In an increasingly interconnected and digital world, the threat of scams has become a pervasive challenge, demanding innovative and collaborative solutions. Recognizing this urgent need, the Singapore Police Force’s (SPF) Anti-Scam Centre (ASC) has forged a powerful alliance with four major banks – DBS Bank, OCBC Bank, Standard Chartered Bank, and UOB Bank – resulting in the successful disruption of over 900 ongoing scams. This concerted effort, spanning the beginning of 2025, targeted a diverse range of fraudulent activities, including enticing job scams, high-pressure investment scams, emotionally manipulative fake-friend call scams, and deceptive e-commerce scams. The tangible outcome of this partnership is the prevention of significant financial losses, highlighting the effectiveness of proactive collaboration in the fight against cybercrime.

A key element underpinning the success of this partnership lies in the strategic implementation of Robotic Process Automation (RPA) technology. This innovative approach has fundamentally altered the speed and efficiency of information sharing between the ASC and the participating banks. RPA allows for the rapid and automated exchange of critical data related to potentially fraudulent transactions and suspicious activities. This, in turn, enables the swift identification of potential scam victims, providing a crucial window of opportunity for timely intervention and the prevention of further financial losses. The real-time intelligence provided by RPA empowers both the ASC and the banks to act decisively and proactively, staying one step ahead of the ever-evolving tactics of scammers.

Between January 1, 2025, and February 28, 2025, the collaborative efforts of the ASC and its banking partners manifested in a proactive communication strategy. Over 9,000 targeted SMS messages were dispatched to more than 7,000 bank customers who had been identified as potential scam victims. These messages served as crucial warnings, alerting individuals to suspicious activity and prompting them to take immediate action to protect their accounts. This proactive measure proved remarkably effective, averting over $58 million in potential losses. These were funds that would have otherwise been siphoned off by malicious actors, underscoring the significant impact of the collaborative and technology-driven approach. The sheer magnitude of the averted losses serves as a stark reminder of the financial devastation that scams can inflict on individuals and the importance of preventative measures.

Beyond the direct intervention efforts, the Singapore Police Force recognizes the critical role of public awareness and education in preventing scams. The SPF urges the public to adopt a proactive approach to scam prevention by remembering to “ACT” against scams, an easily memorable acronym that encapsulates key preventive steps.

ADD: This component emphasizes the importance of enhancing digital security. Individuals are encouraged to bolster their online defenses by adding security features such as the ScamShield application, which helps to identify and block scam calls and messages. Enabling two-factor authentication (2FA) for personal accounts, including bank accounts, social media profiles, and Singpass accounts, adds an extra layer of protection, making it significantly more difficult for scammers to gain unauthorized access. Furthermore, setting transaction limits for internet banking, including PayNow, can help limit potential losses in the event that an account is compromised. These measures act as a digital shield, minimizing vulnerability to scam tactics.

CHECK: Vigilance is paramount in the fight against scams. This component encourages individuals to be observant and carefully check for potential signs of a scam. This includes asking probing questions, verifying requests for personal information or money transfers, and meticulously confirming the legitimacy of online listings and reviews. The SPF emphasizes the importance of pausing and checking before acting impulsively on any request or offer. This critical pause allows individuals to assess the situation rationally and identify potential red flags. A key principle to remember is that if an offer seems too good to be true, it likely is a scam. This healthy skepticism can be a powerful tool in avoiding falling victim to fraudulent schemes.

TELL: Reporting scam encounters is crucial not only for personal protection but also for contributing to the broader fight against cybercrime. This component encourages individuals to report scam encounters to the authorities, providing valuable information that can help to track down and apprehend scammers. Reporting scams to the bank, ScamShield, or by filing a police report allows law enforcement to investigate and disrupt ongoing scam operations. Additionally, sharing information about ongoing scams and preventive steps with friends and family helps to raise awareness and protect others from falling victim to similar schemes. Reporting fraudulent pages and accounts to the relevant platforms helps to remove them from circulation, preventing further harm. By sharing information and reporting suspicious activity, individuals can actively contribute to a safer online environment.

The Singapore Police Force’s commitment to combating scams extends beyond reactive measures and focuses on fostering a culture of awareness and proactive prevention. By empowering the public with the knowledge and tools to “ACT” against scams, the SPF aims to create a more resilient and secure society.

For more information on scams, individuals are encouraged to visit www.scamshield.gov.sg or call the ScamShield Helpline at 1799. Anyone with information on scams can call the Police Hotline at 1800-255-0000 or submit information online at www.police.gov.sg/iwitness. All information will be kept strictly confidential, ensuring that individuals can report suspicious activity without fear of reprisal.

The successful collaboration between the Singapore Police Force, the Anti-Scam Centre, and partner banks serves as a powerful example of how proactive partnerships, technological innovation, and public awareness can effectively combat the growing threat of scams in the digital age. By remaining vigilant, informed, and proactive, individuals and organizations alike can contribute to creating a safer and more secure online environment for all.

