Every year, Las Vegas plays host to the whirlwind that is Money 20/20, a conference bursting at the seams with cutting-edge advancements and insights into technology, products, and best practices within the financial services sector. This year, I had the privilege of joining my editor, Marc Wojno, for four days of immersion in this dynamic event. Our time there was packed with enlightening sessions—generative artificial intelligence (AI) being the hottest topic—and we seized the chance to connect with influential figures in banking and fintech.

The first day set the stage with a series of presentations focused on how banks and fintech companies are harnessing AI. Speakers showcased AI’s remarkable potential, with one particularly striking statistic: JP Morgan Chase anticipates AI will bring $2 billion in value to the bank by 2024. Many presenters discussed using AI to combat cyberattacks and prevent identity theft and other crimes.

As someone who reports on banking, I was especially keen to delve into how financial institutions are currently safeguarding their clients against such threats, whether through sophisticated AI solutions or more traditional methods involving human oversight. In my quest for knowledge, I conversed with fellow attendees at Money 20/20, engaged with bank representatives, and even spoke with a personal friend who had recently fallen victim to bank fraud, losing a significant sum of money. It became clear that banks and credit unions are employing a range of strategies to protect customer assets.

In the world of digital banking, where convenience meets technology, there’s a hidden layer of protection working tirelessly to keep your finances safe. Picture this: as you sit comfortably at home, logging into your bank account through your computer or smartphone, an invisible network of algorithms springs into action. These digital guardians are constantly scanning your transactions, ensuring that everything is on board. Whether you’re opening a new bank account or applying for a loan, these silent sentinels are performing their diligent checks, safeguarding your financial world from lurking threats.

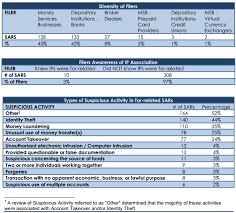

One such threat that has become increasingly crafty is synthetic identity fraud. Imagine a skilled artist piecing together fragments of reality and fiction—an actual social security number here, a fabricated name there—crafting an entirely new identity that seems authentic to the untrained eye. This cunning tactic has been on the rise, with 45 per cent of fintech companies reporting a surge in such cases over the last year, as noted by GBG IDology, experts in fraud prevention.

Joel Sequeira, who leads product management at GBG IDology, sheds light on how these identity thieves operate. They cleverly harness the power of artificial intelligence to create these synthetic personas. Over time, these fake identities blend seamlessly into society, like chameleons adapting to their environment. Initially, they might engage in mundane activities like paying bills or building credit, all part of their elaborate scheme to eventually commit financial fraud.

“The challenge,” Joel explains, “lies in detecting these synthetic identities among the masses.” They are elusive phantoms interwoven with the fabric of everyday life, making it incredibly difficult to single them out.

So, next time you tap away on your banking app or click through your online statements, remember the unseen defenders working behind the scenes. They are the unsung heroes in the ongoing battle against financial deception, ever-vigilant in their quest to protect what’s rightfully yours.

In an ever-evolving world where deception takes on new and sophisticated forms, financial institutions find themselves locked in a perpetual dance with technology, striving to outsmart those who attempt to exploit the system. Picture a bustling bank, where the hum of computers and the chatter of employees create a symphony of vigilance against fraud. Here, cutting-edge tools stand as sentinels, vigilantly scanning for anomalies that might suggest something amiss. These digital guardians are trained to spot subtle cues—a risky IP address lurking in the shadows, an email address that whispers of suspicion, or a phone number that should have long been silent.

Sequeira, a seasoned expert from GBG IDology, shares insights into this intricate web of defence. “There’s a wealth of indicators that surface,” he explains, “allowing companies to make swift judgments about whether to welcome a new customer or demand further proof of legitimacy.” This split-second decision-making is crucial in a landscape where occupational fraud looms large.

Occupational fraud, a cunning adversary, often ensnares unwary employees in its web. Picture an employee, innocently seated at their desk, clicking away at their keyboard. Suddenly, a seemingly urgent request flashes across their screen—an invoice demanding immediate payment. This moment of deception is not uncommon; it is a tactic frequently employed by scammers who trawl platforms like LinkedIn, casting wide nets in hopes of reeling in unsuspecting victims.

The stakes are high. As revealed by the Association of Certified Fraud Examiners in their 2024 report, occupational fraud is a colossal titan among financial crimes, its shadow stretching globally with costs soaring into the trillions. Yet, amidst this daunting challenge, banks and companies are not powerless. They arm themselves with additional safeguards during transactions—steps designed to thwart fraudulent activities before they can take root.

