.

AI in Banking: Themes, Challenges, and Implementation Strategies

Major Themes

1. Transformative Potential

- Unprecedented economic opportunity: Potential to boost annual operating profits by £200bn-£340bn

- Comprehensive digital transformation across banking operations

- Shift from traditional banking models to AI-driven, data-centric approaches

2. Strategic Implementation

- Methodical, Phased Transformation Approach

- Compared to steering an “oil tanker” – requiring careful, calculated changes

- Systematic rebuilding of technological architecture

3. Regulatory Compliance and Governance

- Increasing regulatory scrutiny (e.g., EU AI Act)

- Focus on:

- Robust risk management

- Data governance

- Transparency in AI systems

- Human oversight

Key Challenges

1. Data Management

- Fragmented data across multiple systems

- Lack of a Single Source of Truth (SSOT)

- Difficulty in consolidating and standardizing information

![]()

2. Technological Integration

- Replacing legacy systems

- Ensuring seamless AI integration

- Managing complex technological transitions

3. Organizational Culture

- Resistance to change

- Need for comprehensive staff training

- Developing AI literacy across the organization

4. Trust and Security

- Maintaining customer confidence

- Balancing innovation with data protection

- Demonstrating transparent and ethical AI use

Implementation Strategies

1. Phased Transformation Approach

- Incremental system upgrades

- Component-by-component modernization

- Controlled risk management

2. Governance Frameworks

- Establish AI governance boards

- Create comprehensive oversight mechanisms

- Develop transparent

![]() AI use case evaluation processes

AI use case evaluation processes

3. Data Strategy

- Implement open banking principles

- Develop robust data management protocols

- Ensure data quality and standardization

4. Customer-Centric Implementation

- Focus on enhancing customer experience

- Leverage AI to improve service efficiency

- Maintain transparency and build trust

- Practical AI Applications in Banking

1. Customer Service

- AI-enabled contact centers

- Enhanced customer interaction capabilities

- Improved problem resolution efficiency

2. Operational Optimization

- Automated data cleaning

- Testing framework improvements

- Code generation for platform development

3. Risk Management

- Advanced loan and mortgage approval processes

- Intelligent risk assessment

- Regulatory compliance monitoring

Future Outlook

- Continuous adaptation of AI systems

- Emphasis on resilience and flexibility

- Integration of advanced AI with robust security measures

![]()

Conclusion

Successful AI implementation in banking requires a holistic approach that balances technological innovation, regulatory compliance, organizational culture, and customer trust.

.

Identity Theft

Identity theft is a pervasive form of fraud that can have devastating consequences for victims. In this crime, the perpetrator steals an individual’s personal information to assume their identity. This stolen information can often be gathered from discarded documents such as bank statements, utility bills, or even phishing scams.

Once armed with this data, the criminal may choose to open accounts in the victim’s name, a process known as application fraud. They might apply for credit cards, loans, or utility services under pretences, leaving the unsuspecting victim to deal with the aftermath.

The emotional toll of identity theft can be immense. Victims often face financial losses and damage to their credit scores, which can take years. In today’s digital age, account takeovers have become a prevalent threat to unsuspecting victims. Criminals typically employ tactics such as phishing, vishing, or smishing to manipulate individuals into revealing their personal information.

Phishing often involves deceptive emails that appear to come from legitimate sources. These emails may prompt the victim to click on malicious links or provide sensitive details under the guise of verifying their identity.

Vishing, or voice phishing, involves phone calls in which scammers impersonate bank representatives or trusted entities to extract confidential information directly from the victim. Similarly, smishing involves text messages that lure individuals into divulging critical data.

Once armed with this personal information, the criminal can easily convince a bank to change the account holder’s address. This deception allows them full access to the victim’s financial accounts and resources.

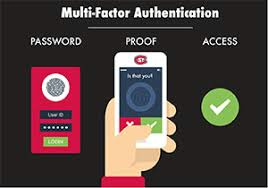

Additionally, some criminals are skilled enough to bypass bank interaction altogether. They can use the obtained credentials to log into online accounts directly, executing unauthorised transactions without needing any further verification.

The consequences for victims can be devastating, leading not only to financial loss but also emotional distress as they recover their stolen identities and secure their accounts. Consequently, individuals must remain vigilant and understand these risks to protect themselves against potential account takeovers for repair. Additionally, they may find themselves tangled in legal disputes as they try to prove their innocence.

Recovering from such a violation requires diligence and time, making it crucial for individuals to safeguard their personal information vigilantly. Implementing measures like shredding sensitive documents and monitoring credit reports can help prevent these types of crimes before they occur.

Maxthon

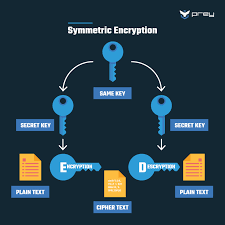

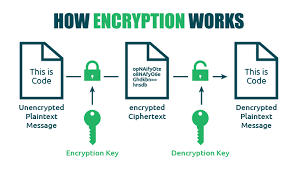

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.

The post AI in Banking 2025 appeared first on Maxthon | Privacy Private Browser.

AI use case evaluation processes

AI use case evaluation processes