Digital Fraud in Financial Services: 2023 Trends

According to the LexisNexis Risk Solutions report:

- Digital fraud attacks in financial services increased by 17% in 2023

- Human-initiated attacks rose by 8% year-over-year, reaching 1.2%

- Regional variations were significant:

- North America: 30% increase in attack rates

- Asia-Pacific and EMEA: Decreases of 15% and 24%, respectively

Bot Attacks

- Financial services faced 1.8 billion automated bot attacks (50% of the global total)

- Despite the high volume, bot attacks in this sector decreased by 6% YoY.

Types of Fraud

- New account creation fraud increased by 12% YoY, especially on mobile browsers.

- Payment fraud rose by 9% YoY, primarily through mobile channels

- Third-party account takeover was the most common fraud type (28.7% of cases)

- Other prevalent types: scams (16%), bonus abuse (16%), and first-party fraud (14.6%)

Global Trends

- Overall digital fraud attacks across all sectors increased by 19% YoY

- North America saw the highest regional increase at 43% YoY

- E-commerce experienced a 59% YoY increase in attacks

- Gaming and gambling saw a 103% increase in bot attacks

Southeast Asian Scam Centers

- Organized criminal groups (mainly from China) operate cyber scam centers across Southeast Asia.

- These centers are often staffed by trafficked individuals working in abusive conditions.

- The UN estimates over 200,000 people have been trafficked into Myanmar and Cambodia.

- These operations generate approximately $3 trillion in illicit revenue annually.

Analysis of Fraud Trends and Prevention in Singapore

Key Fraud Trends in Southeast Asia

Based on the LexisNexis Risk Solutions report, several notable fraud trends are affecting Singapore and the broader Southeast Asian region:

- Rising Authorized Payment Fraud: The report specifically highlights the rapid increase in authorized push payment (APP) fraud in Southeast Asia, which is particularly concerning for Singapore as a financial hub.

- Regional Scam Centers: Organized criminal groups, primarily from China, have established extensive scam operations throughout Southeast Asia, affecting Singapore both directly and indirectly through regional instability.

- Mobile Channel Vulnerabilities: New account creation fraud and payment fraud are increasingly occurring through mobile channels, which is significant, given Singapore’s high smartphone penetration rate.

- Contrasting Regional Patterns: While North America saw a 30% increase in attack rates, the Asia-Pacific region experienced a 15% decrease. This suggests potentially more mature fraud prevention systems in the APAC region, which includes Singapore.

Prevention Strategies for Singapore

Regulatory Approaches

Singapore’s financial regulatory framework has been proactive in addressing digital fraud:

- Monetary Authority of Singapore (MAS) Initiatives: MAS has implemented stringent requirements for financial institutions regarding fraud detection and prevention, including:

- Transaction monitoring systems

- Customer due diligence procedures

- Regular risk assessments

- Collaboration Frameworks: Singapore has established cross-border cooperation with other ASEAN nations to combat the regional scam centers mentioned in the report.

Technical Solutions

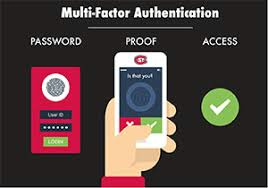

- Multi-layered Authentication: Singapore’s financial institutions have widely adopted:

- Biometric verification

- SingPass integration

- Transaction signing with second-factor authentication

- Advanced Analytics: Implementation of:

- Behavioral analytics to detect anomalous patterns

- Machine learning models for fraud prediction

- Network analysis to identify connected fraudulent activities

Consumer Education

- ScamShield: Singapore’s ScamShield app helps citizens identify and block potential scam calls and messages.

- Anti-Scam Centre: The Singapore Police Force’s dedicated Anti-Scam Centre works to recover funds and educate the public.

- National Crime Prevention Council Campaigns: Regular awareness campaigns to educate consumers about the latest fraud techniques.

Challenges and Recommendations

Challenges

- Cross-border Nature of Fraud: Singapore faces challenges with fraud originating from scam centers in neighboring countries like Cambodia and Myanmar.

