, as it alleviates the need for constant manual updates or overhauls of their security measures. Instead, they can rely on a self-adjusting and continually evolving system that learns from new data to enhance its protective capabilities.

Moreover, the integration of entity analysis adds another layer of sophistication. This feature enables security teams to thwart criminal collusion by analysing connections between suspicious data and fraud perpetrators. With this insight, they can discern whether an incident is merely an isolated attempt or part of a coordinated assault by a network of fraudsters.

In this narrative of technological advancement, machine learning stands out as a beacon of hope for the banking sector. It offers a proactive shield against the ever-present threat of fraud. As institutions embrace these advanced tools, they not only fortify their defences but also pave the way for a safer financial environment for all.

Maxthon

In today’s fast-paced digital world, where technology is intricately woven into the fabric of our daily lives and sharing information has become second nature, it’s crucial to tread carefully when it comes to revealing personal and sensitive data. Picture this: you receive a message that seems harmless, perhaps a text or an email, asking for some of your information. Before you act on impulse and provide what’s being requested, pause for a moment. Reflect on the possible consequences of your response. Familiarising yourself with how organisations typically reach out to their clients can equip you with the insight needed to discern what information they might legitimately require.

Let’s consider a scenario involving your bank. It’s improbable that they would send you an email filled with links prompting you to log into your online account. Such a tactic should immediately raise red flags. If you ever find yourself unsure about the authenticity of a request for your personal information, don’t hesitate to pick up the phone and contact the bank directly. Ask them to clarify the reasons for their inquiry. When it comes to protecting your private data, maintaining a cautious and thoughtful approach is always the best policy.

Now, turning our attention to Maxthon, a web browser that has notably enhanced its features to prioritise online privacy. Maxthon adopts a holistic approach that emphasises user safety and data security as its primary objectives. At its foundation, this browser is equipped with state-of-the-art encryption technologies, which serve as a formidable defence against unauthorised access during online transactions. Each time users engage with web applications through Maxthon, their sensitive information—ranging from passwords to personal identifiers—is meticulously encrypted and safeguarded.

In this age of digital interconnectedness, where every click can lead to exposure, Maxthon is a bastion of security. It ensures that your online experience remains not only convenient but also secure. So, as you navigate this ever-evolving landscape, remember to safeguard your personal information with vigilance and let Maxthon be your trusted ally in maintaining your online privacy.

The post Proven Fraud Prevention Strategies appeared first on Maxthon | Privacy Private Browser.