However, these protective measures come at a price: time. In industry parlance, they introduce “friction” into the process—a necessary resistance that companies willingly endure if it means safeguarding vast sums from vanishing into the ether. Sequeira paints a vivid picture: “Imagine you’re poised to transfer $50,000 from your account,” he says. “You’d likely welcome an extra layer of verification, whether it’s a visit to the branch or simply uploading your driver’s license via a secure link.”

Thus unfolds the story of a relentless pursuit—a narrative in which technology and human ingenuity converge to combat deceit and preserve trust in a world where every transaction holds potential peril.

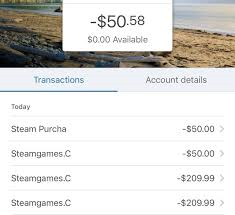

In the ever-evolving battle against fraud, banks have embraced advanced technologies to shield their customers. Yet, amidst this digital armour, the human element remains a vital line of defence. To shed light on this, let me share a story about my friend, whom we’ll call Darla, to maintain her privacy. She recently fell prey to a cunning government impersonation scam, which left her bank account severely depleted.

Darla’s Unfortunate Encounter with Deception

It all began innocently enough when Darla received an alarming pop-up message on her computer. It instructed her to call a number that supposedly belonged to the Federal Trade Commission (FTC). The man on the other end of the line claimed her computer was compromised and advised her to seek assistance from Microsoft tech support. As the conversation progressed, he warned Darla that her personal information was circulating on the dark web and was being exploited for identity theft. The only way to protect her funds, he insisted, was to entrust them to him until the culprits were apprehended.

Caught in a web of deceit and fear for her financial security and the impact it might have on her son, Darla complied. She first handed over thousands of dollars in Apple gift cards. Then, as instructed, she withdrew nearly all her savings, placed the cash in a shoebox, and handed it over to a courier who arrived at her door.

Reflecting on the ordeal, Darla lamented how she failed to recognise the scam for what it was. The fraudster had skillfully gained her trust, exploiting her anxiety about potential identity theft. “I’m so angry at myself,” she confessed. “I should have known better, given my understanding of computers.”

A Glimmer of Hope: Bank Personnel Intervene

On the day she prepared the shoebox of cash, Darla faced obstacles withdrawing such a large amount due to protective measures at her regional bank. She attempted to circumvent these restrictions by making smaller withdrawals. However, alert bank personnel noticed the unusual activity and intervened, ultimately thwarting further damage.

This incident reminds us that while technology plays a significant role in preventing fraud, the vigilance and intervention of bank employees can be equally crucial in safeguarding our finances against cunning schemes.

Darla recounted the day with a mixture of regret and gratitude. She had been on a mission, determined to access her own money despite the persistent concerns voiced by the bank employees. Each time they tried to dissuade her, she found herself repeating, “It’s my money, so why can’t I have it?” They peppered her with questions: “Why do you need such a large sum? Wouldn’t a check suffice? Carrying cash isn’t safe.” Yet, Darla remained resolute.

After visiting three different branches, the bank’s security systems flagged her activity as suspicious, leading to an immediate freeze on her accounts. An automated alert was sent to her adult son, whom she had intentionally kept uninformed to shield him from the situation. When he arrived at her home, he listened intently to her explanation. It was then that he helped her see the truth: she had fallen victim to a scam. Unfortunately, by that point, the scammers had already made off with the cash she had withdrawn.

Despite the loss, Darla realised she had narrowly avoided further financial ruin. She had been on the verge of liquidating an annuity and other investments for the fraudsters, but the intervention came just in time. Reflecting on the experience, Darla expressed deep appreciation for the bank employees who had tried so hard to prevent her from making a costly mistake. Their persistence ultimately spared her from more significant financial harm.

One encounter stood out in her memory. While visiting one of the branches, she was approached by the bank manager. Fresh from a meeting about fraud prevention with their headquarters, he spoke to her earnestly in a private cubicle. “Please,” he implored, “don’t go through with this.” In hindsight, Darla admitted it was foolish not to have trusted their judgment sooner.

Through this ordeal, Darla learned a valuable lesson about vigilance and trust. The banks, with their diligent staff and swift action, played a crucial role in safeguarding her remaining assets, and she was profoundly thankful for that.

In an ever-evolving world of digital finance, banks are embarking on a mission to empower their customers with knowledge and tools for secure banking. Picture this: a bustling city where banks transform into vigilant guardians, ensuring their patrons are well-informed about the latest security measures. In this vibrant landscape, emails, in-app notifications, and social media posts become the town criers, spreading messages of safe banking practices far and wide. Webinars and virtual workshops serve as community gatherings where knowledge is shared and wisdom is imparted.

Take a stroll through this digital city, and you’ll find banks weaving security into the very fabric of the customer experience. Some institutions have even crafted elaborate information hubs on their websites, offering a treasure trove of articles dedicated to safe banking. Imagine visiting Chase Bank’s Security Center web page, a virtual library filled with guides on crafting unbreakable passwords, identifying scams, reporting fraud, safely using Zelle, and shielding seniors from deceit.