- Evolving Tactics: Fraudsters rapidly adapt their methods to circumvent new security measures.

- Balance Between Security and User Experience: Implementing robust security while maintaining convenience for legitimate users.

Recommendations

- Enhanced Regional Cooperation: Singapore should continue strengthening collaboration with neighboring countries to dismantle scam operations.

- Fraud Intelligence Sharing: Establish more robust mechanisms for sharing fraud intelligence between financial institutions.

- Technology Investment: Continue investing in AI and machine learning technologies to stay ahead of emerging fraud patterns.

- Regulatory Advancement: Develop regulations that specifically address APP fraud and third-party account takeover vulnerabilities.

Singapore’s position as a financial hub makes it both a target for sophisticated fraud attempts and a leader in fraud prevention technologies. By building on existing strengths in regulation, technology implementation, and public education, Singapore can continue to effectively combat the rising tide of digital fraud affecting the financial services sector.

Fraud Assistance Resources in Singapore

Singapore has developed a comprehensive ecosystem of support services to assist fraud victims and prevent future incidents. Here’s an overview of the key fraud assistance resources available:

Government Resources

1. Singapore Police Force (SPF) Anti-Scam Centre

- Established in 2019 as a specialized unit to tackle scams

- Focuses on quick intervention to freeze suspicious bank accounts and recover stolen funds

- Works directly with major banks to expedite the freezing of accounts

- Contact: Call 1800-255-0000 or report online via the Police e-Service website

2. National Crime Prevention Council (NCPC)

- Operates the Scam Alert website (scamalert.sg)

- Provides up-to-date information on the latest scam trends

- Offers prevention tips and educational resources

- Runs the “Spot the Signs. Stop the Crimes” public education campaign

3. Monetary Authority of Singapore (MAS)

- Coordinates industry-wide response to financial fraud

- Enforces regulations requiring banks to implement fraud prevention measures

- Provides financial consumer education through MoneySense initiatives

- Has established accountability frameworks for banks handling scam cases

Technological Tools

1. ScamShield App

- Free app developed by the National Crime Prevention Council

- Filters and blocks known scam calls and messages

- Allows users to report scam messages

- Available for iOS and Android devices

2. Bank Security Features

- Central Singaporean banks offer:

- In-app scam alert notifications

- Transaction monitoring systems that flag suspicious activities

- Temporary card freezing options

- Two-factor authentication for sensitive transactions

Assistance for Fraud Victims

1. Immediate Response Protocol

When Singaporeans become victims of fraud, they should:

- File a police report immediately

- Contact their bank to freeze accounts and attempt fund recovery

- Preserve all evidence of the fraud (messages, emails, transaction details)

- Report to relevant platforms where the fraud occurred

2. Financial Assistance

- Case-by-case financial assistance may be available through:

- Social service agencies

- Community development councils

- Financial institutions’ goodwill policies

3. Mental Health Support

- Fraud victims often experience significant emotional distress

- Support available through:

- Silver Ribbon Singapore

- Singapore Association for Mental Health

- Institute of Mental Health’s helpline

Educational Initiatives

1. Digital Defense Campaign

- National initiative to improve digital literacy and fraud awareness

- Targets vulnerable populations, including seniors and young adults

- Provides workshops and educational materials

2. Inter-Ministry Committee on Scams

- Coordinates whole-of-government approach to scam prevention

- Develops educational content for different demographic groups

- Implement awareness campaigns across multiple channels

Industry Collaboration

1. Association of Banks in Singapore (ABS)

- Coordinates industry-wide anti-fraud measures

- Facilitates information sharing between financial institutions

- Implements standardized fraud response protocols

2. Singapore FinTech Association

- Promotes fintech solutions for fraud prevention

- Coordinates security standards among fintech companies

- Offers educational resources for the fintech community

Singapore’s approach to fraud assistance emphasizes prevention, rapid response, and cross-sector collaboration. The integration of government agencies, financial institutions, and technology platforms creates a robust support system for addressing the growing challenge of financial fraud in the digital age.

