Buzz! A notification rings on WhatsApp.

You glance at your screen and see a message from an unfamiliar number.

“YOUR DAUGHTER HAS BEEN KIDNAPPED. IF YOU WANT HER BACK, SEND $5000 IMMEDIATELY. DO NOT INFORM THE POLICE!”

What would your reaction be to such a distressing text?

Image may be NSFW.

Clik here to view.

A wave of panic crashes over you, drowning out all rational thought. Ignoring the glaring warning signs, you cling to the hope that time is on your side and that you can reach your daughter before her abductors reconsider.

Without a moment’s hesitation, you dash to the nearest bank and hastily transfer the demanded sum.

While this scenario may sound far-fetched, it reflects a grim reality: every day, countless individuals from diverse backgrounds fall prey to scams like this one.

But don’t despair; it’s never too late to educate yourself about these deceitful tactics! To start, consider asking yourself some vital questions:

What kinds of scams are prevalent in Singapore? What measures can I take to safeguard myself and my loved ones?

What Exactly Constitutes a Scam?

The term “scam” encompasses a variety of deceitful practices, often referred to as fraud, hoaxes, or social engineering. This phenomenon has existed throughout history, harking back to the era when the phrase “snake oil salesmen” became widely recognised.

Scams can manifest in numerous ways, appearing as emails, phone calls, advertisements, voicemail messages, or even social media platforms. They typically pair with offers that sound almost too good to be true, luring individuals into their traps.

Image may be NSFW.

Clik here to view.

The primary objective of a scam is straightforward: to trick you into relinquishing your money or personal information by presenting an enticing offer that seems valuable in exchange.

As society progresses and technology advances, scams have evolved as well, becoming increasingly intricate and deceptive.

In this discussion, we will explore some of the most prevalent scams that individuals encounter today, equipping you with the knowledge to recognise and respond to them effectively.

What Scams Are Most Common in Singapore?

According to recent findings, five scams stand out as particularly troublesome for residents:

1. Job Scams (25.7%)

2. E-commerce Scams (20.2%)

3. Phishing Scams (13.4%)

4. Investment Scams (7.2%)

5. Love Scams (>7%)

Data from the Singapore Police Force indicates that losses due to scams exceeded S$330 million in just the first half of this year, with reported victim numbers increasing by over 60 per cent compared to the previous year.

It’s crucial to understand that these figures reflect only the cases that have been reported; many victims opt not to come forward for various reasons, suggesting that the actual numbers could be much higher.

Delving Deeper into Job Scams in Singapore

Imagine receiving a message that reads, “All you need to do is complete this survey, and we’ll send you the money!”

Image may be NSFW.

Clik here to view.

Many job scams begin by appearing as an innocuous opportunity that demands little effort and presents low risk at first glance. However, as the scheme unfolds, the so-called “employer” suddenly claims they are unable to send the promised payment.

The Allure of Attractive Paychecks

Imagine a scenario where you come across an enticing job advertisement that reads, “No prior experience needed! Work from home and earn a salary of $4,000.” This is too good to be true. Unfortunately, it often is. The so-called “employer” dangles the promise of salaries that far exceed the usual market rates, typically requiring minimal, if any, experience.

⚠️ It’s important to note that scammers have become increasingly sophisticated. They’ve refined their tactics, opting for more plausible figures to lure potential victims. Nonetheless, the jobs they offer still require minimal effort while boasting generous pay. For instance, you might be asked to leave short one-minute reviews on Google or participate in surveys that pay around S$20 each. If you were to dedicate an entire workday—let’s say eight hours—to this kind of task, you could theoretically rake in at least S$9,000 in a single day!

The Mystery of Unfamiliar Companies

Now, let’s delve deeper into the world of these dubious job postings. You might find yourself reading something like, “We are Durian Trading Limited; would you like to explore a quick and simple job opportunity?” But as you dig further, you realise that the company appears to be a mere figment of their imagination, or worse yet, yields vague results when searched online.

⚠️ Scammers are clever; they frequently alter their company names to align with whatever narrative they’re spinning. They might use names like “Gemini Trust LLC,” which sounds legitimate enough to dissuade someone from investigating the authenticity of the “employer.” This tactic creates a façade of credibility, making it easier for them to ensnare unsuspecting individuals.

The Art of Poorly Constructed Job Descriptions

Let’s take a look at another red flag: poorly written job descriptions. You might encounter phrases such as, “Your only task will be to post Google reviews.” The lack of detail and professionalism in the writing can serve as a glaring indicator that something is amiss.

In this tangled web of enticing offers and questionable legitimacy, it’s crucial to remain vigilant and sceptical. By recognising these signs—outlandish salary promises, non-existent companies, and shoddy descriptions—you can better protect yourself from falling prey to these deceptive schemes. Always remember that if it sounds too good to be true, it likely is.

Image may be NSFW.

Clik here to view.

3. Vague Job Descriptions

Imagine this scenario: A message pops up on your screen proclaiming, “All you need to do is leave Google reviews for us; it’s an easy task!”

Upon closer inspection, the job details provided by this so-called “employer” are alarmingly vague. They lack clarity about the actual responsibilities, necessary qualifications, or any specific requirements that might apply. It becomes evident that the scammer has crafted the narrative solely to support their fraudulent scheme. As you engage in conversation, keep your ears perked for any inconsistencies in their story or scripted responses—they might slip up if you push them for more information.

4. Promises of Unrestricted Work Hours

Picture receiving a message that states, “You can choose to work whenever you like!”

