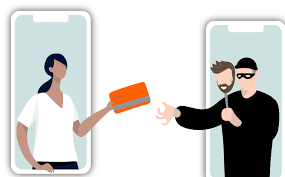

As the world has embraced the convenience of online banking, a darker shadow has emerged alongside it: the rise of online banking fraud. With the surge in digital transactions, bank phishing scams have established themselves as one of the most prevalent forms of criminal behaviour on the web. These nefarious individuals, driven by greed, do not stop at merely pilfering login information for bank accounts; they also target credit and debit card details, seeking to enrich themselves at the expense of unsuspecting victims. But what are the mechanics behind these cybercrimes, and what consequences do they hold for individuals caught in their web?

Online banking fraud can be understood as a malicious act wherein a cybercriminal successfully obtains sensitive banking information belonging to an individual or an organisation. Once they have access to these digital credentials, they can infiltrate bank accounts or credit cards, manipulating them for their illicit purposes. This might involve directly draining funds from an account or engaging in various forms of financial deception. From a legal standpoint, online banking fraud encompasses a wide array of illicit activities conducted through a bank’s digital platform—be it an app or a website. It covers everything from unauthorised access to someone else’s account to the mismanagement or transfer of funds without consent.

The ultra-digital landscape of contemporary banking provides cybercriminals with numerous avenues to execute their schemes. While banks are continually enhancing their security measures to safeguard their clients’ accounts, the evolving complexity of these attacks presents significant challenges. Detecting these fraudulent activities can be incredibly difficult, and preventing them is an even more daunting task.

So, how do these elaborate bank scams unfold? The intricacies of their operation can often leave individuals bewildered and vulnerable, leading them to question their safety in an increasingly digital world. Each story of fraud paints a picture of trust betrayed and finances jeopardised, urging us all to remain vigilant in our online interactions.

Understanding the Mechanics of Bank Scamming

In the ever-evolving world of cybercrime, bank scamming has become a complex web of deceit that ensnares unwitting individuals into revealing their sensitive banking information. This intricate dance of fraud is not merely a straightforward scheme; rather, it encompasses a multitude of strategies that make it increasingly challenging for potential victims to recognise the threats lurking in their inboxes or on their screens. As such, it is crucial for anyone engaging in online banking to familiarise themselves with these nefarious tactics, enabling them to remain vigilant against such predatory actions. Online banking fraud can be categorised into two primary types: Account Takeovers (ATO) and Automatic Transfer Systems (ATS).

The Dark Art of Account Takeovers

At the heart of many bank scams lies the notorious Account Takeover (ATO), where a malicious actor seizes control of an unsuspecting victim’s bank account by exploiting stolen credentials. These digital heists often employ a blend of social engineering and malware, with the most sophisticated attackers utilising both tactics to enhance their chances of success. Let’s delve into some of the prevalent methods that cybercriminals deploy in their pursuit of ATOs and online banking scams.

One of the most insidious techniques is phishing. In these scams, the perpetrator masquerades as a trustworthy representative of the victim’s bank, crafting an email that implores the recipient to verify their login information. Typically, this message contains a link directing the victim to a counterfeit website designed to resemble their actual bank’s site closely. Once the unsuspecting individual inputs their credentials, the scammer swiftly captures this information for malicious purposes. This is precisely why reputable banks frequently remind their clients that they will never solicit sensitive data such as passwords or personal identification numbers (PINs). To heighten the urgency, phishing emails may threaten account suspension or locking if immediate action is not taken.

Then there’s vishing—an alarming twist on phishing that takes place over the phone. In this scenario, the scammer impersonates the victim’s bank during a phone call, skillfully tricking them into divulging their account details and login information. This direct conversation grants the attacker complete access and control over the victim’s finances. In some instances, the fraudster may also seek additional personal information, which can later be exploited in various online banking fraud schemes.

As we navigate this digital age filled with conveniences and pitfalls alike, understanding these fraudulent tactics is essential for safeguarding our financial well-being. Awareness and education are our strongest allies against the persistent threat of bank scamming.