Strategic Importance

Fintech partnerships are increasingly becoming a necessity rather than just an option for banks. With 63% of financial institutions now investing in AI (compared to only 32% in 2023), banks risk falling behind competitors if they don’t innovate. These partnerships allow traditional banks to meet evolving customer expectations for seamless, tech-driven banking experiences.

Complementary Strengths

Banks and FinTechs bring different strengths to partnerships:

- Banks excel at capital deployment and risk management within regulatory frameworks

- Fintechs offer technological agility, rapid development cycles, and innovative approaches to data analysis

Key Benefits of Partnerships

- Enhanced Customer Experience: Creating the seamless digital experiences that modern business clients expect

- AI-powered solutions: Enabling data-backed automation and instant risk decisioning

- Global Expansion Support: Facilitating cross-border payment solutions and navigating complex international tax environments

- Specialized Expertise: Bringing in targeted technological capabilities that would be difficult for banks to develop internally

Implementation Challenges

The article acknowledges several obstacles to successful partnerships:

- Risk aversion in banking culture

- Technical compatibility with legacy systems

- Cultural resistance to technological change

Recommended Implementation Approach

The article advocates for a “crawl-walk-run” strategy that includes:

- Robust security frameworks to combat fraud

- Composable technology architectures with flexible APIs

- Cultural transformation and commitment to digital innovation

Long-Term Vision

The most successful financial institutions will build ecosystems that combine:

- The regulatory expertise and capital strength of traditional banking

- The technological agility and customer focus of FinTechs

This balanced approach recognizes that AI should enhance human judgment rather than replace it, much like self-driving cars still require human oversight.

Fintech Partnerships for Banking in Singapore’s AI Landscape

Singapore’s Unique Banking Environment

Singapore presents a particularly fertile ground for bank-fintech partnerships in the AI era due to several factors:

- Advanced Digital Infrastructure: Singapore’s world-class digital infrastructure provides an excellent foundation for AI-powered banking innovations.

- Supportive Regulatory Framework: The Monetary Authority of Singapore (MAS) has established progressive regulatory sandboxes and frameworks that encourage fintech innovation while maintaining financial stability.

- Tech-Savvy Population: Singapore has one of the highest digital adoption rates globally, with consumers expecting sophisticated digital banking experiences.

- Regional Financial Hub Status: As ASEAN’s financial center, Singapore-based banks need cutting-edge solutions to maintain a competitive advantage.

Strategic Opportunities for Singapore Banks

Cross-Border Commerce Solutions

Singapore’s position as a gateway to ASEAN markets makes fintech partnerships that facilitate cross-border payments and trade finance particularly valuable. AI-powered solutions can help navigate the complex regulatory environments across multiple jurisdictions.

Wealth Management Innovation

With Singapore’s growing importance as a wealth management hub, partnerships that enhance personalized wealth services through AI could create significant competitive advantages.

SME Banking Transformation

Fintech partnerships can help Singapore banks better serve the SME segment through:

- Streamlined credit assessment using alternative data

- Automated compliance for cross-border operations

- AI-powered cash flow management tools

Sustainable Finance Solutions

Singapore’s push toward green finance creates opportunities for partnerships that leverage AI to assess ESG compliance and sustainable investment opportunities.

Implementation Considerations for Singapore Context

- Data Protection Compliance: Partnerships must navigate Singapore’s Personal Data Protection Act and banking secrecy provisions.

- Cultural Integration: Singapore’s multicultural business environment requires careful attention to cultural factors when implementing new technologies.

- Talent Development: Building local AI expertise through partnerships with Singapore’s universities and research institutions.

- Gradual Deployment Strategy: The “crawl-walk-run” approach would work well in Singapore’s pragmatic business culture.

By strategically leveraging fintech partnerships, Singapore banks can maintain their competitive edge in the region while meeting the increasingly sophisticated expectations of their business clients in the AI era.

