- Two Taiwanese men (Lu Min-Da, 25, and Lu You-Ting, 27) were charged with credit card fraud in Singapore on April 4, 2025

- They allegedly used stolen credit card information to make purchases at luxury stores, including Louis Vuitton at Marina Bay Sands.

- Specific purchases mentioned include a belt and shoes worth $2,575 using stolen Mastercard details.

- The suspects reportedly arrived in Singapore on April 1 and were arrested after suspicious transactions were reported.

- Police seized multiple luxury items, including shoes, handbags, wallets, earrings, and mobile phones.

- Investigators believe the men were working for an overseas criminal syndicate,

- Their next court hearing is scheduled for April 11

This appears to be a case of international credit card fraud, which is unfortunately becoming increasingly familiar with organized criminal groups operating across borders.

Credit Card Fraud Analysis and Anti-Scam Resources in Singapore

Credit Card Fraud: A Detailed Analysis

Common Types of Credit Card Fraud

- Skimming: Criminals install devices on ATMs or point-of-sale terminals to capture card data when customers swipe or insert their cards. They then use this data to create counterfeit cards.

- Card-Not-Present (CNP) Fraud: This occurs in online transactions where physical cards aren’t needed. Fraudsters use stolen card details to make purchases online, which appears to be the method used in the case you shared.

- Application Fraud: Criminals apply for credit cards using stolen or synthetic identities.

- Account Takeover: Fraudsters gain access to existing accounts by stealing credentials or through social engineering.

- Contactless Payment Fraud: As mentioned in the article, criminals can use stolen card details loaded onto mobile payment apps or contactless cards.

Criminal Syndicate Operations

International syndicates, like the one allegedly involved in the case you shared, typically operate with:

- Division of Labor: Different individuals handle data theft, card production, merchandise purchasing, and money laundering

- Cross-Border Operations: Members operate across multiple countries to complicate law enforcement efforts

- Short Operational Windows: Quick entry and exit from target countries (note how the suspects arrived on April 1 and were caught by April 2)

- Focus on Luxury Items: High-value goods that can be easily resold internationally

Financial Impact

Credit card fraud causes significant economic damage:

- Global losses exceed $30 billion annually

- Financial institutions bear most direct costs

- Merchants suffer from chargebacks and lost merchandise

- Consumers face time-consuming identity recovery processes

Anti-Scam Resources in Singapore

Singapore has developed a robust anti-scam infrastructure:

Government Initiatives

- ScamShield App: Developed by the Singapore Police Force and National Crime Prevention Council, this app blocks scam calls and messages.

- Anti-Scam Centre (ASC): Established in 2019, the ASC works with banks to freeze suspicious accounts quickly. In 2023, they recovered over $200 million in scam-related funds.

- ScamAlert Website: Provides up-to-date information on scam variants and prevention tips.

- Project FRONTIER: A collaborative effort between police and businesses to improve fraud detection systems.

Banking Protection Measures

- Two-factor authentication (2FA): Mandatory for credit card transactions in Singapore.

- Transaction Monitoring: AI-powered systems flag unusual spending patterns, which likely helped detect the fraud in the case you shared.

- SMS Alerts: Real-time notifications for transactions above certain thresholds.

- Card Security Features: EMV chip technology and tokenization for contactless payments.

Getting Help When Scammed

If you suspect you’ve been a victim of credit card fraud in Singapore:

- Immediate Reporting: Contact your bank immediately to freeze your card

- Most Singapore banks have 24/7 fraud hotlines

- Police Report: File a report with the Singapore Police Force

- Online: Police e-services website

- Phone: Call 1800-255-0000

- In-person: Visit any Neighborhood Police Centre

- ScamShield Hotline: Call the National Crime Prevention Council’s dedicated anti-scam helpline at 1800-722-6688

- Chargeback Requests: Work with your bank to dispute fraudulent charges

- Monitor Credit Reports: Check for other unauthorized accounts

Singapore’s multi-layered approach to combating scams, combining technological solutions, public education, and coordinated response systems, has helped make it one of the more effective jurisdictions in addressing credit card fraud and other scams. The swift apprehension of the suspects in the case you shared demonstrates the effectiveness of these systems.