In the shadowy realm of cybercrime, there exists a particularly nefarious breed of malicious software known as keyloggers. These insidious Trojans lie in wait on unsuspecting computers, silently observing every keystroke made by the user. Their true malevolence reveals itself when a victim unwittingly navigates to a banking website listed in the keylogger’s predetermined targets. In that fleeting moment, the software springs into action, capturing each keystroke with precision. The result? The theft of sensitive login credentials, granting the cybercriminal unfettered access to the victim’s bank account—a gateway to pilfering their hard-earned funds.

But keyloggers are just one weapon in a vast arsenal of malware employed by cybercriminals seeking to siphon off valuable information. Often, these attacks are initiated through seemingly innocuous bank-related email scams, luring victims into downloading attachments laden with malicious code. Unbeknownst to them, their devices become breeding grounds for malware that cleverly imitates legitimate banking sessions. As victims enter their details, believing they are conducting secure transactions, the malware stealthily captures this information, handing it over to the attackers who exploit it for their fraudulent schemes.

Among the many forms of malware that plague online banking, Remote Access Trojans (RATs) stand out, granting hackers remote control over compromised devices. Similarly sinister is the Man-in-the-Browser (MitB) attack, which intercepts crucial data flowing between a web browser and banking applications. Then, there are overlays—deceptive interfaces that trick users into divulging sensitive information through fake websites or applications. Let’s not forget SMS sniffers, which quietly monitor text messages for one-time passwords (OTPs), a vital component in securing online transactions.

Yet, the art of deception doesn’t stop at sophisticated software; some cybercriminals resort to brute force or dictionary attacks to crack bank login credentials. By systematically guessing passwords—often through sheer persistence—they can eventually stumble upon the correct combination, opening the door to the victim’s financial world.

The vulnerability extends even further into the realm of wireless connectivity. Many individuals unknowingly connect to unsecured public Wi-Fi networks, exposing themselves to a host of risks. Cybercriminals eagerly exploit these inadequately protected networks, intercepting any information transmitted across them—including sensitive banking details—like predators lying in wait for easy prey.

One particularly alarming tactic employed by these digital wrongdoers is SIM swapping. This elaborate scheme hinges on social engineering methods to deceive telecommunications providers into transferring a victim’s phone number to a SIM card controlled by the attacker. Once this switch is made, the cybercriminal gains access to everything tied to that phone number, including bank accounts, often facilitated by receiving one-time passwords meant for the genuine account holder.

In this intricate web of deception and theft, the battle between cyber criminals and their unsuspecting victims rages on. Each tactic is more cunning than the last, and with every click and connection made in haste or ignorance, the potential for loss looms more significant than ever. Awareness and vigilance are not just recommended; they are essential shields in this ongoing digital warfare.

The Rise of Automatic Transfer Systems

In an era of rapidly advancing technology, cybersecurity has become a battleground filled with new challenges. Among these challenges lies the growing complexity of Account Takeover (ATO) schemes. As protective measures become more sophisticated, so too do the tactics employed by cybercriminals. In a bid to circumvent these enhanced security protocols and maintain their illicit activities in online banking, these malicious actors have devised an innovative approach known as Automatic Transfer Systems (ATS).

Unlike traditional ATO methods, which often rely on elaborate schemes to deceive victims into revealing their banking credentials, ATS operates with a level of automation that minimises the need for direct interaction with the target. This malware stealthily observes the online behaviour of unsuspecting computer users. When a user enters their bank account, the malware springs into action, injecting malicious scripts into the legitimate banking interface. This initiates unauthorised money transfers without raising suspicion until it’s far too late for the victim to react. The brilliance of this approach lies in its ability to bypass the usual hurdles of information theft and multifactor authentication, leaving attackers less exposed and more efficient.

Distinguishing ATO from ATS

While both ATO and ATS share a common objective—illicitly acquiring funds through financial fraud—their methodologies are markedly different. ATO scams often necessitate a degree of manual intervention by the perpetrator, who relies on social engineering techniques to manipulate victims into divulging sensitive information. This hands-on approach can be time-consuming and requires a certain finesse in deception.