Analysis of Fintech Partnerships in Singapore

Singapore’s Fintech Partnership Landscape

Singapore has established itself as a leading fintech hub in Asia, with a robust ecosystem that facilitates strategic partnerships between traditional financial institutions and technology innovators. This ecosystem is characterized by:

Regulatory Support

- The Monetary Authority of Singapore (MAS) actively fosters innovation through initiatives like the Fintech Regulatory Sandbox.

- The Financial Sector Technology and Innovation (FSTI) scheme provides funding support for innovation projects.

- Singapore’s progressive licensing frameworks (like the Payment Services Act) create clarity for partnerships.

Partnership Models

- Investment and Acquisition: Banks like DBS, OCBC, and UOB have established venture arms to invest in promising fintechs

- API-Based Collaboration: Open banking initiatives enable third-party developers to build applications around financial institutions

- Co-creation Labs: Collaborative spaces where banks and FinTechs develop solutions together

- Accelerator Programs: Bank-sponsored programs that nurture early-stage fintech startups

Key Partnership Areas

- Payments and Remittance: Partnerships enabling real-time cross-border payments

- Wealth Management: AI-powered advisory services and robo-advisors

- SME Banking: Alternative credit scoring and automated lending platforms

- Compliance and Regtech: AI for regulatory reporting and fraud detection

- Blockchain Applications: Distributed ledger solutions for trade finance and securities settlement

Success Factors for Singapore Partnerships

Singapore-Specific Advantages

- Strategic location as gateway to ASEAN markets

- Strong government support for digitalization

- High digital adoption rates among consumers and businesses

- Deep talent pool in both finance and technology

- English as a working language, facilitating international partnerships

Challenges to Address

- Compliance with data localization requirements across different ASEAN markets

- Integration with legacy banking systems

- Aligning business models between traditional banks and tech-focused startups

- Talent retention in a competitive market

Notable Examples

Several successful partnerships demonstrate different models:

- DBS Bank and Partior: Collaboration on blockchain-based clearing and settlement infrastructure

- OCBC and Rapyd: Partnership for unified payment and collection capabilities across multiple countries

- Standard Chartered and Sygnum: Joint venture for digital asset custody services

- UOB and Grab: Strategic alliance for digital financial services across ASEAN

Future Trajectory

Singapore’s fintech partnerships are likely to evolve toward:

- More emphasis on AI-powered personalization and risk assessment

- Increased focus on sustainable finance and ESG integration

- Expansion of embedded finance models into non-financial sectors

- Greater cross-border collaboration throughout the ASEAN region

As financial services become increasingly borderless and technology-driven, Singapore’s unique combination of regulatory support, technological infrastructure, and strategic location positions it as an ideal laboratory for developing next-generation bank-fintech partnerships that could serve as models for the broader Asian market.

Analysis of Bank Jago’s Google Cloud Adoption for Workflow Enhancement

Bank Jago’s partnership with Google Cloud represents a strategic move to transform its workflow and operational efficiency. Here’s an analysis of the key aspects:

Strategic Implementation

Bank Jago is leveraging Google Cloud’s capabilities in several interconnected ways:

- Data Infrastructure Upgrade: Moving to BigQuery allows Bank Jago to consolidate and analyze large volumes of customer data more efficiently than traditional database systems.

- AI Integration: Implementing Vertex AI provides a foundation for developing and deploying machine learning models that can automate complex processes.

- Platform-Based Approach: Rather than developing siloed solutions, Bank Jago is adopting a comprehensive platform strategy that enables consistent AI application across different business functions.

Workflow Enhancements

The partnership explicitly enhances Bank Jago’s workflows through:

- Automated Fraud Detection: Real-time transaction pattern analysis reduces manual review processes and speeds up fraud identification.

- Streamlined Customer Service:

- The sentiment analysis tools help prioritize customer interactions

- AI coaching tools improve agent training and performance assessment

- These reduce training time and improve consistency in customer interactions

- Standardized AI Development: Vertex AI Pipelines create consistent workflows for validating AI solutions, reducing development friction and ensuring quality standards.