The ” employer ” uses this enticing promise of flexible hours to attract a broader pool of potential victims. The allure of creating your schedule can be enticing, but it often serves as a red flag, indicating that something might be amiss.

5. Demands for Advance Payment

Consider the following request: “To get started, we will need a $30 payment upfront for your work license.”

In this case, the “employer” insists on collecting fees for job applications or training programs, often through unofficial channels that lack government endorsement. This is a classic hallmark of a scam, as legitimate employers typically do not require payment from job applicants.

6. Communication in Broken English

You may encounter messages that read, “Yes, we sent money to you today, so please don’t worry.”

Image may be NSFW.

Clik here to view.

Such communication is characterised by broken syntax and unclear phrasing, which can also include unprofessional expressions. This lack of coherent language often points to the dubious nature of the “employer.”

7. Overuse of Complex Terminology (aka “Mumbo Jumbo”)

Imagine reading a convoluted statement like: “Our company’s objective is to achieve elevated sales figures through Google Search metrics, thereby enhancing our visibility in various locations.”

The “employer” might resort to using a lot of jargon and buzzwords in an effort to sound credible and authoritative. However, it’s essential to recognise that scammers frequently employ terms like “cryptocurrency” or other industry-specific language to give their jobs an air of legitimacy—something that may mislead unsuspecting individuals into believing they are dealing with a genuine opportunity.

Tips for Avoiding Job Scams:

To protect yourself from falling victim to such scams, always remain vigilant and critical of job offers that seem too good to be true. Look out for vague descriptions, demands for upfront payments, poor communication skills, and excessive jargon. Trust your instincts, and don’t hesitate to dig deeper if something feels off.

Navigating the Job Market Safely: A Cautionary Tale

Once upon a time, in the bustling realm of job searching, individuals eagerly crafted their resumes and shared personal details with potential employers. It was a time filled with hope and anticipation, but it also came with an underlying vulnerability. Imagine this: you receive a message through WhatsApp or Telegram, potentially from a well-meaning recruiter who stumbled upon your profile.

Yet, lurking within that digital communication could be a nefarious scammer, ready to exploit your aspirations.

In this modern landscape of employment opportunities, it’s crucial to be able to spot the warning signs that may indicate a fraudulent job offer. Protecting yourself from these deceptive schemes is paramount. Always remember, when uncertainties arise, don’t hesitate to reach out and seek clarification from the supposed employer. Maintain a level-headed approach during these discussions; it will help you discern what you are indeed signing up for.

Now that you’re equipped with knowledge about the perils of job scams let’s embark on a little challenge to see how well you can identify these potential traps!

Picture this scenario: one sunny afternoon, a notification pops up on your phone—a WhatsApp message brimming with excitement about a fantastic job opportunity. As you read through it, take a moment to scrutinise the details. Can you identify any red flags? Is there something about this offer that feels off?

Image may be NSFW.

Clik here to view.

If you’re feeling brave, let’s move on to another scenario. Imagine being offered $15 for every survey completed. The employer even provides proof of previous payments made to others. Does that evidence seem credible? Would you consider signing up for those surveys?

And now for the final challenge: an employer attempts to persuade you of the authenticity of their job offer with convincing words. Reflect on this situation—how many of these offers do you believe are genuine?

If your answer is none, then give yourself a pat on the back—that’s an impressive score!

As you navigate this intricate web of job opportunities, always keep this critical question in mind: “Could this be too good to be true?” If a job seems effortless and incredibly lucrative, pause and consider how it found its way to you without any exertion on your part.

Be mindful as the threat of phishing scams looms large in today’s digital world. Remain vigilant and protect your future!

The Deceptive Dance of Phishing Scams

It all begins with a simple greeting. “HELLO,” the email warmly opens, seemingly inviting you in.

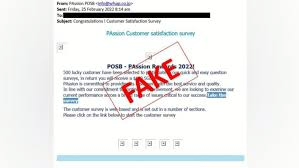

Image may be NSFW.

Clik here to view.

“Our billing team is unable to charge your designated card because there’s some information missing from your payment details,” it continues, creating a sense of urgency that’s hard to ignore.

“To prevent any interruption to your service, please renew your subscription immediately.”

A link follows, beckoning you to click and resolve the issue.

Now, ask yourself—would you be among the countless recipients who entertain such a message? After all, it’s from SingTel; it must be legitimate, right?

Imagine receiving an SMS from “Ninjavan” while you’re eagerly anticipating the arrival of your Shopee packages. The allure of trustworthiness is strong when you’re expecting something important.

In a world where information flows freely and without filters, it’s all too easy to become ensnared in the web of a phishing scam. But just how persuasive can these scams be?

With a single click, the trap can spring. Keep reading to uncover the intricacies of phishing scams!

Who Falls Victim?

David Chew, the director of the Commercial Affairs Department in the police force, explains, “Those who are deeply immersed in the digital landscape—the ones who navigate it daily and are accustomed to clicking on links—are particularly susceptible.”

Yet, it’s not just tech-savvy individuals who find themselves caught. Anyone with internet access is at risk, especially those who may lack digital literacy or who don’t exercise caution with their data.

Image may be NSFW.

Clik here to view.

Recent statistics have shown a startling trend: this year, the bulk of phishing scam victims were aged between 20 and 39. This age group, often seen as the most connected and knowledgeable about technology, proves that even the most adept can fall prey to deception.

As we delve deeper into this modern menace, it’s crucial to remain vigilant and informed, for one-click could lead us down a treacherous path.