On the other hand, ATS operates on a completely automated basis, driven by carefully crafted malware that must be specifically designed for the targeted banking application. This intricate tailoring makes ATS attacks considerably more complex, yet paradoxically, they become more challenging to detect due to their seamless integration with legitimate banking operations. By lying in wait for users to log in, ATS exploits the very systems designed to protect them, eliminating the need for traditional methods of data theft or evading multifactor authentication.

Understanding Identity Theft

At the heart of these cybercrimes lies the sinister concept of identity theft, particularly within the realm of banking. Here, criminals seize control of an individual’s identity to carry out various fraudulent acts. Armed with personal information such as names, birthdates, and Social Security numbers, these attackers can wreak havoc on their victims’ financial lives. The ramifications of bank account identity theft—or identity theft in general—are profound and can lead to devastating, long-lasting consequences for those ensnared in this web of deceit.

As technology evolves and cyber threats grow ever more sophisticated, understanding these tactics becomes crucial for individuals seeking to protect themselves from becoming victims of such financial crimes. The story of Automatic Transfer Systems is just one chapter in a larger narrative about the ongoing battle between innovation in security and the relentless pursuit of cybercriminals looking to exploit vulnerabilities for their gain.

In a world increasingly reliant on digital transactions, the shadowy threat of identity theft looms large, casting a pall over unsuspecting individuals and businesses alike. Imagine a scenario where a thief, cloaked in anonymity, infiltrates the sanctity of personal bank accounts, siphoning funds away as if they were mere droplets in an ocean. This insidious act doesn’t stop there; it spirals into a web of deceit that ensnares the victim in a myriad of complications.

Picture this: the perpetrator crafts new identities from the ashes of stolen information, opening fresh bank accounts and obtaining credit cards that bear the victim’s name. With each fraudulent transaction, they weave a tapestry of chaos—accessing government benefits linked to Social Security numbers, from healthcare assistance to unemployment payments, robbing the valid owner of their rightful entitlements. The aftermath? A devastating blow to credit scores that takes years to mend.

But the implications extend beyond financial ruin. The criminal mastermind may engage in tax fraud, snatching refunds that should have been a source of relief for the victim come tax season. Mortgages can fall into default as the thief plays puppet master with the victim’s financial obligations. Imagine the horror of discovering that your online accounts—your emails and social media profiles—have been hijacked, leaving you vulnerable to impersonation and further damage to your reputation.

As if that weren’t enough, the toll on one’s mental well-being cannot be overstated. Victims often find themselves caught in an exhausting cycle of recovery, spending countless hours and significant sums trying to reclaim their identity and restore their good name. The thought that their personal information now lingers in the dark corners of the internet—the Dark Web—adds another layer of dread. It’s an emotional rollercoaster where feelings of shock, anger, and helplessness intermingle, leaving individuals grappling with an overwhelming sense of vulnerability.

The repercussions of online banking scams stretch far beyond mere dollars and cents. Financial distress is just the tip of the iceberg; the mental anguish suffered by victims can be profound. Stress mounts as they navigate the labyrinthine process of mending their shattered lives, often feeling an intense need to find someone to blame for this violation of trust.

Thus, one must ponder: in this digital age fraught with peril, how can individuals safeguard themselves against such predatory tactics? What measures can be taken to fortify one’s financial fortress and ensure that such invasions remain but a distant threat rather than a haunting reality? The quest for protection is not just about preventing loss; it’s about preserving peace of mind in an increasingly interconnected world.

In the realm of digital banking, where convenience often collides with the lurking threats of cybercrime, safeguarding one’s financial assets has never been more critical. Picture this: you have multiple bank accounts, each serving a unique purpose in your financial life. To ensure that your hard-earned money remains secure, it’s vital to adopt the practice of using distinct login credentials for each account. This simple yet effective strategy can significantly reduce the risk of unauthorised access.

As you navigate through the vast online landscape, consider adding an extra layer of protection by enabling multifactor or biometric authentication. Imagine the peace of mind that comes from knowing that even if someone manages to steal your password, they would still face additional hurdles before gaining entry to your accounts.

