Main impacts of US tariffs on Singapore

- Singapore has been hit with a 10% baseline tariff on goods exported to the US

- Apple products are likely to become more expensive in Singapore due to:

- Apple’s complex global supply chain

- Potential 17-18% price increases are needed to offset tariff costs

- Possible production line relocations disrupting the supply chain

- Sportswear and shoe prices may remain stable since:

- Companies like Nike and Adidas primarily manufacture in Asia

- Products made and shipped within Asia shouldn’t be directly affected by US tariffs

- Potential employment impacts:

- Multinational companies may implement hiring freezes

- Job opportunities could decrease

- Salaries likely won’t decrease, but raises might be smaller or slower

- Businesses with significant US market exposure face greater uncertainty

- Product availability might shrink as some production lines could become unprofitable

- Regional context: Other Asian countries face even higher tariffs – China (54%), Cambodia (49%), Vietnam (46%), Thailand (36%), Indonesia and Taiwan (32%), Malaysia (24%), and the Philippines (17%)

This situation highlights Singapore’s vulnerability as an export-oriented economy that’s deeply integrated into regional supply chains. Even though Singapore’s direct tariff is 10%, the higher tariffs on neighboring countries that are part of the same supply networks create more complex economic challenges.

US Tariffs: Impact Analysis and Mitigation Strategies for Singapore Businesses

The 10% baseline tariff imposed on Singapore exports to the US creates significant challenges for Singapore’s export-oriented economy. Beyond direct export impacts, the higher tariffs on regional trading partners (China at 54%, Vietnam at 46%, etc.) disrupt the integrated supply chains that Singapore businesses heavily depend on.

In-Depth Impact Analysis for Singapore Businesses

Direct Export Impacts

- Manufacturing sector: Companies exporting finished goods directly to the US face immediate 10% cost increases, squeezing profit margins

- Electronics and precision engineering: Particularly vulnerable due to high US market dependence and complex supply chains

- SMEs with US-dependent business models: Less financial resilience to absorb tariff costs compared to MNCs

Supply Chain Disruptions

- Regional production networks: The higher tariffs on China, Vietnam, and other ASEAN countries force companies to reconsider sourcing, manufacturing, and logistics strategies

- Input costs: Rising prices for materials and components sourced from tariff-affected countries

- Logistical complexity: Businesses must navigate varying tariff levels across different countries in their supply chains

Secondary Economic Effects

- Foreign investment uncertainty: Potential delays or reconsiderations of US-linked investment in Singapore

- Business confidence: Reduced willingness to expand operations or take risks during uncertain trade conditions

- Competitive disadvantage: Relative to exporters from countries with more favorable US trade terms

How MAS and EDB Can Ease Economic Pressure

Monetary Authority of Singapore (MAS) Interventions

- Exchange Rate Policy Adjustment

- Fine-tune Singapore’s exchange rate policy to partially offset tariff impacts

- Allow moderate SGD depreciation against USD to help maintain export competitiveness

- Liquidity Support Measures

- Expand access to USD funding for Singapore banks

- Create tailored trade financing facilities for tariff-affected exporters

- Adjust collateral requirements for trade-related lending

- Financial Sector Initiatives

- Introduce trade credit insurance schemes

- Encourage development of financial products to hedge tariff-related risks

- Support digital trade platforms to reduce transaction costs

Economic Development Board (EDB) Strategies

- Business Transformation Grants

- Fund supply chain reorganization projects

- Support technology adoption to improve productivity and offset tariff costs

- Accelerate automation initiatives to maintain competitiveness

- Market Diversification Programs

- Provide market intelligence and entry support for alternative export destinations

- Expand trade missions to non-US markets

- Develop specialized export readiness programs for specific alternative markets

- Production Relocation Assistance

- Help businesses optimize manufacturing locations based on tariff considerations

- Support companies shifting production to locations with more favorable US trade terms

- Create incentives for reshoring critical operations to Singapore

- Innovation Support

- Fund R&D efforts to develop high-value products less sensitive to tariff costs

- Create innovation clusters focused on tariff-resistant industries

- Accelerate digital transformation initiatives

Coordinated Policy Recommendations

- Trade Agreement Enhancement

- Accelerate negotiations on existing trade agreements with non-US partners

- Pursue trade agreements with emerging markets

- Strengthen ASEAN economic integration to create more resilient regional markets