Identifying Phishing Scams: A Cautionary Tale

Once upon a time, in the digital realm, a vigilant user found themselves navigating the treacherous waters of online communication. They were aware that lurking among the friendly faces were deceitful scammers ready to ensnare the unwary. With sharp instincts and a discerning eye, they set out on a quest to uncover the telltale signs of phishing scams.

The first clue came in the form of greetings. One morning, the user received an email that began with a bland salutation: “Hi, Dear.” The user chuckled to themselves, recalling that genuine companies often address their customers by name. This sender, however, had not yet established any personal connection. It was a clear sign that they were just casting a wide net, hoping to ensnare anyone who might bite.

As they continued their exploration, another red flag waved in the wind—spelling mistakes. The user noticed a message that mentioned “Billing information.” Such errors, they realised, revealed a lack of professionalism and care. They understood that any legitimate correspondence would be polished and free from such blunders. The user took a moment to scrutinise the text further, spotting inconsistencies in punctuation and variations in font styles that hinted at something amiss.

Image may be NSFW.

Clik here to view.

Then came a missive that sent chills down their spine. It declared with urgency, “Send payment before we terminate your services!” The user recognised this tactic all too well; it was a common strategy employed by scammers to instil panic and prompt hasty decisions. They recalled the wise words of seasoned internet navigators: authentic businesses would never request sensitive information through casual emails or messages. The user felt empowered by this knowledge, knowing that fear was one of the key weapons in a scammer’s arsenal.

This realisation reminded them of a psychological phenomenon known as loss aversion bias. Scammers had adapted their methods over time, shifting from enticing prizes to ominous threats. The user reflected on how humans naturally fear losing something more than they value gaining something equivalent. This insight allowed them to see through the veil of deceit—what could be more effective than scaring someone into compliance? From promises of winning S$1,000,000 to warnings of criminal charges for money laundering, each message was crafted to capture attention through fear.

Next, the user stumbled upon another warning sign: suspicious email addresses. They received an email purportedly from “Singtel,” but upon closer inspection, the domain read “clearlynotsingtel.org.” The user paused, realising that scammers often mimic legitimate addresses with minor alterations or typos. Armed with this knowledge, they made a mental note to always verify the official domains before clicking on anything.

The final piece of the puzzle came in the form of dubious attachments and links. An email contained an attachment named “strangeapplication.exe.” The user shuddered at the thought of downloading anything from unknown sources, fully aware of the potential dangers lurking within such files. They remembered that high-risk formats like .EXE, .ZIP, .SCR, .DOC, and .TXT could harbour malicious software or viruses ready to wreak havoc on their system.

Links were no exception to this rule; scammers often employed URL-shortening services to disguise malicious destinations. The user was determined not to fall victim to such tricks.

With these insights firmly in hand, our cautious protagonist continued their journey through cyberspace, ever vigilant against the dark forces of phishing scams. By staying informed and aware, they felt prepared to protect themselves from those who sought to exploit the unsuspecting. In this ever-evolving digital landscape, knowledge has become their strongest ally.

Guarding Against Phishing Scams: A Cautionary Tale

In a world where technology evolves at lightning speed, so too do the tactics of those who seek to deceive us. Scammers have become increasingly sophisticated, crafting phishing scams that can easily slip through our defences. Imagine receiving an email or message that seems legitimate, only to discover later that it was a cleverly disguised trap. The lines between what is real and what is counterfeit have blurred, leaving many of us vulnerable.

Image may be NSFW.

Clik here to view.

Yet, amidst this digital chaos, there are strategies we can employ to fortify ourselves against such deceitful practices. Let me share some essential wisdom on safeguarding your online presence.

Step One: Verify the Identity of the Sender!

Picture this: you receive a message that raises your suspicions. It may be from your bank or a popular online service urging you to act quickly. Before you succumb to panic or urgency, take a moment to pause and investigate. Google can be your ally in this endeavour.

First, scrutinise the email address. Does it originate from the official domain of the company in question? If it doesn’t match up, that’s your first red flag. Next, examine any links included in the message. Are they directing you to the trusted website, or do they lead to an unfamiliar territory?

Remember, never click on links or download attachments unless you have thoroughly verified the sender’s identity and feel confident in their legitimacy. Trust your instincts—if something feels off, it probably is.

Step Two: Activate Two-Factor Authentication (2FA) Across All Your Accounts

Now, let’s delve into a powerful tool in your cybersecurity arsenal: two-factor authentication. This feature acts as a formidable barrier, requiring not just a password but also a second form of identification before granting access to your accounts.

Imagine this scenario: you enter your password but are then prompted for a code sent directly to your phone. Even if a cybercriminal has managed to obtain your password, they would still face an uphill battle to breach your account without that second piece of information.

However, beware of any messages asking you for help with your 2FA settings. Such requests are often indicative of a scam in progress. Should you inadvertently share any personal details with these fraudsters, you might find your devices inundated with 2FA notifications—a clear sign that they are attempting to break into your accounts. In such cases, act swiftly! Change your login credentials immediately to cut off their access.

Recognising the Signs of Deceit

As we navigate this treacherous landscape of digital communication, it’s crucial to remain vigilant. By following these guidelines and trusting your intuition, you can arm yourself against the ever-evolving threats posed by phishing scams. Remember, knowledge is power, and with the proper precautions in place, you can protect yourself from falling victim to these insidious schemes. Stay alert, stay informed, and safeguard your online presence with confidence.

Image may be NSFW.

Clik here to view.

Uncovering the Fraud!

For our upcoming hands-on activity, we invite you to pinpoint the fraudulent schemes lurking in these images.

