In a bustling office where colleagues share lunch breaks and chat about their weekend plans, it’s easy to fall into a false sense of security. After all, when you know everyone on a personal level, it’s hard to imagine that anyone would ever betray that trust. You might wonder why someone would attempt to defraud your modest business when there are larger enterprises ripe for the picking. And how could Amanda from accounting—who cheers for your son from the bleachers during little league—ever pose a threat from within?

Image may be NSFW.

Clik here to view.

However, fraud does not care about the size of your company. Small and medium-sized businesses can be just as appealing to fraudsters as their larger counterparts. They are often targeted by schemes such as business email compromise, wire fraud, and insider payment scams. This makes it crucial for you to arm yourself with knowledge and take proactive steps to safeguard your business.

To fortify your defences against potential fraud, consider adopting best practices tailored to your specific situation. One effective strategy is transitioning to digital payment solutions and utilising fraud prevention services. These tools can significantly enhance your ability to detect fraudulent activities swiftly and bolster your protection against future risks. Yet, technology alone isn’t enough; strong internal controls and sound practices are essential.

So, where should you begin on this journey to protect your organisation? Start by assessing your risk landscape. Take the time to educate your employees about the various forms of payment fraud that could endanger your business. Prioritising these risks will help you focus your efforts where they are needed most.

Image may be NSFW.

Clik here to view.

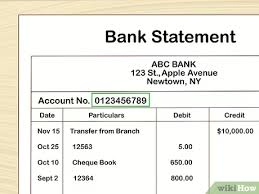

Next, scrutinise your accounts to pinpoint those that are particularly vulnerable to fraud and implement measures to minimise the chances of theft occurring. Establishing robust internal controls will create layers of security that can deter potential fraudsters.

By taking these steps, you not only create a safer environment for your business but also foster a culture of vigilance among your employees, ensuring that everyone is aware and prepared to combat the ever-present threat of fraud.

Establishing Robust Internal Safeguards

In the intricate world of business, the importance of robust internal controls cannot be overstated. To begin with, it is essential to create a clear set of documentation requirements that will substantiate any payment requests. This foundational step ensures that every transaction is backed by the necessary paperwork, providing a solid defence against potential fraud.

Image may be NSFW.

Clik here to view.

Implementing dual controls and maintaining a separation of duties is paramount to further bolstering this framework. This means that no single individual should have sole authority over financial transactions or modifications to vendor details. By dividing these responsibilities among multiple team members, businesses can cultivate a culture of oversight and accountability, minimising the risk of fraudulent activities slipping through the cracks.

Before proceeding with any nonstandard payment requests or alterations to payment instructions or contact details, it is prudent to verify vendor information. This involves conducting callbacks to the official contact numbers recorded in your system. Such diligence serves as a critical checkpoint, ensuring that no unauthorised changes are made without proper verification.

Image may be NSFW.

Clik here to view.

Additionally, companies should actively monitor for unusual behaviours by reviewing key transaction reports. These reports can highlight discrepancies and patterns that may indicate potential fraud, allowing for timely intervention. Engaging fraud protection services can also provide an extra layer of security, helping businesses navigate the complexities of risk management.

Testing Internal Controls

Regular testing of these internal controls is vital for their effectiveness. Conducting periodic fraud prevention training sessions will equip employees with the knowledge and skills they need to recognise and respond to potential threats. Furthermore, identifying vulnerabilities within the organisation can be achieved through mock phishing exercises or business email compromise simulations. These proactive measures not only raise awareness but also strengthen the company’s overall resilience against fraudulent schemes.

Image may be NSFW.

Clik here to view.

A Cautionary Tale of Fraud

Consider, for instance, the case of a small household goods importer employing approximately 25 individuals. This company became a target of insider fraud and found itself ensnared in a web of deceit. The aftermath of this incident revealed profound lessons that can be invaluable for other organisations with limited resources.

In response to this breach, the company took decisive action to fortify its defences. By integrating online banking solutions with stringent internal controls, they enhanced their ability to detect irregularities and prevent future financial losses. This journey toward recovery underscores the significance of vigilance and preparedness in the face of potential fraud.

Image may be NSFW.

Clik here to view.

As we reflect on this story, it serves as a potent reminder that understanding the nuances of business fraud often comes at a steep price. However, with careful planning and implementation of comprehensive safeguards, businesses can better protect themselves and foster a more secure environment for their operations.

