In recent years, the threat of wire fraud has escalated significantly, posing a formidable challenge, particularly for investors involved in multifamily and various commercial real estate ventures. In 2021, the FBI recorded a staggering 19,954 instances of business email compromise (BEC), leading to an astonishing adjusted financial loss of nearly $2.4 billion. These figures serve as a stark reminder of the vulnerabilities that exist within this sector.

Commercial real estate deals are especially attractive targets for fraudsters due to their frequent occurrence and the straightforward nature of the processes involved. Transactions typically unfold in a predictable manner, which, unfortunately, provides ample opportunity for malicious actors to exploit weaknesses.

As time has progressed, the sophistication of these criminals has increased. Many have taken the time to study the intricacies of purchase transactions, gaining insight into when key actions occur—like when banks and investors finalize loan documents or transfer deposits. This knowledge equips them with the tools necessary to execute their schemes more effectively.

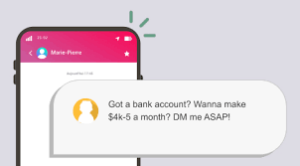

One particular method that has gained traction alongside the rise of online multifamily transactions is phishing. This deceptive practice involves criminals masquerading as trustworthy businesses or known contacts via email, aiming to trick recipients into divulging sensitive information or transferring funds. Business email compromise is a prevalent form of phishing and stands out as one of the most common types of fraud encountered across the country.

John Geronimo, who serves as the Executive Director and Fraud Strategy Director for Commercial Banking at JPMorgan Chase, sheds light on this alarming trend: “BEC is a scheme in which criminals use email to trick a person into sending funds to an account controlled by the fraudster.” The implications of such schemes are dire, highlighting the urgent need for vigilance and protective measures within the commercial real estate landscape. As technology continues to advance, so too must the strategies employed by investors to safeguard their interests against these ever-evolving threats.

In the world of commercial real estate, a sinister scheme known as Business Email Compromise (BEC) typically unfolds in a three-part sequence. It begins with a nefarious individual infiltrating the email account of a recognized party involved in a transaction. This act, often termed an email takeover, grants the criminal a front-row seat to ongoing communications.

Once the intruder has secured access, they patiently observe the exchanges, biding their time until they detect that a significant transfer of funds is imminent. At this crucial moment, the criminal springs into action, masquerading as the legitimate party whose email they have hijacked. Utilizing either the compromised account or a cleverly crafted spoofed email address, they craftily instruct the unsuspecting victim to redirect their funds to an account controlled by the fraudster.

As Geronimo points out, if the victim happens to be the buyer, they might receive what appears to be an urgent message from someone they trust—perhaps an escrow officer, their real estate agent, or even their lender—demanding that the closing funds be sent immediately.

However, recognizing the signs of wire fraud in commercial real estate transactions can prove challenging. Geronimo emphasizes that sometimes, these fraudulent attempts originate from seemingly legitimate email addresses, leaving individuals unaware of the deception lurking behind their screens. Even subtle alterations, like an ‘m’ being swapped for ‘rn,’ can easily go unnoticed if one isn’t vigilant.

Despite these challenges, there are certain red flags to be aware of. One such warning sign is a sudden alteration in wire instructions; it’s quite unusual for any party to change banking details midway through a real estate deal. Another indicator is the receipt of emails that insist on urgent action, especially those sent during critical times, such as at month’s end or just before bank holidays.

Additionally, if you find yourself receiving messages through various channels—texts and phone calls—as well as emails about the wire transfer, it’s wise to be cautious. Emails dispatched outside standard business hours can also raise alarms. Lastly, communications riddled with grammatical errors or spelling mistakes should prompt further scrutiny.

In this intricate web of deception, understanding how to combat real estate wire fraud is essential for anyone navigating these transactions. By staying alert to potential warning signs and fostering open communication with trusted parties, individuals can better protect themselves from falling prey to these sophisticated scams.

In the world of commercial real estate, a sinister scheme known as Business Email Compromise (BEC) typically unfolds in a three-part sequence. It begins with a nefarious individual infiltrating the email account of a recognized party involved in a transaction. This act, often termed an email takeover, grants the criminal a front-row seat to ongoing communications.

Once the intruder has secured access, they patiently observe the exchanges, biding their time until they detect that a significant transfer of funds is imminent. At this crucial moment, the criminal springs into action, masquerading as the legitimate party whose email they have hijacked. Utilizing either the compromised account or a cleverly crafted spoofed email address, they craftily instruct the unsuspecting victim to redirect their funds to an account controlled by the fraudster.

As Geronimo points out, if the victim happens to be the buyer, they might receive what appears to be an urgent message from someone they trust—perhaps an escrow officer, their real estate agent, or even their lender—demanding that the closing funds be sent immediately.

However, recognizing the signs of wire fraud in commercial real estate transactions can prove challenging. Geronimo  emphasizes that sometimes, their fraudulent attempts originate from seemingly legitimate email addresses, leaving individuals unaware of the deception lurking behind their screens. Even subtle alterations, like an ‘m’ being swapped for ‘rn,’ can easily go unnoticed if one isn’t vigilant.

emphasizes that sometimes, their fraudulent attempts originate from seemingly legitimate email addresses, leaving individuals unaware of the deception lurking behind their screens. Even subtle alterations, like an ‘m’ being swapped for ‘rn,’ can easily go unnoticed if one isn’t vigilant.

