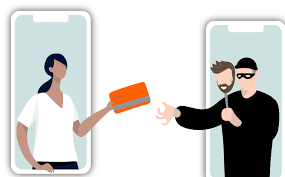

The shrill sound of your phone interrupts the calm of your day. It’s a call from your bank, or so it seems. The voice on the line carries an alarming message: your account has been compromised.

Instinctively, you become wary; you’ve heard enough about scams to know that this could very well be one. Yet, as the caller begins to recite your Social Security number and detailed account information, doubt creeps in. How could anyone but your bank possess such sensitive data?

You’re not alone in your apprehension. Last year, around 300,000 individuals across the United States found themselves in a similar predicament, believing they were speaking with their financial institution. Tragically, many fell victim to the ruse. One woman in Virginia saw a staggering $700,000 vanish from her Wells Fargo account, while another individual in Los Angeles lost $100,000 in mere minutes.

What was once a small-scale con game has morphed into a widespread enterprise. Nowadays, anyone with a few dollars can access the tools necessary for deceit through the Dark Web. The resources available are astonishing—complete with guides that instruct would-be scammers on how to disguise their phone numbers to appear as if they originate from your bank. They even provide scripts for fake customer service agents who can answer queries and allay fears.

The art of deception has evolved into a science for seasoned scammers, who utilize social engineering techniques to manipulate their targets. This term refers to the psychological tactics employed to cultivate trust and exploit vulnerabilities. These con artists excel at tapping into emotions—fear, urgency, and trust—to bend their victims’ perceptions.

When faced with the alarming news that your financial security is at stake, your mind often descends into chaos. Panic sets in, clouding your judgment and making it increasingly difficult to think clearly. In these moments of heightened anxiety, you might overlook red flags or dismiss your gut feelings, leading to potentially devastating consequences.

In the shadowy world of deceit, there exists a breed of con artists who excel at weaving intricate tales that, on the surface, appear entirely plausible. They might mention recent financial transactions or drop snippets of personal information that are strikingly accurate, all designed to gain your trust.

These manipulators are not just content with spinning their yarns; they employ aggressive tactics to instill a sense of urgency, urging you to act swiftly to ‘protect’ your funds. The pressure mounts, and before you know it, you’re caught in their web.

One particularly insidious tactic they use involves video calls. The simple act of seeing another person can create an illusion of trustworthiness. The familiarity of a face can disarm even the most vigilant among us, making it easier for them to manipulate your actions.

Moreover, while they engage you in conversation, they cleverly distract you from any security alerts that might be flashing on your screen, warnings that urge you to halt and reconsider.

The best course of action when faced with such a situation is to take a step back. Allow yourself a moment to assess what’s happening before you react impulsively. This pause could be the difference between falling victim to a scam or emerging unscathed.

Now, let’s delve into the troubling reality of how major banks have responded to these fraudulent activities in recent times. Last year, the reimbursement rates for scam victims were dishearteningly low. For instance, JPMorgan Chase refunded a mere two per cent of disputed transactions identified as scams. Meanwhile, Wells Fargo’s figures were only slightly better, at four per cent. Bank of America stood out somewhat with a reimbursement rate of 24 per cent, but even that leaves much to be desired.

It’s important to note that federal regulations dictate that banks must provide refunds under specific conditions—such as when a thief steals your phone and gains access to your account. However, suppose you willingly sign off on a wire transfer or approve an online transaction only to later discover that you’ve been duped. In that case, you’re left in a precarious position with little recourse.

As you navigate this treacherous landscape, remember that these criminals are all too aware of how the system operates. They exploit the loopholes and weaknesses to orchestrate their attacks, preying on unsuspecting individuals like you.

About Kim Komando: A distinguished figure in the realm of technology and media, Kim is a National Radio Hall of Famer and hosts her show on over 510 stations. Her expertise extends to podcasting and tech advice, and she connects with over 500,000 subscribers through her informative daily newsletter.

In a world where financial security is paramount, the importance of safeguarding your hard-earned money cannot be overstated. Many individuals who have lost everything never saw it coming; they were blindsided by deceitful schemes that turned their lives upside down. To avoid becoming one of these unfortunate victims, it is essential to take proactive measures.

Imagine receiving a phone call from someone claiming to be a representative of your bank. They ask for your account details, sounding official and urgent. In that moment, it’s crucial to pause and reconsider. Instead of engaging with the caller, hang up. Take the initiative to contact your bank directly using the number provided on their official website or printed on the back of your card—never rely on a quick online search for contact information, as that can lead you down a dangerous path.

Now, let’s talk about transfer scams. Picture this: you receive an unsolicited call or email instructing you to wire money, send cryptocurrency, or purchase gift cards. Resist the temptation to comply. Remember, legitimate institutions like your bank or government agencies will never require you to move your funds to a so-called ‘safe’ account. This is a classic tactic used by scammers to exploit unsuspecting individuals.

Additionally, be cautious of any links sent your way. If someone directs you to visit a specific website, download an app, or click on a hyperlink, tread carefully; it’s likely a phishing attempt or an effort to install malware on your device. Always verify the source before taking action.