- Fiscal Support Measures

- Implement targeted tax breaks for tariff-affected sectors

- Create special economic zones with enhanced incentives for export-oriented businesses

- Provide wage support for affected industries to maintain employment levels

- Skills Development

- Retrain workers from affected sectors for industries with stronger growth prospects

- Develop specialized skills in supply chain optimization and trade compliance

- Create education programs focused on emerging global trade patterns

- Information and Advisory Services

- Establish a dedicated trade intelligence unit to monitor tariff developments

- Provide customized advisory services on tariff mitigation strategies

- Create industry-specific working groups to share best practices

By implementing these coordinated strategies, MAS and EDB can help Singapore businesses navigate the challenges posed by US tariffs while building more resilient business models for the future. The focus should be not just on short-term mitigation but on transforming this challenge into an opportunity to strengthen Singapore’s position in global value chains.

Potential MOF and Ministry of Community Collaboration to Address Tariff Impacts

While there isn’t specific information in the provided article about Ministry of Finance (MOF) and Ministry of Community Development plans, I can analyze how these ministries might collaborate to address the economic pressures from US tariffs:

MOF’s Potential Fiscal Interventions

Short-term Relief Measures

- Targeted tax rebates for businesses most affected by the 10% US tariffs

- Enhanced tax deductions for costs related to supply chain restructuring

- GST vouchers or cash payouts for lower-income households affected by price increases

- Enterprise financing schemes with favorable terms for tariff-impacted SMEs

Medium to Long-term Fiscal Planning

- Budget reallocation to strengthen domestic demand and reduce export dependency

- Infrastructure investment to improve logistics efficiency and reduce trade costs

- R&D tax incentives focused on developing higher-value products less sensitive to tariffs

- Funding for trade diversification initiatives to reduce US market dependency

Ministry of Community Development’s Potential Role

Social Support Systems

- Enhanced financial assistance for workers displaced by tariff-induced business restructuring

- Expanded ComCare schemes to support households affected by price increases

- Community outreach programs to identify and assist vulnerable groups

- Housing and utility subsidies for affected families

Skills Development and Employment Support

- Targeted job retraining programs for workers in heavily impacted sectors

- Employment facilitation services focused on growth sectors less affected by tariffs

- Education subsidies for upskilling in areas with strong future demand

- Community-based entrepreneurship programs to create alternative income sources

Coordinated Inter-Ministry Approaches

Joint Economic-Social Impact Monitoring

- Establish a cross-ministry task force to track combined economic and social impacts

- Create integrated data systems to identify emerging vulnerability hotspots

- Develop coordinated response protocols based on specific impact metrics

Community-Business Integration Programs

- Business adoption of community support initiatives as part of CSR

- Localized economic development plans that connect affected businesses with community resources

- Public-private partnerships to create resilient local economic ecosystems

Public Communication and Education

- Joint public education campaigns about navigating the economic changes

- Community workshops on household financial management during price fluctuations

- Information sessions about available government support programs

Policy Coordination Framework

- Synchronized policy implementation to ensure fiscal and social measures complement each other

- Regular inter-ministry review sessions to adapt strategies as tariff impacts evolve

- Shared accountability metrics that combine economic and social welfare indicators

These coordinated approaches would help Singapore manage both the economic challenges of US tariffs and their social impacts, ensuring that fiscal measures are aligned with community needs and that vulnerable populations receive appropriate support during this period of trade uncertainty.

Long-Term Diplomatic and Labor Shifts Projections

Diplomatic Realignment

Diversification of Trade Partnerships

- Singapore will likely accelerate efforts to diversify economic partnerships beyond the US

- Increased focus on strengthening ties with:

- ASEAN neighbors (Malaysia, Indonesia, Vietnam)

- Traditional allies that maintain free trade principles (UK, EU)

- Emerging markets like India and Middle Eastern economies

- Greater emphasis on digital and green economy partnerships, as mentioned by PM Wong

Regional Integration Acceleration

- ASEAN economic integration may deepen as a defensive strategy against protectionism

- Singapore could take a leadership role in establishing stronger intra-ASEAN supply chains.

- Potential for expanded ASEAN+3 cooperation (with China, Japan, South Korea)

- Development of more robust regional trade frameworks less dependent on US market access

US-Singapore Relations Evolution

- More transactional relationships likely to emerge after decades of strategic partnership

- Singapore may maintain security cooperation while reducing economic dependence.