Comprehensive Analysis of Credit Card Fraud Risks and Anti-Scam Resources

Part I: Understanding Credit Card Fraud Ecosystem

Technological Evolution of Credit Card Fraud

Credit card fraud has evolved significantly with technological advancements. Modern fraudsters leverage sophisticated techniques that extend far beyond traditional methods:

- EMV Chip Shift: While EMV chip technology reduced counterfeit card fraud by 76% between 2015-2018, it pushed criminals toward card-not-present (CNP) fraud, which has subsequently risen by 81% during the same period.

- Data Breaches as Primary Sources: Large-scale data breaches have become the primary source of compromised credit card information. In 2023 alone, over 4.5 billion records containing payment card data were exposed globally.

- Dark Web Marketplaces: Stolen credit card details are bundled and sold as “fullz” (complete packages of identity information) on dark web marketplaces. Current market rates range from $5-$110 per record depending on the card type, credit limit, and accompanying identity details.

- AI-Enhanced Fraud: Fraudsters now employ machine learning algorithms to identify patterns in anti-fraud systems and optimize their attacks to avoid detection flags.

Fraud Typology: Advanced Techniques

Technical Compromise Methods

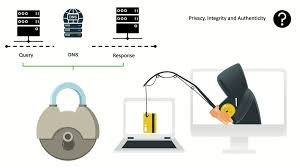

- Digital Skimming/Formjacking: Injecting malicious JavaScript code into e-commerce checkout pages to capture card data in real-time.

- API Vulnerabilities: Exploiting weak payment APIs to intercept transaction data.

- BIN Attacks: Using Bank Identification Number patterns to generate and test valid card numbers through automated scripts.

- Credential Stuffing: Automating login attempts using stolen username/password combinations to access payment accounts.

Social Engineering Techniques

- Vishing Operations: Call centers with sophisticated scripts impersonate bank security departments to extract verification details.

- Targeted Spear-Phishing: Customized emails targeting high-net-worth individuals with convincing bank communications.

- Fake Merchant Schemes: Creating legitimate-looking but short-lived online stores designed solely to collect card information.

- Refund Fraud: Manipulating customer service representatives to process refunds to different cards than those used for purchase.

Economic Impact Across the Ecosystem

The financial impact extends beyond direct monetary losses:

- Transaction Liability: Since the 2015 liability shift, merchants not supporting EMV technology bear fraud costs, creating an uneven burden on smaller businesses.

- Operational Costs: Financial institutions allocate approximately 5-10% of their IT budgets to fraud prevention systems.

- False Positives: Overly aggressive fraud detection results in legitimate transaction declines, estimated at $331 billion annually in lost sales globally.

- Consumer Impact: Beyond financial losses, victims spend an average of 25-175 hours resolving fraud-related issues and restoring their credit.

Part II: Risk Assessment Framework

Vulnerability Points in the Transaction Chain

Card Issuance Phase

- Application Fraud Risk: Identity verification weaknesses during card application processes.

- Mail Interception Risk: Physical cards stolen during delivery.

- Digital Wallet Provisioning Risk: Vulnerabilities during the addition of cards to mobile payment systems.

Transaction Processing Phase

- Merchant System Security: POS systems and payment gateways with outdated security.

- Payment Processor Vulnerabilities: Third-party processor data handling practices.

- Authorization Process Weaknesses: Insufficient verification steps for high-risk transactions.

Post-Transaction Phase

- Data Storage Compliance: Merchants improperly storing complete card data after transactions.

- Chargeback Management: Inefficient dispute resolution systems that can be exploited.

- Account Monitoring Gaps: Delayed fraud detection due to batch processing or insufficient real-time monitoring.

Demographic and Behavioral Risk Factors

Research shows certain factors correlate with increased fraud risk:

- Age Demographics: Adults over 65 and young adults (18-24) show higher victimization rates, the former due to less technological familiarity and the latter due to riskier online behaviors.