- Centralized Model Management: The Model Registry creates a single source of truth for approved AI models, eliminating duplicate efforts and inconsistent implementations.

Business Impact

This technological adoption likely delivers several business benefits:

- Operational Efficiency: Reducing manual processes and standardizing workflows across the organization.

- Scalability: The cloud infrastructure enables Bank Jago to handle its growing customer base (14 million and expanding) without proportional increases in operational costs.

- Innovation Acceleration: The standardized AI development pipeline allows faster deployment of new financial solutions.

- Risk Management: Improved fraud detection and consistent model governance help mitigate financial and regulatory risks.

This partnership represents a comprehensive technological transformation rather than just a tool implementation, positioning Bank Jago to operate more efficiently in Indonesia’s competitive digital banking landscape.

.

AI in Banking: Themes, Challenges, and Implementation Strategies

Major Themes

1. Transformative Potential

- Unprecedented economic opportunity: Potential to boost annual operating profits by £200bn-£340bn

- Comprehensive digital transformation across banking operations

- Shift from traditional banking models to AI-driven, data-centric approaches

2. Strategic Implementation

- Methodical, Phased Transformation Approach

- Compared to steering an “oil tanker” – requiring careful, calculated changes

- Systematic rebuilding of technological architecture

3. Regulatory Compliance and Governance

- Increasing regulatory scrutiny (e.g., EU AI Act)

- Focus on:

- Robust risk management

- Data governance

- Transparency in AI systems

- Human oversight

Key Challenges

1. Data Management

- Fragmented data across multiple systems

- Lack of a Single Source of Truth (SSOT)

- Difficulty in consolidating and standardizing information

![]()

2. Technological Integration

- Replacing legacy systems

- Ensuring seamless AI integration

- Managing complex technological transitions

3. Organizational Culture

- Resistance to change

- Need for comprehensive staff training

- Developing AI literacy across the organization

4. Trust and Security

- Maintaining customer confidence

- Balancing innovation with data protection

- Demonstrating transparent and ethical AI use

Implementation Strategies

1. Phased Transformation Approach

- Incremental system upgrades

- Component-by-component modernization

- Controlled risk management

2. Governance Frameworks

- Establish AI governance boards

- Create comprehensive oversight mechanisms

- Develop transparent

![]() AI use case evaluation processes

AI use case evaluation processes

3. Data Strategy

- Implement open banking principles

- Develop robust data management protocols

- Ensure data quality and standardization

4. Customer-Centric Implementation

- Focus on enhancing customer experience

- Leverage AI to improve service efficiency

- Maintain transparency and build trust

- Practical AI Applications in Banking

1. Customer Service

- AI-enabled contact centers

- Enhanced customer interaction capabilities

- Improved problem resolution efficiency

2. Operational Optimization

- Automated data cleaning

- Testing framework improvements

- Code generation for platform development

3. Risk Management

- Advanced loan and mortgage approval processes

- Intelligent risk assessment

- Regulatory compliance monitoring

Future Outlook

- Continuous adaptation of AI systems

- Emphasis on resilience and flexibility

- Integration of advanced AI with robust security measures

![]()

Conclusion

Successful AI implementation in banking requires a holistic approach that balances technological innovation, regulatory compliance, organizational culture, and customer trust.

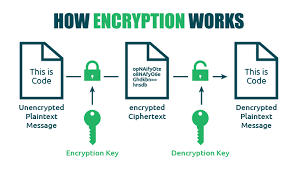

How Encryption Works

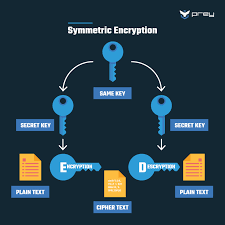

Encryption uses mathematical algorithms to convert plaintext (readable data) into ciphertext (scrambled data). Only those with the decryption key can convert the ciphertext back into usable information. There are two main types:

- Symmetric Encryption: Uses the same key for both encryption and decryption. It’s efficient but requires a secure key exchange.