Were you able to spot all four? If so, fantastic job! Keep in mind that trustworthy emails typically refrain from requesting your details right off the bat.

Online Shopping Deceptions

Abigail learned the hard way when she fell victim to a scam on Carousell while attempting to buy a Nintendo DS. “You can investigate endlessly,” she explains, “but if the seller isn’t an authorised dealer, you’re always at risk of being duped.”

The unfortunate outcomes of such e-commerce scams can range from receiving defective merchandise to never receiving anything at all. These fraudulent activities have surged in recent years, especially following the pandemic in 2019, which led to a significant increase in online shopping.

Scammers take advantage of vulnerabilities through fake online stores, counterfeit payment options, and phoney reviews, making it increasingly easy for them to evade consequences on various e-commerce platforms. Over the last few years, Carousell, in particular, has gained notoriety as a breeding ground for such scams.

So, how can you recognise and avoid falling prey to an e-commerce scam? Let’s delve deeper into this issue.

Typical Victims:

Those who tend to shop impulsively often find themselves lured by enticing offers and discounts, disregarding any red flags. Additionally, individuals who lack familiarity with online shopping platforms or payment processes may also be more susceptible to these scams.

Identifying E-commerce Scams:

[Singapore Police Force]

1. Bargain Prices That Raise Suspicion

What they claim: “Our iPhone 12 is just $90; you won’t find a better offer anywhere!”

When sellers advertise items at prices significantly lower than market value, their justification for such deals often fails to align with the suggested retail price or simply seems too good to be true.

Image may be NSFW.

Clik here to view.

⚠️ These “amazing” bargains that are drastically underpriced are frequently marketed as limited-time offers or flash sales. As Singaporeans, our frugal nature and tendency to be “kiasu” make us prime targets for these tactics.

2. Credibility Through Reviews

What they say: “If you have doubts about me, just check out the reviews.”

In a world where online interactions dominate, it becomes crucial to maintain awareness and scepticism regarding the authenticity of sellers and their products. As we continue this discussion, let’s explore more signs that could help shield you from potential online fraud.

The Red Flags of Trustworthiness

In the bustling world of online shopping, sellers are often eager to win your trust. One common tactic employed is: “If you doubt my credibility, just glance at the numerous 5-star reviews I have.” While on the surface, this may seem reassuring, a deeper look can reveal a troubling reality. Many sellers may have few genuine reviews to back their claims, leaving potential buyers in a precarious position.

Image may be NSFW.

Clik here to view.

⚠️ It’s essential to remain vigilant against fraudulent reviews. In today’s digital age, fake accounts can easily be created or purchased solely to generate positive feedback and boost ratings, creating an illusion of reliability.

The Off-Platform Approach

As you navigate conversations with sellers, a red flag might arise when they suggest moving your chat to a different platform. “Why don’t we switch to WhatsApp?” they might propose. This persistent request for your mobile number and preference to communicate outside the established marketplace raises concerns. Such behaviour often indicates an intention to keep their dubious dealings away from prying eyes and official records.

Unconventional Payment Demands

Another warning sign appears when a seller insists on using uncommon payment methods. “I don’t accept ShopeePay; you can send me money via PayNow or even through gift cards,” they insist. This insistence on bypassing secure payment options provided by the online shopping platform is an apparent attempt to circumvent protections designed to safeguard buyers from scams.

The Pressure to Decide Quickly

Imagine being pressed into a corner with the seller exclaiming, “Do you want to buy or not? Someone else is interested, so let me know ASAP!” This strategy aims to rush you into making hasty decisions. When faced with such pressure, it’s all too easy to overlook critical warning signs and make impulsive purchases that could lead to regret.

The Defensive Display of Documents

In some cases, a seller may go to great lengths to prove their legitimacy, saying, “You’re sceptical? Here, let me show you proof.” They may share images of bank account information, identification cards, or certificates in an effort to bolster their credibility.

Image may be NSFW.

Clik here to view.

⚠️ However, it’s crucial to recognise that these documents might not be what they seem. Reports have surfaced indicating that images of bank details could be ‘borrowed,’ identification cards may be stolen, and certificates could be entirely fabricated. Such tactics can create a deceptive veneer of trustworthiness that masks underlying deceit.

Navigating the Landscape of E-commerce Safely

To protect yourself from falling prey to e-commerce scams, consider these precautionary measures:

1. Steer Clear of Unknown Sellers: When making significant purchases, it’s wise to only engage with sellers you know or those who have established a solid reputation online. Avoid venturing into transactions with unfamiliar sellers, particularly when considering high-value items for the first time.

2. Practice General Caution: Always maintain a discerning eye when browsing and buying online. By staying informed and aware of potential risks, you can safeguard yourself against unscrupulous individuals looking to exploit unsuspecting shoppers.

Image may be NSFW.

Clik here to view.

In this vast digital marketplace, vigilance is your best ally in ensuring a safe shopping experience.

Evaluating Sellers: A Cautionary Guide

When venturing into the world of online shopping, particularly from sellers based outside of Singapore, it is crucial to conduct a thorough evaluation. First and foremost, you should ascertain whether the seller operates from a location outside of Singapore. This detail can significantly affect your purchasing experience and potential recourse in case of issues.

Next, it’s imperative to consider the seller’s reputation. Do they boast a history marked by positive reviews? A seller with a commendable track record is more likely to provide a satisfactory transaction. Furthermore, genuine consumer feedback is invaluable; check for authentic reviews that reflect the experiences of past buyers. These insights can reveal much about the seller’s reliability and the quality of their products.

