The evolution of technology is a double-edged sword, bringing both convenience and danger into our lives. As technology becomes increasingly integral to our daily routines, it has transformed the way we communicate, shop, and connect with others. However, this rapid advancement also provides new avenues for criminals to exploit, leading to a significant rise in cybercrime.

Image may be NSFW.

Clik here to view.

In 2020, cybercrimes accounted for a staggering 43% of Singapore’s overall crime statistics. The digital landscape has birthed various types of cyber offences, each more insidious than the last. E-commerce scams have gained notoriety, notably as online shopping surged during the pandemic.

Many shoppers gravitate toward established online retailers, but some seek out deals on platforms like Carousell, where individuals can easily buy and sell items. Unfortunately, this accessibility has made it easier for scammers to prey on unsuspecting buyers.

In October 2021, the arrest of a 25-year-old Carousell seller highlighted the growing threat of such scams. This individual was implicated in defrauding over 100 victims, amassing losses exceeding S$114,000. The police have since intensified their efforts to combat these crimes, reminding us all that while technology can enhance our lives, it also requires vigilance against those who would use it for harm.

In today’s digital age, consumers must be cautious about where they shop. To safeguard themselves from becoming the next target of online scams, it is highly recommended that shoppers purchase items exclusively from official retailers or trusted online sources. Furthermore, it’s essential to secure your accounts with robust passwords, particularly those linked to credit cards. If you are using platforms akin to Carousell, it’s wise to arrange in-person meetings with sellers. Take the time to thoroughly inspect the merchandise before making any payments, and always peruse reviews of previous transactions to verify the seller’s credibility.

Image may be NSFW.

Clik here to view.

Moving on to a pressing issue that many might not be aware of—SMS phishing scams. The term ‘phishing’ aptly describes the deceitful practice of ‘fishing’ for sensitive personal information like PINs, credit card numbers, and passwords. Cybercriminals deploy these tactics to exploit unsuspecting individuals. Often, these fraudulent text messages contain dubious URL links and are crafted with convincing language designed to entice recipients into clicking on them.

Earlier this year, the news reported a shocking incident where nearly 470 customers of OCBC Bank fell victim to an SMS phishing scheme, resulting in a staggering loss of over $8.5 million. Tragically, many of these victims saw their life savings vanish in mere moments.

To protect yourself, it’s advisable to access your banking accounts solely through the official website or the legitimate mobile app at all times. Exercise caution when encountering any suspicious links sent via SMS, WhatsApp, or other messaging platforms. If you receive messages or notice activities that raise red flags, don’t hesitate to contact your bank or service provider for clarification. Additionally, ensure that your accounts are fortified with a strong password—never divulge this information to anyone. For those using Apple devices, consider downloading the ScamShield application; it can help filter out unwanted spam calls and messages.

Now, let’s delve into another area of concern: phone scams. These scams often involve unsolicited calls that can leave individuals feeling anxious and vulnerable. As technology connects us more than ever, it’s also become a breeding ground for deception. Scammers may impersonate legitimate organisations or even government agencies, employing fear tactics to manipulate their targets into providing personal information or transferring funds.

Imagine receiving a call from someone claiming to represent your bank. They urgently inform you of suspicious activity on your account, and their tone of urgency sends shivers down your spine as they request immediate verification of your details. It’s easy to feel trapped in such situations, especially when the caller seems knowledgeable and authoritative.

Image may be NSFW.

Clik here to view.

However, it’s vital to remember that legitimate institutions will never ask for sensitive information over the phone. Always take a step back and verify the caller’s identity before proceeding. If you have any doubts, hang up and call your bank’s official number directly.

Navigating through these treacherous waters requires vigilance and a proactive approach to security. By remaining informed and adopting safe practices, you can fortify yourself against the ever-evolving landscape of scams that lurk around every corner.

Phone Scams: A Cautionary Tale

Imagine this: you’re going about your day when suddenly, your phone rings. You glance at the screen and see an unfamiliar number, but curiosity gets the better of you. You answer, and a voice on the other end claims to be from a courier service. They inform you that a parcel is awaiting delivery but that there’s a payment required to proceed. Alarm bells ring in your head, but before you can think it through, the conversation takes another dark turn. What if they tell you that your child has been kidnapped and demanded a ransom? This type of manipulation is more common than you might think; these scams have been lurking in the shadows for years.

Image may be NSFW.

Clik here to view.

These deceptive calls are often designed to extract sensitive personal information or trick unsuspecting individuals into making payments that benefit only the criminals behind the scenes. To protect yourself, it’s wise to steer clear of answering calls from numbers you don’t recognise, mainly if they appear to be international. If you notice a ‘+’ at the beginning of the number, it’s likely coming from abroad. And remember, legitimate Singaporean numbers don’t start with ‘+65’ anymore. Never share personal details such as your NRIC, passport number, home address, or credit card information over the phone. When faced with uncertainty, take a moment to verify the situation before succumbing to panic or hastily agreeing to any payments.

### Social Media & Instant Messaging Communication Scams: A Stark Reality

Now, let’s delve into another alarming area: social media and instant messaging scams. Picture this scenario: your social media account has been hacked. It’s not just a breach of your privacy; it poses a significant threat to your loved ones as well. Your account holds not only your personal information but also the contact details of family members, friends, and business associates. Cybercriminals may exploit this access to reach out to those in your circle, using your identity to carry out their deceitful schemes. It’s disheartening to think how easily someone might fall for a scam when they believe they are receiving a genuine message from a trusted friend.