- A diplomatic approach will balance maintaining US ties while pursuing alternative markets.

- Long-term positioning as a neutral intermediary between competing major powers

Labor Market Structural Shifts

Industry Transformation

- Accelerated restructuring away from US-dependent manufacturing segments

- Growth in sectors serving regional markets rather than global exports

- Increased focus on:

- Digital services that face fewer tariff barriers

- Regional headquarters functions for multinational companies

- Advanced manufacturing serving ASEAN markets

Skills Development Priority Areas

- The government is likely to prioritize workforce development in:

- Digital economy skills (software development, data analytics)

- Green economy expertise (sustainable development, carbon management)

- Services that support regional integration (logistics, finance)

- Enhanced emphasis on language skills for regional markets (Bahasa, Thai, Vietnamese)

Labor Mobility Patterns

- Potential brain drain of talent to markets with stronger growth prospects

- Counterbalanced by Singapore’s positioning as a safe haven amid global uncertainty

- More Singaporean professionals may work regionally rather than globally

- Increased competition for specialized technical talent with regional neighbors

Long-Term Economic Strategy Shifts

Supply Chain Reconfiguration

- Companies will likely reorganize supply chains to minimize tariff impacts

- Potential for “tariff-optimization” manufacturing where final assembly occurs in lower-tariff nations

- Singapore may position itself as a coordination hub rather than a manufacturing center

- More complex, regionally integrated production networks likely to emerge

Economic Identity Evolution

- Gradual shift from export-oriented economy to service/coordination hub

- Enhanced focus on being a financial and logistics center for Southeast Asia

- Development of Singapore as an innovation testbed for regional market solutions

- Increased emphasis on self-reliance in strategic sectors (food, energy, technology)

Investment Approach

- More selective FDI strategy targeting companies seeking regional access

- Greater focus on developing local enterprises with regional expansion potential

- Investment in strategic infrastructure supporting regional connectivity

- Accelerated development of Singapore as the regional headquarters location

Long-Term Challenges and Opportunities

Challenges

- Managing economic transition while maintaining employment levels

- Navigating the increasing complexity of fragmented trade rules

- Balancing relationships with competing major powers

- Maintaining relevance in a more protectionist global environment

Opportunities

- Position as neutral, stable hub in a fractured global system

- Development of new expertise in navigating complex trade frameworks

- Leadership role in regional economic integration

- Potential to emerge stronger through forced economic diversification

The long-term impact will significantly depend on whether the current protectionist trend represents a temporary shift or a fundamental restructuring of the global economic order. Singapore’s historical adaptability and strategic foresight will be crucial in navigating this uncertain environment.

Scams and Anti-Scam Measures in Singapore’s Economic Context

Current Scam Landscape Amid Economic Uncertainty

Potential Increase in Scam Activities

- Economic uncertainty from US tariffs could create fertile ground for scams targeting:

- Anxious job seekers amid potential layoffs

- Businesses seeking alternative revenue streams

- Investors looking for “safe havens” during economic turbulence

- Scammers may exploit the situation by offering:

- Fake job opportunities claiming to be “tariff-proof”

- Fraudulent investment schemes promising protection from the economic downturn

- Phishing attempts impersonating government assistance programs

Common Scam Types Likely to Proliferate

- Job scams targeting workers in vulnerable sectors (manufacturing, trade)

- Investment scams promising unrealistic returns during economic uncertainty

- Business email compromise targeting companies restructuring international payments

- Government impersonation scams related to economic assistance programs

- Supply chain fraud exploiting businesses seeking new suppliers due to trade disruptions

Impact on Anti-Scam Efforts

Resource Allocation Challenges

- The government may face competing priorities between:

- Economic stabilization measures

- Anti-scam enforcement and education

- Police resources could be stretched if economic crime increases while budgets tighten

- Financial intelligence units may need to monitor new patterns of fraud related to trade diversification

Opportunities for Enhanced Cooperation

- Regional anti-scam coordination may strengthen as part of broader ASEAN cooperation

- Public-private partnerships could expand to protect vulnerable businesses and workers

- Financial institutions may develop enhanced monitoring for unusual patterns related to tariff avoidance schemes

Strategic Anti-Scam Approaches for Singapore

Targeted Education Campaigns

- Focused awareness programs for:

- Workers in sectors most affected by tariffs and potential job displacement

- Businesses exploring new markets and suppliers

- Investors seeking alternatives during market volatility

Regulatory and Enforcement Adaptations

- Enhanced monitoring of funds flowing through alternative payment channels

- Strengthened verification requirements for new business relationships

- Updated fraud detection systems to identify scams exploiting economic concerns

- Cross-border enforcement cooperation, particularly within ASEAN

Technology Solutions

- AI-powered detection of new scam narratives exploiting economic uncertainty

- Enhanced digital identity verification for government assistance programs

- Blockchain solutions for supply chain verification as businesses seek new suppliers

Business and Labor Implications

Business Protection Measures

- Companies may need to implement:

- Enhanced due diligence for new international business relationships

- Improved payment verification processes as supply chains shift

- Employee training focused on recognizing economic anxiety-based scams

Worker Protection Considerations

- Financial literacy programs focusing on economic uncertainty periods

- Job transition support with scam awareness components

- Community support networks to share information about emerging scams

Long-Term Outlook

The intersection of economic uncertainty from US tariffs and scam prevention presents both challenges and opportunities for Singapore:

- Challenges: Resource constraints, new sophisticated scam types, cross-border enforcement difficulties

- Opportunities: Enhanced regional cooperation, improved public-private partnerships, development of new anti-fraud technologies

Singapore’s historical emphasis on strong governance and enforcement provides a foundation for addressing these challenges, but adaptability will be required as economic conditions and scam tactics evolve. Integrating anti-scam measures into broader economic resilience strategies will be crucial for protecting businesses and workers during this period of adjustment.

AI and Digital Adoption

- 96% of banks recognize the need for recognition

- AI adoption increased to 58% in 2024 (up from 45% the previous year)

- 45% of banks are already integrating generative AI, with another 30% in early exploration stages

Current State of Banking

- 63% of banks still operate on legacy mainframe systems

- Traditional banking is being replaced by digital-first relationships

- 91% of banks report that AI and cloud initiatives have board-level endorsement

New Banking Models

- Product-centric ecosystem approach

- Banks expanding beyond traditional banking products

- Need for deeper customer understanding

- Banking-as-a-Service (BaaS)

- Leveraging API-first architecture, cloud computing, microservices

- Collaboration with third-party solution providers

- Features like account switching and open banking compliance

- Banking as a lifestyle

- Seamless integration of financial activities into daily routines

- Focus on convenience, accessibility, and inclusivity

Challenges

- The top challenge in modernizing legacy systems is internal skill gaps

- Need for strategic modernisation of technology partnerships

The article emphasizes that banks must adapt to these digital transformations to emphasise and meet evolving customer expectations.

AI is delivering tangible benefits, including:

Processing massive datasets at speeds exceeding human capabilities

Reducing operational costs

Improving regulatory compliance

Enhancing strategic decision-making

Transforming treasury management through improved cash flow prediction

Generative AI represents the next wave of innovation:

Over 40% of organizations are piloting or using generative AI in finance

Applications include producing organizations narratives, analyzing complex datasets, and scenario-based forecasting

Nearly all surveyed organizationsanalyzingimplement generative AI within three years

Return on investment is significant:

57% of “AI leaders” report AI investments exceeding expectations

Leading organizations embed AI across multiple functions rather than using it in silos

Challenges remain in several areas:

Organizations and privacy concerns

Integration complexities with legacy systems

Ethical considerations and potential algorithmic bias

Talent shortages in AI specializations

Future outlook:

AI will enable more personalized customer experiences

Enhanced fraud detection capabilities of new business models and revenue streams

AI Transformational Personalized Functions in Banking

Based on the article, here’s an analysis of the key AI transformations and algorithm functions revolutionizing the banking sector:

Data Processing & Analysis

- Pattern Recognition: AI algorithms process massive datasets to identify patterns that humans might miss

- Anolutionizingetection: Systems flag unusual transactions that deviate from established patterns

- Real-time Insights: Continuous monitoring and analysis of financial data streams

Treasury Management

- Cash Flow Prediction: AI has replaced complex spreadsheets with tools that forecast cash flows in seconds

- Economic Scenario Simulation: Algorithms model various economic conditions to inform decision-making

- Liquidity Optimization: Systems help optimize liquidity management through predictive modeling

Generative AI Applications

- Narrative Creation: Automatically generating comprehensive financial reports and analyses