Another vital aspect to investigate is the presence of a buyer protection refund policy. This policy acts as a safety net for consumers, ensuring that you have some form of recourse should your purchase not meet expectations.

To further safeguard your interests, take time to read independent assessments of the online vendor. Pay close attention to customer feedback regarding product authenticity, quality, delivery times, and after-sales support. This due diligence will empower you to make informed decisions while shopping online.

Payment Precautions

When it comes to payment methods, always prioritise safety. Avoid agreements involving bank transfers or unconventional payment methods that are outside the established online shopping platform. Stick to payment options provided by the site to minimise risk.

Moreover, never disclose personal information such as your two-factor authentication codes, National Registration Identity Card (NRIC) number, or bank account details. Protecting your data is paramount in avoiding potential scams.

A Real-Life Example: The Carousell Incident

Consider a troubling incident that occurred in July involving Carousell, a popular online marketplace. In this case, 54 unsuspecting fans fell victim to a scam where they paid exorbitant amounts for Taylor Swift concert tickets that were falsely advertised. This event serves as a stark reminder of the risks inherent in online transactions.

The problem extends beyond ticket sales; similar scams have infiltrated other markets, including food products, impacting even local celebrities. To gain deeper insights into these fraudulent schemes, viewers are encouraged to watch an episode of “Crime Watch,” which delves into the mechanics of such scams.

The Allure and Danger of Investment Scams

Investment scams present another layer of deception in our financial landscape. One victim poignantly reflected on his experience, stating, “I’ve always believed I was a prudent investor. But when you see the potential profits, it can make you greedy.” This retrospective insight highlights how easily even cautious individuals can fall prey to alluring promises.

Image may be NSFW.

Clik here to view.

Investment scams are structured to mislead investors with false assurances of high returns—returns that are often unattainable. They come in various forms, including pyramid schemes, Ponzi schemes, multi-level marketing schemes, offshore investments, and the more recent surge in cryptocurrency frauds.

Such scams are typically orchestrated by individuals or organisations lacking legitimate business practices or regulatory oversight. For those following celebrity news, you may have encountered stories about alleged cryptocurrency scams linked to American influencer Logan Paul or the staggering $8 billion collapse of FTX.

In a world rife with deceitful schemes, remaining vigilant and informed is crucial to protecting your finances and personal information. Always exercise caution and conduct thorough research before engaging in any online transactions or investment opportunities.

Image may be NSFW.

Clik here to view.

2. Cultivating a Sense of Urgency

Imagine this scenario: You’re chatting with a friend, and he leans in with an air of excitement. “You’ve got to jump on this opportunity right now! Trust me, the market won’t sit around waiting for you!”

He continues, “Everyone’s snapping this up as we speak; if you hesitate, you’ll lose out!”

Then, he adds with a wink, “Invest today, and I can get you an extra 15% credit on top!”

In moments like these, there’s an unmistakable pressure building. The urgency is palpable, almost like a ticking clock urging you to act before it’s too late. Scammers are masters at this game, often pushing potential investors to make hasty decisions without taking a moment to investigate the legitimacy of the offer. They thrive on the fear of missing out, using phrases designed to provoke anxiety about being left behind.

To bolster their pitch, they might present glowing testimonials—crafted or exaggerated—to position the investment as a must-have opportunity. They play on your emotions with limited-time offers, enticing gifts, or fleeting discounts, all aimed at securing your commitment before you have a chance to pause and think critically.

3. Opacity in Operations

Picture this: a smooth-talking representative from an investment firm leans back confidently in his chair, looking you straight in the eye. “Just trust me,” he says with an assured grin. “I’ve been in this game for years, and believe me, you’ll see returns faster than you can imagine.”

Image may be NSFW.

Clik here to view.

Yet, as you press for more clarity, you find that the company is evasive and reluctant to share crucial details regarding the investment. Official documents—financial statements or investment prospectuses—seem conspicuously absent. It’s almost as if they don’t exist at all.

One common tactic employed by these scammers is using terms like “complex strategies” or “proprietary methods.” When they describe their approach in such convoluted terms, it raises red flags; they may be trying to obscure the truth or hide less-than-reputable practices. In this murky atmosphere of deception and lack of transparency, it becomes clear: if something seems too good to be true, it likely is.

4. Absence of Proper Licensing

Imagine being reassured by an investment firm that your money is perfectly secure with them—“Don’t worry, your investment is safe,” they might say. However, the reality is often starkly different. In many cases, these investment companies operate without the necessary oversight from regulatory authorities, leaving investors vulnerable.

Consider this: when you encounter investment professionals who lack proper licenses, it’s a glaring indicator of potential fraud. Some of these unscrupulous entities might even go so far as to falsely claim that they are regulated by legitimate bodies, all in an effort to deceive you.

This deceptive practice is particularly prevalent in offshore investment schemes that dangle the alluring prospect of “promising investments” in foreign markets or companies, often with little to no regulatory scrutiny. It’s crucial to understand that by engaging with an unregulated entity, you are essentially forfeiting the protections afforded to you under the laws set forth by the Monetary Authority of Singapore.

5. The Allure of “Commissions”

Picture this scenario: a friend excitedly shares an enticing offer from an investment firm, promising $500 for every new investor they refer. At first glance, it may seem like a harmless way to earn some extra cash. Yet, this tactic is a red flag in the world of legitimate investments.