When it comes to accessing your bank’s services, exercise caution with links found in emails. It’s all too easy to fall victim to phishing schemes designed to deceive you into revealing sensitive information. Instead, take a moment to type your bank’s URL directly into your web browser. This small act can serve as a powerful shield against potential threats.

Moreover, when using banking applications on your devices, be diligent about their authenticity. Always download these apps from the official bank website or reputable app stores. Regular updates are also crucial, as they often contain vital security enhancements that protect you from emerging threats.

Familiarity with your bank’s security and privacy measures is another essential step. Many institutions are transparent about their protocols; for instance, it is standard practice for banks to refrain from asking customers for their PINs via email or phone calls. Knowing these guidelines can empower you to recognise and report suspicious requests.

In our increasingly interconnected world, it is imperative to log into your bank accounts only over secure internet connections. Public Wi-Fi may seem convenient, but it often lacks the necessary protections. Instead, opt for private home networks secured with WEP, WPA, or WPA2 standards. This choice can be pivotal in keeping your sensitive data safe.

Reviewing your bank and credit card statements regularly is akin to performing a routine check-up on your financial health. If you notice any transactions that seem out of place, do not hesitate to contact your bank immediately. Prompt action can mitigate potential damage and help catch fraudsters before they can cause further harm.

Additionally, using a virtual private network (VPN) can provide an added layer of security when accessing digital banking systems. A VPN encrypts your internet connection, making it much harder for malicious actors to intercept your data.

Finally, ensure that your devices are equipped with robust antivirus software. Keeping this software up to date with the latest security patches is crucial; after all, new threats are constantly emerging in the digital landscape.

With online banking theft becoming increasingly sophisticated, it is essential to remain vigilant. The consequences of such attacks can ripple through one’s financial stability, social connections, and emotional well-being. By understanding the tactics used by cybercriminals and implementing proactive security measures, you can significantly decrease the likelihood of falling victim to these malicious schemes.

Embarking on a Confident Voyage through the Digital Realm

In our contemporary society, where the internet intricately intertwines with the essence of our everyday experiences, safeguarding our online identity takes on monumental significance. Picture yourself setting forth on an exhilarating adventure across the infinite and uncharted territories of cyberspace, where every click unveils gateways to boundless knowledge and exhilarating escapades. Yet, amid this vast virtual expanse, lurking dangers await—threats capable of jeopardising your personal information and overall security. To traverse this intricate web with assurance, it is crucial to choose a browser that prioritises your safety above all else. Enter Maxthon Browser, your steadfast companion on this journey, available to you at no cost.

Maxthon’s Unique Approach to Windows 11

What distinguishes Maxthon from conventional web browsers is its unwavering dedication to defending your digital privacy. Imagine it as a vigilant guardian, always alert to the myriad risks that populate the online landscape. Armed with a remarkable suite of integrated tools—including ad-blocking features and anti-tracking technologies—Maxthon tirelessly endeavours to protect your online persona. When you operate Maxthon on Windows 11, these protective mechanisms create a formidable shield against intrusive advertisements while simultaneously thwarting websites from snooping into your browsing patterns.

The Perfect Partnership of Maxthon and Windows 11

As you navigate the expansive digital terrain on your Windows 11 device, Maxthon’s commitment to your privacy becomes increasingly apparent. The browser employs state-of-the-art encryption methods to safeguard your sensitive information during your online explorations. This means that as you venture into the uncharted territories of the web, you can feel secure knowing that your data remains shielded from those who might wish to infringe upon your privacy.

Maxthon Browser’s Collaboration with Windows 11

Yet, this expedition through the digital wilderness is not just about protection; it’s also about discovering new horizons. With Maxthon as your loyal guide, you can explore without fear, knowing that each step you take is backed by robust security features designed to enhance your browsing experience. As you delve deeper into the wonders of the internet, let Maxthon illuminate your path, ensuring that your journey remains both thrilling and safe.

The post Strategies To Prevent Online Banking Scams appeared first on Maxthon | Privacy Private Browser.