You might believe you truly understand someone…

When the long-serving president of a household goods company stepped down, the newly appointed leadership team took it upon themselves to scrutinise the company’s financial records. They aimed to pinpoint areas that could benefit from updates and improvements. However, what they stumbled upon was far from what they expected: clear evidence suggesting that their bookkeeper—who had been with the company for over a decade—had been misusing the corporate credit card for her expenses and had even written checks to herself.

Through their investigation, the team uncovered nearly $100,000 in fraudulent transactions spanning the past two years. The reliance on paper statements and traditional checks considerably prolonged their inquiry. This troubling situation highlighted the urgent need for several key safeguards to prevent such occurrences in the future:

Image may be NSFW.

Clik here to view.

Implementing multitouch approval controls ensured that no single individual—such as the bookkeeper—could independently process a transaction without another person reviewing it first. This added layer of oversight was crucial.

Additionally, the leadership team’s instituting regular reviews helps verify the legitimacy of transactions, allowing them to detect fraud much earlier in the process.

Turning a setback into a lesson learned

With the guidance of its Commercial Banking team, the household goods company began reassessing its entire payment strategy.

The first significant step was to transition all of its accounts to fraud detection. These advanced digital banking platforms significantly streamlined operations like check-writing, alleviating much of the burdensome workload that had previously rested on the small finance team.

In addition to simplifying treasury management services, banks also equipped the company with enhanced tools designed to bolster payment approval controls, paving the way for a more secure and efficient financial environment.

Image may be NSFW.

Clik here to view.

In a significant shift towards enhancing `operational integrity, the company’s newly appointed management team took decisive action to bolster its risk management framework. They established a protocol that mandated the involvement of two distinct individuals—one of whom must be a member of the management team—to initiate and authorise all transactions digitally. This move was not just about compliance; it was a commitment to transparency and accountability.

To further streamline their financial processes, the company embraced automation in its reconciliation activities. By implementing these automated systems, they ensured that funds were tracked and recorded with precision, allowing for real-time visibility over their financial landscape. This modernisation meant that if any discrepancies were to arise in the future, they would not have to wade through mountains of paper records from years past—a cumbersome task that could slow down their response time considerably.

Understanding that fraud is a threat that looms over organisations regardless of their size; the company recognised that prevention is an ongoing endeavour. It necessitates a blend of comprehensive training, rigorous testing, and proactive measures designed to thwart potential breaches.

Image may be NSFW.

Clik here to view.

In this context, advanced Fraud Protection tools emerged as invaluable assets. They not only minimised the manual tasks associated with payment processing but also fortified the organisation’s control mechanisms. With these tools in place, the likelihood of fraud and abuse slipping through the cracks was significantly diminished.

In this journey toward heightened security and efficiency, the company positioned itself not merely as a business but as a vigilant guardian of trust, dedicated to safeguarding its resources and reputation against the ever-evolving landscape of threats. Their commitment was clear: they were here to help, ready to navigate the complexities of modern finance with care and precision.

Image may be NSFW.

Clik here to view.

Maxthon: Your Reliable Companion in the Digital Landscape

In a world where technology evolves at breakneck speed, entering the online sphere can feel like embarking on an expedition through a vast and unpredictable wilderness. To successfully navigate this ever-changing terrain, it takes more than just any tool; selecting the right web browser is essential for ensuring that your online experiences are both smooth and enjoyable.

Image may be NSFW.

Clik here to view.

As you contemplate which browser to adopt, two fundamental aspects should be at the forefront of your decision-making: security and privacy. Every action we take in the digital space plays a significant role in shaping our online personas, making it crucial to choose a platform that offers robust protection for that identity. In a crowded marketplace of options, Maxthon emerges as a dependable ally.

With a reputation built on effectively addressing user concerns, Maxthon has established itself as a trustworthy choice while being completely free to use. Its intuitive interface, paired with an impressive array of features, empowers users to navigate the internet with confidence and ease.

Furthermore, Maxthon boasts exceptional compatibility with Windows 11, granting users access to advanced tools and functionalities specifically designed to elevate their browsing experience. With Maxthon as your trusted companion, you can explore the vastness of the digital world with peace of mind, knowing that your security and privacy are meticulously protected at every turn.

The post Tips To Protect Your Business From Fraud Today appeared first on Maxthon | Privacy Private Browser.