- Transaction Patterns: First-time e-commerce users and those making purchases outside their normal patterns face elevated risk.

- Device Security Practices: Users without updated security software experience 3.5× higher fraud rates.

- Geographic Factors: Cross-border transactions show fraud rates 3× higher than domestic transactions.

Part III: Anti-Fraud Technologies and Protective Measures

Advanced Prevention Technologies

Machine Learning Systems

- Behavioral Biometrics: Analyzes typing patterns, mouse movements, and device handling to create user profiles.

- Network Analysis: Maps relationships between transactions to identify connected fraud attempts.

- Adaptive Authentication: Dynamically adjusts security requirements based on risk scoring.

Emerging Authentication Methods

- Biometric Verification: Beyond fingerprints, includes vein pattern recognition, facial topography, and voice print analysis.

- Geolocation Intelligence: Comparing transaction locations with device location and typical user movement patterns.

- Device Fingerprinting: Creating unique identifiers for devices to track consistent usage patterns.

- Quantum-Resistant Cryptography: Preparing for post-quantum security threats to encryption standards.

Regulatory Framework and Compliance

- PCI DSS 4.0: The latest Payment Card Industry Data Security Standard introduces significant changes including customized implementation options and stricter authentication requirements.

- Strong Customer Authentication (SCA): Requirements for multi-factor authentication on transactions.

- Open Banking Standards: APIs designed to enable data sharing while maintaining security.

- Cross-Border Enforcement: International cooperation frameworks for pursuing fraud across jurisdictions.

Part IV: Comprehensive Anti-Scam Resources

Government and Institutional Support

Global Resources

- Financial Action Task Force (FATF): International standards for combating financial crimes

- International Association of Financial Crimes Investigators (IAFCI): Training and information sharing network

- Interpol Financial Crimes Unit: Cross-border investigation coordination

Regional Resources (Singapore Focus)

- Anti-Scam Centre: Singapore’s specialized unit focusing on scam intervention

- Response Time: Capable of freezing suspicious accounts within hours of reporting

- Recovery Rate: Successfully recovered 35% of amounts lost to scams in 2023

- Case Management: Provides dedicated officers for complex fraud cases

- Monetary Authority of Singapore (MAS) Initiatives

- Project FRONTIER: Public-private partnership developing shared fraud intelligence

- Digital Defense Playbook: Industry guidelines for financial institutions

- ScamShield Implementation: National app blocking known scam numbers and messages

- Singapore Police Force Specialized Services

- E-Investigation Centre: Handles digital evidence collection for card fraud cases

- Commercial Affairs Department: Investigates complex financial crimes

- Community Policing Units: Provides localized education on fraud prevention

Banking Sector Protections

- Real-Time Fraud Monitoring: Systems that analyze transactions within milliseconds using behavioral patterns

- Transaction Limits and Controls: Customizable spending limits and geographic restrictions

- Secure Communication Channels: Authenticated messaging systems for account alerts

- Dedicated Fraud Hotlines: Specialized response teams for immediate intervention

Self-Protection Strategies for Consumers

Digital Hygiene Practices

- Virtual Card Numbers: Single-use or merchant-specific card numbers

- Dedicated Transaction Email: Separate email account for financial communications

- Credit Monitoring Services: Real-time alerts for account changes

- Digital Wallet Security: Tokenization benefits in mobile payment apps

Recovery Resources

- Documentation Systems: Templates for recording fraud incidents

- Credit Bureau Remediation: Processes for correcting fraudulent entries

- Identity Restoration Services: Professional assistance programs

- Legal Aid Resources: Access to specialized legal consultation

Part V: Future Trends and Emerging Concerns

Evolving Threat Landscape

- Synthetic Identity Fraud: Creating fictional identities by combining real and fabricated information

- Account Creation Fraud: Opening accounts with stolen identities specifically for “bust out” schemes

- Real-Time Payment Vulnerabilities: Exploiting the irreversible nature of instant payment systems

- Supply Chain Infiltration: Compromising payment systems before they reach merchants