In reality, such practices are not indicative of a trustworthy investment scheme. The true intention behind these “referral commissions” is to pressure existing investors into bringing in more people quickly, expanding the company’s investor base in record time. This model bears a striking resemblance to a pyramid scheme, where individuals (often referred to as victims) are lured into investing in a company or product with the promise of earning commissions for bringing in additional investors. The cycle continues, but at what cost?

Guarding Against Investment Fraud: A Cautionary Tale

In the world of investments, it is crucial to remain alert and proactive. As you embark on your financial journey, consider this guide on safeguarding yourself from deceitful schemes that might lure you in.

Image may be NSFW.

Clik here to view.

1. Exercise Common Sense

Picture this: an investment opportunity surfaces, promising returns that seem too good to be true. A voice in your head whispers, “Is this really aligned with current market trends?” If the prospect seems overly enticing, it’s time to pause and reflect.

Next, consider the nature of the offer. Did it come unsolicited? If so, tread carefully. Often, those who push aggressively for your commitment may have ulterior motives.

2. Investigate Thoroughly

Before you dive headfirst into an investment, take a step back. Don’t rush to accept every claim at face value! Conduct a thorough examination of the company in question.

Image may be NSFW.

Clik here to view.

– Is there a credible history you can uncover?

– Can you find evidence of a solid performance record?

– Is the entity registered with the Financial Institutions Directory?

– Are any of the so-called reputable individuals connected to this company listed in the Register of Representatives?

– Moreover, has this entity found itself on the Investor Alert List as a potential risk?

If uncertainties arise, don’t hesitate to bombard them with inquiries until you feel completely at ease with the opportunity presented. Be wary if they evade your questions or appear unable to provide clear answers—these are often signs to be cautious.

3. Seek Expert Guidance

When in doubt, enlist the help of a professional! Consulting a financial advisor or a trusted attorney can provide you with invaluable insights before you make any commitments. Their expertise can illuminate paths that might otherwise remain obscured.

4. Red Flags to Watch For

Steer clear of these pitfalls:

– Never divulge sensitive personal information!

– Resist any sense of urgency to invest hastily!

– Avoid making decisions based solely on superficial details!

The cornerstone of evading investment fraud lies in diligent research, asking probing questions, and never succumbing to haste. Constantly scrutinise a business’s authenticity, leadership, and financial standing before parting with your hard-earned money.

—

The Deceptive Allure of Love Scams in Singapore

Have you ever experienced the heart-wrenching pain of being deceived in matters of love? Imagine not infidelity but rather being ensnared by someone who doesn’t even exist. Picture finding an alluring individual on Tinder—a striking figure behind the wheel of an impressive Porsche—who seems ready to sweep you off your feet at a moment’s notice.

Yet, as with all fairy tales, there lurks an obstacle in this romantic fantasy. This charming Canadian gentleman of your dreams presents a catch: a barrier that stands between you and the passionate embrace you long for.

As we unravel these narratives of deception—whether in investments or matters of the heart—remember that vigilance and scepticism can be your greatest allies. Always protect yourself from those who would take advantage of trust and innocence.

Is it possible to be so enamoured that one could fall prey to such deceitful schemes? A striking statistic uncovered during the crackdown on scam operations in 2022 reveals a staggering S$33.3 million lost by unsuspecting victims, shedding light on this poignant question.

Image may be NSFW.

Clik here to view.

In recent times, love scams—often referred to as romance scams—have surged in prevalence across Singapore.

The nature of these scams is predominantly online, allowing perpetrators to fabricate entire personas. They can masquerade as potential romantic interests on dating platforms or social media, skillfully crafting an alluring facade.

Once a target is ensnared, the scammer embarks on a drawn-out and intimate virtual relationship, often delving into tales of personal adversity. They expertly connect with the victim’s emotional struggles while showering them with expressions of love and affection, creating an illusion of deep connection.

As the relationship develops and trust is fully established, the scammer subtly begins to solicit money from the victim under various pretences, often disguised as urgent needs or emergencies. At this juncture, they may also feel emboldened enough to request sensitive information like bank account or credit card details.

The financial fallout from love scams can be catastrophic for victims, with some individuals losing thousands or even tens of thousands of dollars. Therefore, it is crucial for anyone engaging in conversations with strangers online to remain vigilant, especially when faced with requests for money or personal data.

Who Falls Victim:

The yearning for companionship often stems from a profound need for emotional or physical intimacy. This longing is particularly prevalent among lonely, vulnerable, or introverted people.

Older individuals, those grappling with existing relationship issues, or people experiencing social isolation frequently find themselves at risk. Moreover, a lack of familiarity with online dating or social media can hinder victims from recognising the early warning signs of a love scam. Surprisingly, there are indeed hopeless romantics out there who seek emotional connections through mere words.

Identifying Love Scams:

Image may be NSFW.

Clik here to view.

To safeguard against these deceptive practices, it’s essential to be aware of certain red flags.

1. Over-the-Top Compliments

Consider the line: “Wow, your eyes are truly stunning…”

Such excessive flattery often serves as a tool for scammers to disarm their targets and establish emotional ties early on.

By remaining cautious and discerning while navigating the online dating landscape, individuals can protect themselves from the heartache and financial ruin that these scams can inflict.

The Red Flags of Online Romance

Image may be NSFW.

Clik here to view.

In the realm of online dating, one can easily find themselves swept up in the allure of love, especially when emotions are running high. However, hidden beneath the surface can lie a series of warning signs that should not be ignored.