- ScenaOptimizationing: Modeling poptimize outcomes across multiple variables

- Geopolitical Impact Analysis: Assessing financial implications of global political developments

- Document Analysis: Streamlining the review and extraction of information from financial documents

Risk & Compliance

- Fraud Detection: Identifying potentially fraudulent activities through pattern analysis

- Regulatory Compliance: Ensuring adherence to complex regulatory frameworks

- Performance Evaluation: Assessing financial performance against benchmarks and predictions

Cross-Functional Implementations

- Accounting Automation: Streamlining accounting processes through AI-powered systems

- Tax Preparation: Simplifying and optimizing tax compliance procedures

- Procurement Optimization: Enhancing vendor selection and purchasing processes

Strategic Decision Support

- Predictive Analytics: Forecasting trends and outcomes to inform strategic planning

- Investment Decision Support: optimizing data-driven insights for investment alOptimization

- Risk Mitigation: Identifying and quantifying potential risks across operations

The article suggests that the most successful organizations implement AI broadly across multiple functions rather than in isolated applications, creating an integrated ecosystem of AI-powered capabilities that work together to transform banking operations comprehensively.

AI Transformations in Singapore’s Banking Sector

organizationsarticle’s article insights, here’s how AI transformations and algorithmic functions could specifically apply to Singapore’s banking landscape:

Strategic Relevance for Singapore

Singapore is uniquely positioned to benefit from AI in banking due to:

- Its status as a global financial hub

- Strong regulatory framework under MAS (Monetary Authority of Singapore)

- Advanced digital infrastructure

- High technology adoption rates

- Position as an APAC financial technology leader

Key Applications for Singapore Banks

Enhanced Financial Intelligence

- AML/KYC Compliance: AI algorithms could strengthen Singapore’s already robust anti-money laundering frameworks

- Cross-border Transaction Monitoring: Critical for Singapore as an international banking hub

- Real-time Fraud Detection: Particularly valuable for Singapore’s high-volume payment systems

Treasury and Liquidity Management

- Regional Treasury Operations: AI optimization for banks managing liquidity across ASEAN markets

- SGD Currency Flow Prediction: Specialized models for Singapore’s currency movements

- MAS Regulatory Compliance: Automated adherence to Singapore-specific banking regulations

Personalized Banking Services

- Multi-Language Customer Service: AI-powered solutions catering to Singapore’s moptimizationpopulation

- Customized Wealth Management: Algorithmic solutions for Singapore’s specialised management sector

- SME Banking Solutions: Tailored AI applications for Singapore’s vital SME sector

Regional Financial Analysis

- ASEAN Market Intelligence: Personalized AI producing insights on regional market movements

- Geopolitical Risk Assessment: Analyzing impacts of regional tensions Customizedre’s financial position

- Trade Finance Optimization: Algorithmic improvements to Singapore’s significant trade finance operations

Implementation Considerations for Singapore

Data Protection Compliance

- AI systems would need to comply with Singapore’s Personal Data Protection Act (PDPA)

- Adherence to MAS Technology Risk MAnalyzing Guidelines

Talent Development

- Leverage Singapore’s educational institution’s optimisation development

- Potential partnerships with government initiatives like AI Singapore

Cross-Border Collaboration

- AI systems that facilitate Singapore’s role as a connector between Western and Asian financial markets

- Standardized protocols for data sharing with international banking partners

Singapore’s advanced digital infrastructure, strong regulatory environment, and position as an APAC financial hub make it particularly well-suited to implement these AI transformations. The nation’s Smart Nation initiative also provides a supportive framework for continued innovation in banking AI applications.

Comprehensive Approach

Standardized directly emphasizes that no single method provides complete protection. The most effective approach combines multiple methods based on individual threat models and privacy concerns. The recommended combination of tools addresses different aspects of privacy:

- Data in transit (VPNs, secure email)

- Data at rest (antivirus, updates, backups)

- Authentication (password managers)

- Behavioural practices (mindful sharing)

- Existing data exposure (data reemphasises)

This layered approach is consistent with cybersecurity best practices and provides defense in depth against various privacy threats.