Technological Countermeasures on the Horizon

- Blockchain-Based Verification: Distributed ledger solutions for payment authorization

- Quantum Computing Defenses: Preparing for post-quantum cryptographic standards

- Federated Learning Models: Collaborative fraud detection across institutions without sharing sensitive data

- Continuous Authentication: Persistent verification throughout user sessions rather than point-in-time checks

Building Resilient Systems

The most effective approach combines technological, procedural, and human elements:

- Security by Design: Building fraud prevention into payment systems from inception

- Frictionless Security: Balancing user experience with protection measures

- Adaptive Risk Management: Dynamic adjustment of security based on emerging threats

- Cross-Industry Collaboration: Shared intelligence networks spanning financial services, e-commerce, and telecommunications

By addressing credit card fraud as an ecosystem challenge rather than focusing solely on individual protection measures, stakeholders can develop more comprehensive and effective defenses against this evolving threat.

Singapore’s Anti-Scam Measures

Singapore has implemented a comprehensive approach to combat scams, though this new method specifically challenges some existing protections:

Current Protections

- Legal Framework:

- Severe penalties (up to 10 years imprisonment for cheating)

- Recent money mule laws that this scheme specifically circumvents

- Rapid investigation and prosecution (arrests made within hours in some cases)

- Police Operations:

- Quick response to reports from retailers

- Cross-border cooperation to tackle transnational syndicates

- Targeted investigation teams focusing on specific scam typologies

- Retailer Advisories:

- Police have issued specific guidance to high-value retailers

- Warning signs have been communicated (multiple payment attempts, contactless-only payments)

- Recommendations for verification procedures, like requesting physical cards

- Banking Protections:

- Transaction monitoring systems (although these appear to have been bypassed)

- Fraud detection algorithms

- Card verification procedures

Gaps This Scam Exploits

- Contactless Payment Vulnerabilities:

- Less stringent authentication requirements for contactless payments

- No physical card verification is required

- Transaction limits that allow significant purchases

- Retail Staff Training Gaps:

- Staff may not recognize suspicious purchase patterns

- High-value sales incentives may discourage scrutiny

- Lack of standardized verification protocols

- Jurisdictional Challenges:

- The transnational nature complicates investigations.

- Different legal frameworks between countries

- Challenges in prosecuting syndicate leaders operating abroad

Recommended Additional Measures

Based on this analysis, Singapore could strengthen its defenses by:

- Enhanced Payment Verification:

- Requiring additional authentication for high-value contactless payments

- Implementing biometric verification at point-of-sale for large transactions

- Developing systems to verify the authenticity of mobile wallet implementations

- Improved Retailer Protocols:

- Mandatory ID verification for high-value purchases

- Training staff to recognize scam indicators

- Installing advanced fraud detection systems at point-of-sale

- Consumer Education:

- Increasing awareness about protecting credit card information

- Teaching recognition of phishing attempts

- Promoting regular monitoring of account activities

- Cross-Border Cooperation:

- Strengthening intelligence sharing with regional partners

- Coordinating law enforcement operations across borders

- Developing common legal frameworks to prosecute transnational fraud

This scam represents a concerning evolution that specifically targets gaps between anti-fraud systems, exploiting both technological vulnerabilities and human factors in retail environments.

Payment Fraud Landscape in Singapore:

- 49% of respondents have experienced payment fraud

- 33% of consumers feel less safe shopping compared to ten years ago

- 52% of businesses reported an increase in fraud attempts in the past year

Top Types of Payment Fraud in 2025:

- Phishing

- Social engineering attacks to steal personal information

- Increasingly sophisticated, using synthetic identities

- In 2024, victims lost S$59.4 million to phishing scams

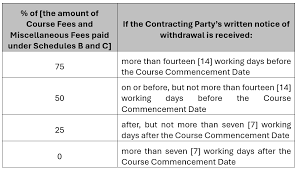

- Refund Fraud / Policy Abuse

- Exploiting business return, refund, and promotion policies

- It can be conducted by professional fraudsters and every day consumers

- Experienced by nearly half of online merchants worldwide

- Card Testing

- Test stolen cards to verify their active status

- Active cards can be sold at higher prices on the dark web

- Friendly Fraud / First-Party Fraud

- Consumers making purchases and then requesting chargebacks

- Accounts for up to 70% of credit card fraud

- Costs the industry over US$132 billion annually

Business Response to Fraud:

- 66% considering partnerships with providers offering chargeback liability guarantees

- 62% using AI to prevent fraudulent transactions

- 60% recognize fraud increases during peak shopping periods

Additional Payment Trends:

- 31% of Singaporeans don’t carry wallets

- 48% used mobile wallets in the past year

- QR code payments grew 31% year-on-year

- 51% shopped via social media platforms

The report highlights the growing sophistication of payment fraud and the need for robust security measures in Singapore’s digital payment ecosystem.

Payment Fraud Versions and Prevention Strategies:

- Phishing Characteristics:

- Sophisticated social engineering attacks

- Aim to steal Personal Identifiable Information (PII)

- Advanced tactics include creating synthetic identities

- In 2024, caused S$59.4 million in losses in Singapore

Prevention Methods:

- Implement robust second-factor authentication (2FA)

- Educate consumers about identifying suspicious communications

- Use AI-powered fraud detection systems

- Develop advanced identity verification technologies

- Regularly update security protocols to counter emerging tactics

- Refund Fraud / Policy Abuse Characteristics:

- Exploiting business return and refund policies

- Conducted by both professional fraudsters and opportunistic consumers

- Difficult to detect

- Affects nearly 50% of online merchants globally

Prevention Methods:

- Develop clear and strict refund policies.

- Implement sophisticated tracking systems for returns

- Use AI to identify suspicious return patterns

- Set reasonable time limits for returns

- Create detailed documentation requirements for refunds

- Monitor customer behaviour and flag unusual return activities

![]()

- Card Testing Characteristics:

- Fraudsters test stolen credit card details

- Aim to verify card validity

- Successful cards sold at higher prices on the dark web

Prevention Methods:

- Use advanced payment gateway fraud detection

- Implement real-time transaction monitoring

- Utilize machine learning algorithms to detect unusual transaction patterns

- Set up velocity checks to limit multiple quick transactions

- Use device fingerprinting technology

- Implement CAPTCHA and additional verification for suspicious transactions

- Friendly Fraud / First-Party Fraud Characteristics:

- Consumers make legitimate purchases, then request chargebacks

- Accounts for 70% of credit card fraud

- Costs the industry over US$132 billion annually

Prevention Methods:

- Maintained detailed transaction and delivery records

- Implement clear communication channels with customers

- Use chargeback management software

- Provide excellent customer service to resolve issues proactively

- Develop comprehensive documentation for each transaction

- Create transparent return and refund policies

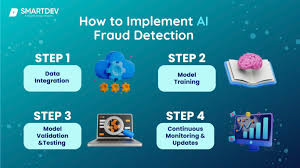

Advanced Prevention Strategies:

- Technology Integration

- 62% of businesses now use AI for fraud prevention

- Leverage machine learning and predictive analytics

- Implement real-time fraud detection systems

- Use blockchain for secure, transparent transactions

- Authentication Techniques

- Encourage second-factor authentication (2FA)

- Biometric verification

- Tokenization of payment information

- Continuous authentication during transactions

- Consumer Education

- Raise awareness about fraud tactics

- Provide guidelines for safe online shopping

- Encourage vigilance and reporting of suspicious activities

- Collaborative Approaches

- 66% of businesses considering partnerships with secure payment providers

- Share fraud intelligence across industries

- Develop cross-platform fraud detection networks

The evolving landscape of payment fraud requires a multi-layered, adaptive approach. Businesses must continuously update their prevention strategies, leverage advanced technologies, and maintain a proactive stance against emerging fraud tactics.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

Maxthon private browser for online privacyThis meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.

The post Taiwanese Crime Syndicate Charged With Credit Card Fraud appeared first on Maxthon | Privacy Private Browser.