- Asymmetric Encryption uses a pair of keys—a public key for encryption and a private key for decryption—to allow secure communication without prior key exchange.

Key Encryption Applications for Privacy

Device Encryption

- Full-disk encryption: Protects all data on your computer or smartphone (BitLocker for Windows, FileVault for Mac, and built-in encryption for iOS and Android)

- File-level encryption: Protects individual files and folders

Communication Encryption

- HTTPS: Secures website connections (look for the padlock icon in your browser)

- End-to-end encryption: Used in messaging apps like Signal, WhatsApp, and others to ensure only you and your recipient can read messages

- Email encryption: Options include PGP (Pretty Good Privacy), S/MIME, or encrypted email services

Network Encryption

- VPNs: Create an encrypted tunnel for all your internet traffic

- Wi-Fi encryption: WPA3 is the current most substantial standard for wireless networks

Cloud Storage Encryption

- At-rest encryption: Protects stored data

- Zero-knowledge encryption: The provider has no access to your encryption keys

- Client-side encryption: Data is encrypted before leaving your device

Implementing Encryption in Your Digital Life

- Enable device encryption on all your computers and mobile devices

- Use encrypted messaging apps for sensitive communications

- Verify HTTPS connections when sharing personal or financial information

- Consider encrypted email for sensitive communications

- Choose cloud services with strong encryption policies

- Use a VPN when connecting to public Wi-Fi networks

- Password-protect and encrypt sensitive files and backups

Limitations to Consider

- Encryption can’t protect against malware already on your device

- Weak passwords can undermine even the strongest encryption

- Encryption doesn’t hide metadata (who you’re communicating with, when, how often)

- Some countries have laws limiting encryption use or requiring backdoors

Encryption is a fundamental aspect of digital privacy that works best as part of a comprehensive security strategy. By understanding and implementing appropriate encryption methods, you can significantly enhance your online privacy protection.

.

Identity Theft

Identity theft is a pervasive form of fraud that can have devastating consequences for victims. In this crime, the perpetrator steals an individual’s personal information to assume their identity. This stolen information can often be gathered from discarded documents such as bank statements, utility bills, or even phishing scams.

Once armed with this data, the criminal may choose to open accounts in the victim’s name, a process known as application fraud. They might apply for credit cards, loans, or utility services under pretences, leaving the unsuspecting victim to deal with the aftermath.

The emotional toll of identity theft can be immense. Victims often face financial losses and damage to their credit scores, which can take years. In today’s digital age, account takeovers have become a prevalent threat to unsuspecting victims. Criminals typically employ tactics such as phishing, vishing, or smishing to manipulate individuals into revealing their personal information.

Phishing often involves deceptive emails that appear to come from legitimate sources. These emails may prompt the victim to click on malicious links or provide sensitive details under the guise of verifying their identity.

Vishing, or voice phishing, involves phone calls in which scammers impersonate bank representatives or trusted entities to extract confidential information directly from the victim. Similarly, smishing involves text messages that lure individuals into divulging critical data.

Once armed with this personal information, the criminal can easily convince a bank to change the account holder’s address. This deception allows them full access to the victim’s financial accounts and resources.

Additionally, some criminals are skilled enough to bypass bank interaction altogether. They can use the obtained credentials to log into online accounts directly, executing unauthorised transactions without needing any further verification.

The consequences for victims can be devastating, leading not only to financial loss but also to emotional distress as they recover their stolen identities and secure their accounts. Consequently, individuals must remain vigilant and understand these risks to protect themselves against potential account takeovers for repair. Additionally, they may find themselves tangled in legal disputes as they try to prove their innocence.

Recovering from such a violation requires diligence and time, making it crucial for individuals to safeguard their personal information vigilantly. Implementing measures like shredding sensitive documents and monitoring credit reports can help prevent these types of crimes before they occur.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.

The post Digital Fraud Trends in Financial Services appeared first on Maxthon | Privacy Private Browser.

AI use case evaluation processes

AI use case evaluation processes