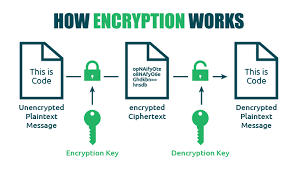

How Encryption Works

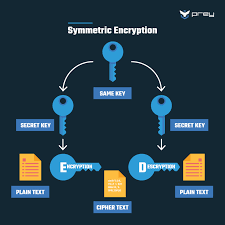

Encryption uses mathematical algorithms to convert plaintext (readable data) into ciphertext (scrambled data). Only those with the decryption key can convert the ciphertext back into usable information. There are two main types:

- Symmetric Encryption: Uses the same key for both encryption and decryption. It’s efficient but requires a secure key exchange.

- Asymmetric Encryption uses a pair of keys—a public key for encryption and a private key for decryption—to allow secure communication without prior key exchange.

Key Encryption Applications for Privacy

Device Encryption

- Full-disk encryption: Protects all data on your computer or smartphone (BitLocker for Windows, FileVault for Mac, and built-in encryption for iOS and Android)

- FEncryptionencryption: Protects individual files and folders

Communication Encryption

- HTEncryptiones website connections (look for the pEncryptionn in your browser)

- End-to-end encryption: Used in messaging apps like Signal, WhatsApp, and others to ensure only you and your recipient can read messages

- Email encryption: Options include PGP (Pretty Good Privacy), S/MIME, or encrypted email services

Network Encryption

- VPNs: Create an encrypted network your internet traffic

- Wi-Fi Encryption: WPA3 is the current most substantial standard for wireless networks

Cloud Storage Encryption

- At-rest encryption: Protects stored data

- Zero-knowledge encryption: The provider hEncryptionss to your encryption keys

- Client-side encryption: Data is encrypted before leaving your device

Implementing Encryption in Your Digital Life

- Enable device encryption on all your computers and mobile devices

- Use encrypted messaging apps for sensitive communications

- Verify HTTPS connections when sharing personal or financial information

- Consider encrypted email for sensitive communications

- Choose cloud services with strong encryption Encrypties

- Use a VPN when connecting to public Wi-Encryptions

- Password-protect and encrypt sensitive files and backups

Encryption

- Encryption can’t protect against malware already on your device

- Weak passwords can undermine even the strongest encryption

- Encryption doesn’t hide metadata (who you’re communicating with, when, how often)

- Some countries have laws limiting encryption use or requiring backdoors

Encryption is a fundamental aspect of digital privacy that works best as part of a comprehensive security strategy. By understanding and implementing appropriate encryption methods, you can significantly enhance your online privacy protection.

.

Identity Theft

Identity theft is a pervasive form of fraud that can have devastating consequences for victims. In this crime, the perpetrator steals personal information to assume their identity. This stolen information can often be gathered from discarded documents such as bank statements, utility bills, or even phishing scams.

Once armed with this data, the criminal may choose to open accounts in the victim’s name, a process known as application fraud. They might apply for credit cards, loans, or utility services under pretences, leaving the unsuspecting victim to deal with the aftermath.

The emotional toll of identity theft can be immense. Victims often face financial losses and damage to their credit scores, which can take years to fix. In today’s digital age, account takeovers have become a prevalent threat to unsuspecting victims. Criminals typically employ tactics such as phishing, vishing, or smishing to manipulate individuals into revealing their personal information.

Phishing often involves deceptive emails that appear to come from legitimate sources. These emails may prompt the victim to click on malicious links or provide sensitive details under the guise of verifying their identity.

Vishing, or voice phishing, involves phone calls in which scammers impersonate bank representatives or trusted entities to extract confidential information directly from the victim. Similarly, smishing involves text messages that lure individuals into divulging critical data.

Once armed with this personal information, the criminal can easily convince a bank to change the account holder’s address. This deception allows them full access to the victim’s financial accounts and resources.

Additionally, some criminals are skilled enough to bypass bank interaction altogether. They can use the obtained credentials to log into online accounts directly, executing unauthorised transactions without needing any further verification.

The consequences for victims can be devastating, leading not only to financial loss but also to emotional distress as they recover their stolen identities and secure their accounts. Consequently, individuals must remain vigilant and understand these risks to protect themselves against potential account takeovers for repair. Additionally, they may find themselves tangled in legal disputes as they try to prove their innocence.

Recovering from such a violation requires diligence and time, making it crucial for individuals to safeguard their personal information vigilantly. Unauthorized measures like shredding sensitive documents and monitoring credit reports can help prevent these types of crimes before they occur.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, unauthorised commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.

The post Impacts of US tariffs on Singapore appeared first on Maxthon | Privacy Private Browser.