“We begin by equipping our customers with the tools they need to safeguard their accounts,” shares Darius Kingsley, the maestro of business practices for consumer banking at Chase. “Our mobile app and online platforms are fortified with privacy and security features, alongside practical dos and don’ts.” Beyond the digital realm, Chase extends its educational efforts to branch locations, hosting informative sessions for curious minds.

Meanwhile, other banks embark on a quest to motivate customers toward best cybersecurity practices. Fifth Third Bank, for instance, has unveiled its complimentary SmartShield product—a formidable arsenal against cyber threats. This includes fraud monitoring, threat blocking, and login security features. The crown jewel of SmartShield is its protection meter, assessing a customer’s security status on a tiered scale, with “exceptional” reigning supreme.

Ben Hoffman, Fifth Third Bank’s chief strategy officer and consumer product leader, reveals that “within SmartShield, “users engage in tasks like updating passwords or tackling monthly quizzes to ascend to higher status levels within the app. Since the dawn of SmartShield earlier this year, over a million customers have embraced its protective embrace.

As you navigate this realm of secure banking, remember that banks stand as steadfast allies in your quest to thwart bank fraud. They arm themselves with measures to shield consumers from harm while inviting you to join them in this noble pursuit.

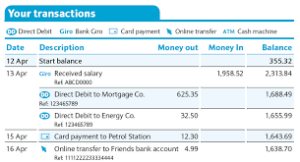

In banking, where the digital and physical worlds intertwine, protecting oneself from financial deception is both an art and a science. While banks deploy sophisticated methods to shield their customers from fraudulent activities, consumers can significantly bolster their defences through awareness and innovative practices. Let me walk you through some common types of financial fraud and how you can safeguard yourself against them.

Picture this: a stranger, armed with your personal information, opens a new bank account or credit card in your name or perhaps even applies for a loan. This scenario is known as new account fraud. To combat such deceit, David Liu, a seasoned expert in fraud and risk at Trulioo, advises regular monitoring of one’s credit reports. This vigilance is particularly effective when it comes to spotting unauthorised credit extensions.

Now, imagine another type of fraud—account takeover. Here, an imposter gains access to your account without permission, either by using your login details online or by pretending to be you over the phone. To thwart these intrusions, consider employing a password manager to create unique passwords for each account. David Liu further recommends enabling two-factor authentication and opting for device enrollment whenever possible as additional protective measures.

Then there’s digital pickpocketing—a modern twist on an age-old crime. Fraudsters use mobile point-of-sale devices to initiate unauthorised transactions by merely tapping them against your pocket, wallet, or purse. In Visa’s biannual threats report, Marijus Briedis from NordVPN suggests keeping your belongings close and investing in RFID-blocking wallets to prevent such incidents.

Reflecting on my journey through Money 20/20 and subsequent research, I was fascinated by the innovative ways banks are leveraging artificial intelligence to fend off fraud in real-time. Equally heartening was the tale of a prominent regional bank that empowers its staff at every branch to be vigilant warriors in this ongoing battle against financial fraud.

In this ever-evolving landscape, staying informed and adopting preventive measures can make all the difference in safeguarding your financial well-being.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

Maxthon Browser is dedicated to providing a secure and private browsing experience for its users. With a strong focus on privacy and security, Maxthon employs strict measures to safeguard user data and online activities from potential threats. The browser utilises advanced encryption protocols to ensure that user information remains protected during internet sessions.

In addition, Maxthon implements features such as ad blockers, anti-tracking tools, and incognito mode to enhance users’ privacy. By blocking unwanted ads and preventing tracking, the browser helps maintain a secure environment for online activities. Furthermore, incognito mode enables users to browse the web without leaving any trace of their history or activity on the device.

Maxthon’s commitment to prioritising the privacy and security of its users is exemplified through regular updates and security enhancements. These updates are designed to address emerging vulnerabilities and ensure that the browser maintains its reputation as a safe and reliable option for those seeking a private browsing experience. Overall, Maxthon Browser offers a comprehensive set of tools and features aimed at delivering a secure and private browsing experience.

Maxthon Browser, a free web browser, offers users a secure and private browsing experience with its built-in Adblock and anti-tracking software. These features help to protect users from intrusive ads and prevent websites from tracking their online activities. The browser’s Adblock functionality blocks annoying pop-ups and banners, allowing for an uninterrupted browsing session. Additionally, the anti-tracking software safeguards user privacy by preventing websites from collecting personal data without consent.

By utilising Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser stands out as a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive web browser market.

The post Banks’ New Tactics Against Financial Scams appeared first on Maxthon | Privacy Private Browser.