1. The Elusive Encounter

Imagine this: you’ve been chatting with someone who seems utterly charming, and just when the conversation turns to meet face-to-face, they suddenly drop a bombshell. “Oh dear, my passport was stolen,” they claim with a sense of urgency. This is a common tactic among those who wish to keep all interactions strictly virtual. They often come up with various excuses to avoid any real-life meetings, preferring to remain cloaked in the anonymity of the dating platform.

2. The Mysterious Background

As you delve deeper into getting to know your “partner,” you may notice a pattern of vague responses when you inquire about their personal life. Questions about their background or experiences are often met with evasive answers or generic replies. It’s crucial to recognise this behaviour as a potential red flag; scammers refine their methods over time and can even borrow identities from previous victims to lend credibility to their stories.

Image may be NSFW.

Clik here to view.

3. The Financial Inquiry

Once a certain level of comfort is established, your partner may take a more intrusive turn by asking, “Sweetheart, what’s your monthly income?” This shift is often a strategic move to assess your financial situation and determine if pursuing this relationship is worth their while. It’s a subtle yet alarming sign that their interest may not be as genuine as it appears.

4. The Mixed-Up Tales

As conversations unfold, you might find yourself puzzled by conflicting stories. “Oh yes, John was at that party too—now that I think about it!” Your partner may frequently backtrack on details, attributing inconsistencies to forgetfulness or other flimsy excuses. Such storytelling can feel disorienting and should raise suspicions about their authenticity.

5. The Monetary Request

In a bid to solidify their connection, your partner may make an unexpected request: “Darling, could you lend me $500? I promise I’ll pay you back.” This plea often comes wrapped in tales of urgent need—perhaps for travel costs to finally meet you or for unexpected medical bills. Regardless of the fabricated circumstances, the urgency is always emphasised, aiming to tug at your heartstrings.

6. Emotional Manipulation

As the relationship deepens, so too does the manipulation. When they sense your hesitation about financial matters, they may resort to guilt tactics, saying something like, “If you truly loved me, you’d buy this for me.” Such statements are designed to exploit the emotional bond that has developed over time, gradually eroding your initial reluctance and pushing you toward compliance.

Navigating the Waters of Online Love

While the thrill of online romance can be intoxicating, it is essential to remain vigilant. Recognising these red flags can help safeguard your heart and finances from those who prey on vulnerability. Always trust your instincts, and don’t hesitate to seek advice if something feels off. Remember, love should never come with strings attached—or demands for money. Stay alert and protect yourself from falling into the trap of love scams.

Image may be NSFW.

Clik here to view.

Avoiding Love Scams: A Cautionary Tale

In today’s digital age, online dating has become an integral part of our social interactions, offering convenience and simplicity. However, as we navigate this new landscape, it’s crucial to remain vigilant against the lurking threat of love scams. Here are some essential strategies to protect yourself from falling victim to deceitful individuals who prey on vulnerable hearts.

Take Your Time!

Imagine you’ve met someone who seems to tick all the right boxes—a charming smile, engaging conversation, and a shared sense of humour. It’s easy to get swept away in the excitement of a budding romance. Yet, it’s vital to resist the urge to rush headlong into a relationship. Instead, allow yourself the luxury of time. Spend meaningful moments together in person, gradually uncovering the layers of your potential partner’s personality. This slow approach not only fosters genuine connection but also provides you with the opportunity to observe any red flags that might arise.

Scrutinise Your Conversations!

As you engage with this new person, pay close attention to the nuances of your chats. Do they seem overly eager to meet or frequently initiate conversations? Are they sharing an abundance of sob stories that tug at your heartstrings? If you find yourself being asked for financial assistance or encountering inconsistencies in their narratives, these could be significant warning signs. Moreover, watch for frequent grammatical errors in their messages—these can be telltale signs of a scammer at work. If you notice any concerning behaviours, it’s time to dig deeper.

Image may be NSFW.

Clik here to view.

Confirm Their Identity!

In an era where information is readily accessible, take advantage of online resources to verify the authenticity of your potential partner. Use search engines to cross-reference their photos and claims; a quick image search can reveal whether those alluring pictures belong to someone else entirely. Explore their presence on social media and other dating platforms—do their profiles align? Is there any indication of past fraudulent activity? Moreover, don’t shy away from requesting a video or voice call. If your partner consistently avoids face-to-face interaction, consider this a significant red flag.

Exercise Caution with Personal Information!

As your relationship develops, it may be tempting to share intimate details about your life. However, it’s essential to keep personal information—such as your home address, workplace, or banking details—under wraps until you can fully trust the other person. Additionally, never agree to assist anyone financially online, no matter how convincing their story may be. Protecting yourself means setting firm boundaries.

A Cautionary Example

Reflecting on real-life experiences can serve as a powerful reminders of the potential dangers lurking in online relationships. In 2021, a promising young graphic design student found himself ensnared in a web of deception when he was manipulated by someone posing as “Lin Fei.” The allure of an “in-game marriage” led him to part with S$2,100—an amount he believed was harmlessly spent. In hindsight, he recalled how playful and friendly “Lin Fei” had been, which clouded his judgment and made him less cautious.

Fast-forward to late 2022, another poignant story emerged involving a single father who faced a staggering loss of S$110,000 due to a similar scam. This individual was drawn in by a supposed girlfriend who expressed concern for his well-being during a particularly challenging time. Her emotional support masked her ulterior motive: persuading him to invest heavily in a gold-trading scheme that ultimately left him devastated.

These cautionary tales remind us that behind every enticing online persona could lie a scam artist waiting for the opportune moment to strike. In the realm of digital romance, the stakes can be high—but by remaining aware and following these guidelines, you can protect your heart and wallet from becoming collateral damage in the world of love scams.

