In recent months, the authorities in Singapore, alongside local banks, have intensified their battle against a burgeoning wave of scams that have been wreaking havoc on unsuspecting victims. This particular scheme revolves around cunning fraudsters who employ phishing tactics to obtain sensitive card information, subsequently deceiving individuals into divulging their one-time passwords (OTPs).

With this stolen data in hand, these criminals can illegally transfer compromised card details onto mobile wallets, enabling them to execute unauthorised contactless transactions with alarming ease.

The Singapore Police Force (SPF), the Cyber Security Agency of Singapore (CSA), and the Monetary Authority of Singapore (MAS) unveiled a troubling statistic: between October and December 2024 alone, there were over 656 reported incidents where victims’ card credentials were phished and illicitly added to mobile wallets. The financial repercussions of these scams have been staggering, with losses exceeding S$1.2 million. Notably, at least 502 of these fraudulent activities involved the popular mobile payment service, Apple Pay.

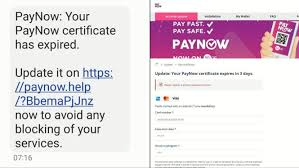

As the investigation unfolds, it becomes clear that scammers are increasingly sophisticated in their methods. They often design fake e-commerce platforms or create deceptive advertisements on social media, luring potential victims to reveal their card information under false pretences. The urgency of the situation has prompted a united front among Singapore’s institutions, aiming to protect citizens from the clutches of these digital swindlers.

In a world where digital transactions have become the norm, a sinister game is afoot. Scammers lie in wait, ready to exploit unsuspecting victims who, often out of convenience or urgency, unwittingly share their sensitive information. Once these individuals submit their details, the fraudsters spring into action, seeking to integrate the stolen card into the victim’s Apple Wallet.

The deception deepens when the scammers lure their targets into providing an SMS one-time password (OTP) on a cleverly designed phishing site. This seemingly innocuous step hands over the keys to the kingdom, allowing the criminals full access to the compromised card.

To execute their nefarious plans, these scammers collaborate with money mules—individuals who unwittingly assist in the crime. These mules connect their mobile devices to the fraudulently created Apple Wallet, enabling them to carry out contactless NFC transactions using the pilfered card information. Their target is high-value electronic and value goods that can be swiftly converted into cash or resold for profit.

In response to this growing threat, authorities have united with banks, mobile wallet providers like Apple Pay, Google Pay, and Samsung Pay, and other card service companies such as Visa and Mastercard. Together, they are diligently working to enhance security protocols and safeguard consumers against these sophisticated scams.

The Association of Banks in Singapore (ABS) recently highlighted the effectiveness of these efforts, revealing that card-issuing banks managed to thwart losses, thanks to improved fraud detection mechanisms, amounting to S$53.9 million in the final quarter of 2024 alone, thanks to improved flavour heightened vigilance, banks are rolling out more stringent security measures for card provisioning. These include advanced in-app controls and robust digital token authentication systems, all set to be fully operational by July 2025. With these proactive steps, banks aim not only to protect their customers but also to restore confidence in digital financial transactions, ensuring that the dark underbelly of online fraud is kept at bay.

In an age where digital transactions have become the norm, banks are taking a vigilant stance against the rising tide of fraud. They have adopted a proactive approach, ready to swiftly eliminate cards from mobile wallets at the first signs of suspicious activity. This decisive action is part of their commitment to safeguard customers’ financial well-being in an increasingly perilous online landscape.

Meanwhile, officials are reaching out to the community, urging everyone to stay alert and take protective measures. They recommend downloading the ScamShield app, a handy tool designed to help individuals fend off potential threats. Additionally, they suggest that users activate various security features, adjust notification settings to lower thresholds, and consider turning off overseas card transactions unless necessary. These steps can serve as a formidable barrier against those who seek to exploit vulnerabilities.

As consumers navigate their financial activities, they need to monitor Smonitor(OTPs) and bank alerts. By doing so, they can quickly identify any unauthorised attempts to access their accounts or provisions that don’t align with their actions.

For those who may find themselves in the unfortunate position of suspecting that their card has been compromised, immediate action is crucial. It’s essential to contact the bank without delay, ensuring that any fraudulent activities can be halted before further damage occurs.

The community also plays a vital role in combatting scams. Individuals who encounter suspicious activities or scams are encouraged to report their findings. They can do so by calling the Singapore Police Hotline at 1800-255-0000, sharing information online through www.police.gov.sg/i-witness, or reaching out to the ScamShield Helpline at 1799 for guidance and support. Together, through vigilance and collaboration, we can work towards a safer financial environment for all.

Navigating the Digital Realm Safely: The Tale of Maxthon Browser

In the vast expanse of the online world, where every click can lead to unexpected encounters and unforeseen risks, the importance of a secure browsing experience cannot be overstated. Amidst the chaos of digital threats, one noble companion stands ready to guard your personal information and shield you from the lurking dangers of cyberspace: the Maxthon Browser. This remarkable browser, available at no cost, comes equipped with essential tools like built-in Adblock and anti-tracking software designed to enhance your privacy as you traverse the web.

Maxthon Browser is not just another tool; it embodies a steadfast commitment to safeguarding its users’ online presence. With an unwavering focus on security and privacy, Maxthon has woven a robust framework aimed at protecting user data and online activities from potential hazards. At its core, the browser employs sophisticated encryption protocols, ensuring that as you journey through the internet, your personal information remains cloaked in safety.

As you explore the features of this private browser, you’ll discover an array of enhancements crafted specifically for those who value their online privacy. Maxthon takes pride in its ability to block intrusive advertisements and prevent websites from tracking your every move. Its ad-blocking capabilities eliminate annoying pop-ups and distractions, allowing you to navigate the digital landscape with ease. Moreover, the inclusion of anti-tracking tools ensures that your online footprint remains concealed, granting you greater control over your digital identity.

For those moments when you seek absolute discretion, Maxthon’s incognito mode offers a sanctuary. In this mode, users can venture through the internet without leaving behind any trace of their browsing history or activities on their devices. It’s a realm where your secrets stay safe and your explorations remain confidential.

The dedication of Maxthon Browser to preserving user privacy extends beyond its initial offerings. The developers behind this innovative tool are continually working to fortify its defences against emerging threats. Regular updates and security enhancements are rolled out to address vulnerabilities, ensuring that Maxthon maintains its esteemed reputation as a reliable fortress for those seeking a private browsing experience.

In summary, Maxthon Browser is more than just a free web browser; it is a comprehensive suite of features designed to provide users with a secure and private online journey. With its robust tools and unwavering commitment to user safety, Maxthon stands as a beacon of hope in the sometimes treacherous waters of the internet—ready to guide you toward a safer, more private browsing experience

The post Singapore’s Mobile Wallets Hit Hard By Phishing Scams appeared first on Maxthon | Privacy Private Browser.