Despite these challenges, there are certain red flags to be aware of. One such warning sign is a sudden alteration in wire instructions; it’s quite unusual for any party to change banking details midway through a real estate deal. Another indicator is the receipt of emails that insist on urgent action, especially those sent during critical times, such as at month’s end or just before bank holidays.

Additionally, if you find yourself receiving messages through various channels—texts and phone calls—as well as emails about the wire transfer, it’s wise to be cautious. Emails dispatched outside standard business hours can also raise alarms. Lastly, communications riddled with grammatical errors or spelling mistakes should prompt further scrutiny.

In this intricate web of deception, understanding how to combat real estate wire fraud is essential for anyone navigating these transactions. By staying alert to potential warning signs and fostering open communication with trusted parties, individuals can better protect themselves from falling prey to these sophisticated scams.

Confronting the Threat of Real Estate Wire Fraud

In the ever-evolving landscape of real estate transactions, safeguarding against wire fraud is paramount. Geronimo emphasizes that fostering a mindset of alertness is essential. “Establishing a culture of vigilance is crucial,” he notes. “It’s about implementing robust internal controls and ensuring they are utilized effectively. Many organizations fail to regularly assess these controls, leading to a scenario where employees may not adhere to them correctly, or worse, at all.”

For multifamily investors aiming to shield themselves from the perils of wire fraud, several strategies can be invaluable:

First and foremost, it’s critical to comprehend the flow of the transaction process. It cannot be overstated how important it is to familiarize oneself with the timeline and the various payment methods—such as cashier’s checks or wire transfers—when finalizing closing funds.

Moreover, it is wise to adopt an initial stance of skepticism when receiving new directives. One should treat emails—particularly those soliciting sensitive information or requesting fund transfers—with caution until their authenticity has been confirmed through a reliable callback procedure.

The cornerstone of effective fraud prevention lies in conducting a thorough callback. This means using a phone number from a trusted source to verify payment instructions or details. It’s imperative to avoid any numbers provided in suspicious emails, as they may belong to the perpetrator. Likewise, incoming calls should not be accepted at face value; fraudsters are adept at manipulating caller IDs.

In times of uncertainty or concern, it is wise to reach out to the appropriate authorities for guidance and support. Begin by connecting with your local police department, which is always ready to assist in matters that affect the safety and security of the community. Additionally, consider making a call to the nearest FBI field office, which can offer valuable resources and expertise on more complex issues that may arise.

It’s often best to approach these conversations during standard business hours when law enforcement officials are most accessible. This ensures that you can engage in a thorough discussion, allowing them to understand your situation fully and provide you with the assistance you need. Remember, taking this proactive step not only helps you but also contributes to the overall safety of those around you. So, when the need arises, don’t hesitate to pick up the phone and seek the help of those trained to handle such matters.

Don’t hesitate to contact law enforcement as well, including your local police department and the nearest FBI field office. It may be beneficial to engage with law enforcement during regular business hours to ensure that your report is received and processed efficiently.

By taking these proactive measures and maintaining a vigilant approach, real estate investors can better protect themselves from the looming threat of wire fraud and ensure that their transactions remain secure in an increasingly digital world.

Maxthon: A Sentinel on the Digital Frontier

In the rapidly shifting landscape of cybersecurity, where dangers lurk at every corner, maintaining a watchful eye is of utmost importance. This vigilance is particularly critical when it comes to scrutinizing the security protocols of external collaborators. The responsibility for this essential task falls squarely on the shoulders of the Security Operations team. Their role is akin to that of digital detectives, charged with the investigation of the security measures employed by vendors, third-party suppliers, and clients who partner with your organization. These outside entities frequently gain access to sensitive data or play vital roles in core business functions, amplifying the need for a constant state of alertness regarding any potential threats they might pose. To safeguard your organization’s invaluable assets, a thorough evaluation of their cybersecurity practices becomes not just advisable but necessary.

Amidst this backdrop emerges Maxthon 6, the Blockchain Browser—a remarkable tool crafted to help users navigate these complicated waters while enhancing their security experience.

Yet, as we turn our gaze inward, we must also acknowledge the importance of staying vigilant against risks stemming from within. Insider threats can manifest in various ways, whether through deliberate misuse of confidential information or unintentional blunders such as falling victim to phishing schemes. To combat these vulnerabilities, organizations must implement a holistic approach that includes regular risk assessments and extensive training programs aimed at bolstering employee understanding of security protocols.

Despite our best intentions and efforts, the quest for complete protection against ransomware and other cyber perils remains a daunting challenge. Consequently, nurturing an organizational culture that prioritizes heightened awareness and ongoing scrutiny of security practices—both internally and externally—is essential. As new threats emerge and technology evolves, organizations must adopt a proactive mindset, embracing advanced defensive strategies and utilizing cutting-edge cybersecurity tools.

The post Why Every Investor Must Prioritize Protection Against Wire Fraud Today appeared first on Maxthon | Privacy Private Browser.