Analysis of Singapore’s Scam Prevention Approach

Government and Institutional Measures

Based on the article, Singapore has implemented several institutional approaches to combat scams:

- Monetary Authority of Singapore (MAS) Initiatives:

- Working directly with banks to enhance digital banking security

- Implementing new protective measures like eliminating clickable links in official emails/SMSes

- Requiring a minimum 12-hour delay before activating new soft tokens on mobile devices

- Providing specific guidance to banking customers on safe practices

- Police Force Involvement:

- The Singapore Police Force (SPF) actively tracks and reports on scam statistics

- Conduct investigations of scammers and money mules (as evidenced by the case involving 170 men and 89 women)

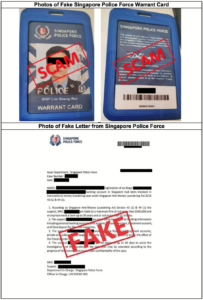

- Shares examples and screenshots of scams to raise public awareness

- Banking Sector Protections (specifically highlighted for DBS):

- Stopping non-essential SMSes with links

- Sending only essential communications like security notifications and OTP authentication

- Implementing default transaction notification thresholds (S$100)

- Providing in-app security features like card locking and customizable spending limits

- Offering digital tokens with enhanced encryption

Effectiveness Analysis

The approach appears to be multi-faceted, combining:

- Technical barriers: Implementing security features that make scamming more difficult

- Public education: Raising awareness about standard scam techniques

- Enforcement: Actively investigating scam cases

However, the rising scam statistics mentioned (16% increase in cases, with amounts cheated rising from S$63.5M to S$168M) suggest these measures may be struggling to keep pace with evolving scam techniques.

Strengths of Singapore’s Approach

- Coordinated response: Collaboration between regulatory bodies (MAS), law enforcement (SPF), and financial institutions

- Customer-focused solutions: Tools that give customers more control over their security

- Practical implementation: Specific, actionable measures rather than just general advice

Potential Gaps and Recommendations

- Technology gap: The article doesn’t mention advanced detection technologies like AI for identifying unusual transaction patterns

- Demographic considerations: No specific mention of tailored approaches for vulnerable groups like seniors

- Private sector cooperation: Limited discussion of how businesses beyond banks are involved in prevention

- International coordination: No mention of cooperation with other countries to address overseas-based scammers

Singapore’s approach appears to be comprehensive but could potentially benefit from more advanced technological solutions and broader cooperation across sectors and borders to address the evolving nature of scams.

Social Engineering: Anatomy of Manipulation and Defense

Social Engineering Techniques

Psychological Manipulation Strategies

- Authority Impersonation

- Scammers pose as official representatives (e.g., bank officers, government officials)

- Exploit victims’ respect for authority and tendency to comply with perceived authoritative figures.

- Use official-sounding language, titles, and fabricated credentials.

![]()

- Fear and Urgency Tactics

- Create artificial time pressures to prevent critical thinking

- Trigger emotional responses like panic or anxiety

- Common threats include:

- Legal consequences

- Financial penalties

- Account suspension

- Potential criminal investigations

- Trust Building and Rapport

- Develop a seemingly genuine conversational flow

- Use personal details to appear credible

- Gradually escalate requests, starting with minor, seemingly innocuous asks

- Exploit human tendency to be helpful and avoid confrontation

- Information Harvesting

- Collect fragmentary personal information from multiple sources

- Use social media, public databases, and previous data breaches

- Craft highly personalized, convincing narratives

Technical Manipulation Methods

- Phishing Techniques

- Spoofed communication channels

- Lookalike websites and email addresses

- Malicious links and attachments

- Screen sharing and remote access exploitation

- Multi-Stage Scam Progression

- Complex narratives involving multiple fake personas

- Gradual erosion of victim’s skepticism

- Continuous redirection and technical jargon

Prevention Strategies

Personal Awareness and Education

- Critical Thinking Development

- Always verify unsolicited communications independently

- Use official contact methods from verified sources

- Never click links or download attachments from unknown sources

- Recognize and resist emotional manipulation

- Communication Red Flags

- Unsolicited contact requesting personal information

- Pressure to act immediately

- Requests for financial transfers

- Communication via unofficial channels

- Threats or aggressive language

Technical Protective Measures

- Digital Security Practices

- Use multi-factor authentication

- Regularly update software and security systems

- Install reputable antivirus and anti-malware solutions

- Use dedicated communication and banking apps

- Enable transaction notifications

- Information Protection

- Minimize public personal information sharing

- Use privacy settings on social platforms

- Create complex, unique passwords

- Regularly monitor financial statements

- Use virtual credit cards for online transactions

Institutional and Technological Interventions

- Technological Defenses

- Implement AI-driven fraud detection systems

- Develop advanced caller ID and communication verification tools

- Create comprehensive scam reporting mechanisms

- Educational Initiatives

- Regular public awareness campaigns

- School and workplace training programs

- Clear, accessible resources on emerging scam techniques

- Collaborative efforts between government, tech companies, and financial institutions

Psychological Resilience

- Emotional Intelligence

- Recognize personal emotional triggers

- Practice calm, methodical responses to unexpected communications

- Develop healthy skepticism without becoming paranoid

- Community Awareness

- Share scam experiences

- Supporting vulnerable community members

- Create support networks for scam victims

Emerging Trends

- Increasing sophistication of AI in social engineering

- Cross-platform information integration

- More personalized, contextually relevant scam attempts

Conclusion

Social engineering exploits fundamental human psychological vulnerabilities. Comprehensive defense requires a multi-layered approach combining technological solutions, personal awareness, and continuous education.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

Maxthon private browser for online privacyThis meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.

The post Singapore Police and Banks Thwart Over 900 Scams appeared first on Maxthon | Privacy Private Browser.