In today’s digital age, it’s wise to consider using a virtual phone number for transactions related to your finances. Given the numerous data breaches reported this year, there’s a high likelihood that your actual phone number has been compromised. By opting for a virtual number instead, you can keep your personal information out of reach from potential scammers.

Moreover, make it a habit to frequently check your transaction history. The earlier you detect any unauthorized activity, the better equipped you are to address it swiftly and effectively. Set up alerts through your banking app for transactions exceeding a certain amount or those made in foreign countries. Some banks even allow you to impose limits on withdrawals and purchases, which can add another layer of protection against fraud.

Finally, knowledge is power. Stay informed about the latest scams and educate your family and friends, particularly older relatives who may be more vulnerable to such tactics. Share these protective strategies with them because awareness is one of the strongest defences against becoming a target.

Remember, the threat extends beyond just fake calls and emails; cybercriminals are continuously evolving their methods. By taking these precautions and remaining vigilant, you can significantly reduce your risk of falling prey to their schemes. Your financial security is worth the effort!

In the digital age, the threats lurking behind a screen are far more than mere nuisance calls or spam emails. Cybercriminals have an extensive arsenal of cunning strategies designed to deceive you into relinquishing your hard-earned money and sensitive personal information.

Take, for instance, the rise of counterfeit banking applications. These fraudsters expertly craft fake versions of well-known banking apps, mimicking every detail—from logos to user interfaces. You might find yourself downloading what appears to be a legitimate app, only to discover that by entering your login information, you’ve unwittingly handed over your credentials to thieves. To protect yourself, always ensure you’re downloading applications directly from your bank’s official website or a reputable app store. If you notice a suspiciously low number of downloads or reviews, it’s a red flag that should prompt you to look elsewhere.

Then there are the deceptive emails that purport to come from your bank, complete with official logos and signatures that seem entirely authentic. Thanks to advanced AI tools, creating these convincing messages is alarmingly simple. They may closely replicate your bank’s usual correspondence, making it even harder to discern the truth. If you ever find yourself questioning the legitimacy of an email, resist the urge to click any links. Instead, navigate directly to your bank’s website or reach out using the phone number on the back of your debit or credit card.

Another tactic employed by these cyber criminals involves the theft of one-time passcodes. They may manipulate you into revealing a legitimate code that has been sent to your phone for security purposes. It’s crucial to remember that your bank will never request these codes from you. If you receive a one-time passcode unexpectedly, take it as a warning sign that someone may be attempting to breach your account.

Social media has also become a playground for fraudsters masquerading as customer service representatives from banks. These imposters often target individuals who publicly voice complaints, offering seemingly helpful assistance that can quickly spiral into a dangerous exchange of personal information. Always exercise caution; never disclose any account details through social media platforms or direct messaging. Reputable banks only address concerns through their official communication channels.

Let’s not overlook the risk associated with QR codes. Just because you spot one in your bank’s parking lot or near its branding does not guarantee its safety. Scanning random QR codes can be just as perilous as clicking on an unknown URL—both can lead you down a treacherous path.

Vigilance is your best defence against deception in this landscape. Always stay alert and informed to safeguard against those who seek to exploit your trust.

Vigilance is your best defence against deception in this landscape. Always stay alert and informed to safeguard against those who seek to exploit your trust.

Navigating the Waters of Safe Online Discovery

In a world where the internet is intricately intertwined with our daily lives, prioritizing a secure online journey has become essential. Picture yourself setting sail on an extraordinary expedition across the vast digital sea—each click you make opens up avenues of knowledge, yet lurking beneath the surface are unseen dangers that threaten your privacy and security. To chart a successful course through this complex network, selecting a browser that prioritizes user safety is crucial. Enter Maxthon Browser, an exceptional ally in this voyage, available to you at no cost.

Maxthon: Your Reliable Navigator on Windows 11

Among the vast array of browsers vying for attention, Maxthon stands out with its steadfast dedication to protecting your online experience. Think of it as a sturdy shield, guarding you against the multitude of hazards that hide in the depths of the internet. Armed with a remarkable collection of built-in features such as Adblock and anti-tracking tools, Maxthon diligently strives to preserve your browsing privacy. These integrated defenses act as a robust barrier, preventing intrusive advertisements from disrupting your exploration and blocking websites from monitoring your every click.

Maxthon’s Commitment to Your Privacy

As you embark on your digital journeys using a device powered by Windows 11, Maxthon’s unwavering commitment to your privacy becomes increasingly apparent. The browser harnesses cutting-edge encryption technologies to ensure your sensitive information remains secure throughout your online adventures. This means that as you venture into the unexplored territories of the web, your personal data is shielded from prying eyes.

But the voyage doesn’t end there. Maxthon is also equipped with additional features designed to further bolster your privacy. Imagine navigating through the internet in incognito mode—a personal refuge where you can roam freely without leaving behind any trace of your activities. Here, you can explore without worry, confident in the knowledge that Maxthon is vigilantly safeguarding your privacy throughout your entire online expedition.

The post How To Stay One Step Ahead Of Bank Fraud Threats appeared first on Maxthon | Privacy Private Browser.