Image may be NSFW.

Clik here to view.

Singapore’s Battle Against Scams: A Growing Concern

As a resident of Singapore, it’s disheartening to witness the escalating number of scams infiltrating our society. The reality is that as long as there are cracks in our systems, the threat of becoming a target for these deceptive schemes looms large.

The impact goes beyond mere financial losses; it shakes the foundation of trust we have in our local financial institutions.

However, amidst this climate of concern, the government has stepped up its efforts to address these issues, propelled by the public’s heightened anxiety over safety.

Current Measures in Place

One notable initiative making waves is ScamShield—an innovative algorithm that operates directly on your device. This technology scrutinises your incoming SMS messages against a comprehensive database of known scams, serving as a crucial line of defence against potential fraudsters.

You can integrate ScamShield with WhatsApp to automate the handling of suspicious messages or simply download the dedicated mobile app for Android and iOS devices. This allows for real-time detection of possible scams!

Since its introduction in November 2020, ScamShield has made significant strides, having successfully flagged over 22,865 SMS messages and blocked more than 5,537 questionable phone numbers through the app.

A New Alert System

Have you noticed messages labelled “Likely-Scam” appearing in your inbox over the past year? The Infocomm Media Development Authority (IMDA) provides this alert system, a valuable tool.

The “Likely Scam” designation serves as an additional layer of protection, heightening our awareness towards messages from unverified sender IDs.

Navigating E-commerce Safely

Diving into which platforms are reliable can be challenging in the realm of online shopping. To aid consumers in this journey, the introduction of the E-commerce Marketplace Transaction Safety Ratings (TSR) allows us to stay informed about the credibility of widely used platforms such as Shopee, Lazada, and Qoo10.

This initiative empowers us, as savvy consumers, to evaluate risks more effectively and avoid dubious sites.

Fresh Strategies for Scam Prevention in 2023

Building on these established initiatives, the government is unveiling new strategies for scam prevention throughout 2023. Minister of State Sun Xueling recently addressed Parliament, elaborating on a strategic framework aimed at combating scams more effectively.

As Singapore continues to grapple with this pressing issue, collective vigilance and proactive measures are clearly essential in safeguarding our community against fraud.

Let’s dive into the crucial updates that will keep you informed and prepared!

First, we are witnessing an increase in collaborations aimed at utilising technology to combat scams more effectively. This initiative is all about enhancing our defences against the persistent barrage of unwanted calls, text messages, and deceptive online advertisements that scammers typically rely on.

Secondly, security measures for government services and banking platforms are being significantly strengthened. This development means that it will be much more challenging for scammers to exploit weaknesses in these systems to reach us. For instance, one practical step being taken is the elimination of clickable links in official communications such as emails and text messages, which helps minimise the chances of falling victim to phishing schemes.

Lastly, there is a movement to tighten legislation surrounding scam-related activities. This new framework will act as a strong deterrent for those who facilitate these scams, particularly money mules. They will now face prosecution under severe laws, specifically the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act.

Image may be NSFW.

Clik here to view.

Equally important is the emphasis on public education. Being informed about the latest scams is vital for everyone. The government has committed significant resources to raise awareness through educational initiatives that keep us updated on anti-scam efforts each year.

This year’s campaign slogan, “ACT against scams,” is designed to be straightforward and memorable. The acronym stands for:

– Adding security features.

– Checking for signs of scams and consulting official sources.

– Telling authorities, friends, and family.

You might have noticed similar informational displays popping up around your neighbourhood in recent months. Even if you’ve only glanced at them, these visual aids play a crucial role in fostering instinctive awareness and encouraging proactive responses to potential scams.

As responsible citizens of Singapore, it’s imperative that we actively recognise and report scams within our community. By doing so, we can better safeguard ourselves and our loved ones from the threats posed by fraudsters.

In conclusion, while discussions about scams often highlight the importance of early prevention, the reality becomes starkly apparent when one has personally endured the consequences of such deceit. It is through these experiences that we understand the true impact of being vigilant and proactive in our defences against scams.

Maxthon

In a time when digital interactions are continuously evolving, navigating the vast expanse of the internet can feel like embarking on a daunting journey filled with obstacles. This online realm is not just an endless source of information; it also harbours various risks. Therefore, individuals need to arm themselves with dependable tools that can offer protection as they traverse this complex digital world. Among the numerous web browsers available today, Maxthon Browser stands out as a significant option. This remarkable browser tackles essential concerns related to security and privacy, all while being entirely free for its users.

Maxthon has carved out a niche in the fiercely competitive browser industry by placing utmost importance on user safety and privacy. With a steadfast dedication to protecting personal information and online behaviour from numerous cyber threats, Maxthon employs a variety of innovative strategies designed to safeguard user data. Through the use of advanced encryption techniques, this browser ensures that sensitive information remains secure and private during online sessions.

Image may be NSFW.

Clik here to view.

What sets Maxthon apart from other browsers is its relentless commitment to enhancing user privacy throughout the browsing experience. It has been thoughtfully designed with features aimed at minimising your digital footprint. Its robust ad-blocking functionality, extensive anti-tracking mechanisms, and specialised private browsing mode work in unison to eliminate intrusive ads and block tracking scripts that could jeopardise your online safety. As a result, users can navigate the web with increased confidence. Furthermore, the private browsing mode provides an additional layer of security, enabling users to browse without leaving any digital traces on their devices.

The post How To Protect Yourself From Singapore’s Scam Threats appeared first on Maxthon | Privacy Private Browser.