Just last year, authorities issued warnings about a particular scam technique involving compromised WhatsApp accounts. Scammers employed what was dubbed the ‘Voicemail method’ to hijack these accounts, subsequently targeting contacts listed within them with tantalising offers—like gold bars priced 30% below market value. This cunning trap preys on trust and familiarity.

Image may be NSFW.

Clik here to view.

Have you considered enabling two-factor authentication on your social media or messaging accounts? This simple precaution could enhance your security and help shield your loved ones from similar threats. Always remember to verify any suspicious messages before acting on them; vigilance is key in this digital age!

The Resurgence of Investment Scams

Once upon a time, investment scams were merely a cautionary tale whispered about in hushed tones. However, in recent years, they have resurfaced with alarming frequency, aided by the rise of instant messaging platforms like Telegram, WhatsApp, and Facebook Messenger. These digital avenues provide scammers with a convenient means to reach out to unsuspecting victims. Often, they initiate contact through a mutual acquaintance who has referred you or by sending mass invitations to group chats, presenting what they claim is a once-in-a-lifetime opportunity to amass wealth at lightning speed. Ironically, while they promise riches to their targets, it is the scammers themselves who walk away with the profits.

In this modern age, cryptocurrency has captured the imagination of younger investors, becoming a particularly enticing lure for fraudsters. It’s not uncommon for these criminals to adopt similar tactics to entice individuals into investing in nonexistent or fraudulent cryptocurrency schemes.

Image may be NSFW.

Clik here to view.

As the investment landscape continues to evolve, potential investors must remain vigilant and recognise the warning signs that often accompany scams. Be wary of promises of unrealistically high returns; referral commission offers, exaggerated claims regarding experience or past successes, limited-time promotions, and assertions of regulation or oversight.

The allure of high returns can be irresistible. It’s a siren song that draws many into the treacherous waters of investment scams. These cunning deceivers understand how to manipulate emotions and exploit the hopes of their victims. A common mantra among scammers is that if something seems too good to be true, it probably is. Legitimate investments typically refrain from offering incentives like referral bonuses or commissions. Fraudsters frequently employ this tactic to entice friends and family members into their web of deceit.

Another classic strategy used by these con artists involves applying pressure. They often create a sense of urgency by claiming that an incredible offer will soon expire. This pressure can lead individuals to make hasty decisions without conducting proper research or considering their options thoroughly.

Thorough due diligence is imperative for those looking to invest wisely. One should verify whether a company is regulated and authorised to provide financial services by consulting the Monetary Authority of Singapore (MAS) Financial Institution Directory. Moreover, it’s essential to base investment decisions on reliable information sourced from trustworthy channels rather than falling prey to glamorous promises spun by scammers.

Image may be NSFW.

Clik here to view.

In this digital age, knowledge is power. By staying informed and cautious, investors can protect themselves from falling victim to the resurgence of investment scams and ensure their financial journeys are grounded in reality rather than deceit.

An Expedition into Safe Surfing

Image may be NSFW.

Clik here to view.

In the boundless realm of the internet, where information cascades like a river, and connections flourish in every direction, the significance of maintaining a secure online identity is paramount. As we traverse this complex digital landscape, selecting a trustworthy and fortified browser becomes a crucial action in defending our data against the ever-present threats lurking in cyberspace. Among the myriad options available, one browser shines brightly for its unwavering dedication to privacy and security: the Maxthon Browser, which users can enjoy without any financial burden.

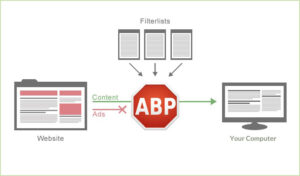

Picture this: setting out on your digital adventure with a loyal companion by your side, one that prioritises your safety above all else. The Maxthon Browser embodies this role perfectly—an unwavering partner in the pursuit of a secure browsing journey. It comes equipped with an arsenal of powerful built-in features, including AdBlock and anti-tracking technology, specifically designed to protect users from intrusive ads and unwanted surveillance. In today’s digital era, where each click could potentially expose us to hidden dangers, having such protective tools feels akin to wrapping oneself in an invisible shield that repels threats.

Image may be NSFW.

Clik here to view.

As you explore Maxthon, you’ll find that it offers robust support for Windows 11, ensuring that users of this operating system can navigate safely and efficiently.

Image may be NSFW.

Clik here to view.

Maxthon’s steadfast commitment to creating a secure online environment is evident through its relentless emphasis on user privacy. The browser utilises sophisticated encryption protocols, acting as a stronghold that defends personal data during every online encounter. With these advanced security features firmly in place, users are free to roam the vast internet with tranquillity, assured that their sensitive information remains safeguarded from prying eyes.

As you dive deeper into the functionalities of Maxthon, you will uncover an impressive suite of tools designed to bolster your online privacy further. The presence of ad blockers means that your surfing experience is not marred by pesky pop-ups, allowing you to immerse yourself in content without distractions. At the same time, its anti-tracking capabilities thwart the efforts of websites eager to keep tabs on your every action, ensuring that your online habits remain private and under your control.

Furthermore, Maxthon introduces an innovative approach to browsing, enhancing both security and user experience.

The post Steps To Prevent Falling For Scams In Singapore appeared first on Maxthon | Privacy Private Browser.