Mental Health Impact on Scam Victims

- Victims often experience shame, fear, guilt, and severe emotional trauma

- Some develop serious conditions like depression or anxiety disorders

- Sleep problems, paranoia, loss of trust, and low self-esteem are common

- The psychological recovery process can take weeks to six months

Clik here to view.

Case Examples

- Ms. Lie, 52, lost approximately S$111,000 in a malware scam after downloading a third-party app for what she thought was a tour ticket.

- She experienced insomnia, emotional distress, and severe self-blame (“I ask myself why I’m so stupid”)

- Ms. Khoo, 58, lost S$44,487 in a similar malware scam and became extremely distrustful and fearful afterward.

Clik here to view.

Mental Health Expert Insights

- Dr. Lim Boon Leng notes victims typically go through stages including denial, anger, and “bargaining” (trying to recover losses)

- Dr. Annabelle Chow points out that older victims may particularly struggle with “loss of face” in Asian cultures.

- Experts emphasize that recovery requires time to grieve, acceptance, and moving forward.

Clik here to view.

How to Support Scam Victims

- Listen without judgment and validate their emotions

- Help with practical matters like reporting to authorities

- Avoid telling them to “just move on” or downplaying their experience

- Never blame or shame the victim, as they’re already suffering

The article concludes with helpline resources for those experiencing mental health challenges.

Clik here to view.

Analysis of Scams and Their Impact

Types of Scams Mentioned

- Malware Scams: The primary scam highlighted in the article involves victims downloading third-party apps that give scammers control over financial accounts. Both Ms. Lie and Ms. Khoo fell victim to this type of scam.

- Social Media Advertisement Scams: Ms. Lie was initially lured by a Facebook advertisement for an inexpensive durian day-tour ticket to Malaysia (S$28), which turned out to be fraudulent.

Clik here to view.

Scale and Impact

Financial Impact

- Over 1,400 victims fell prey to malware scams between January and August

- Total losses amounted to at least S$20.6 million

- Individual losses were substantial:

- Ms. Lie: US$81,000 (approximately S$111,000)

- Ms. Khoo: S$44,487 from multiple credit cards and bank accounts

Clik here to view.

Psychological Impact

- Emotional Trauma: Shame, fear, guilt, and self-blame

- Sleep Disturbances: Insomnia and irregular sleep patterns

- Trust Issues: Paranoia and difficulty trusting others

- Self-Esteem: Severe decline in self-worth and confidence

- Long-term Conditions: Potential development of depression and anxiety disorders

- Social Withdrawal: Victims become wary of everyday activities (like using social media or answering phone calls)

- Family Burden: Family members take turns to provide care and supervision

Clik here to view.

Prevention Strategies

Individual Protection Measures

- Verify Sources: Be skeptical of unusually low-priced offers or deals, especially on social media.

- App Downloads: Only download apps from official app stores (Google Play, Apple App Store)

- Link Verification: Never click on suspicious links, mainly those promising deals or requiring immediate action

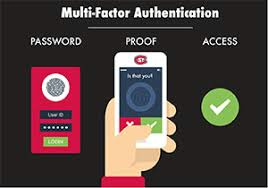

- Two-factor authentication: Enable this for all financial accounts

- Regular Monitoring: Check bank statements and credit card transactions frequently

- Credit Limits: Keep default credit limits lower and only increase them temporarily when needed

- Secure Banking: Use banking apps that have additional security features

- App Permissions: Review what permissions you grant to apps, especially financial access

Clik here to view.

Systemic Prevention

- Education Campaigns: Target vulnerable populations with awareness programs

- Financial Institution Safeguards: Banks could implement additional verification for unusual transactions

- Rapid Response Systems: Improve mechanisms for quickly freezing accounts when scams are reported

- Social Media Platform Responsibility: Stricter verification of advertisers and monitoring of potential scam content

Clik here to view.

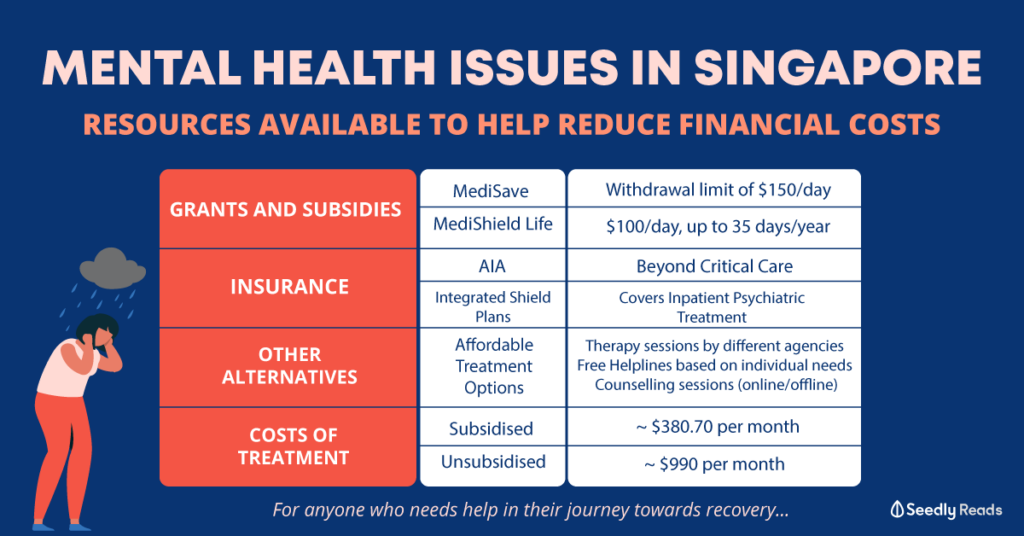

Recovery Support

- Financial Counseling: Help victims manage the aftermath of financial losses

- Mental Health Services: Specialized psychological support for scam victims

- Community Support Groups: Create spaces where victims can share experiences and healing strategies

- Legal Aid: Assistance in navigating reporting procedures and potential recovery options

Clik here to view.

Cultural Considerations

The article specifically mentions that in Asian cultures, the concept of “loss of face” can make recovery particularly challenging. Prevention and support strategies should be culturally sensitive, acknowledging that shame may prevent victims from seeking help promptly.

Implementing these preventative measures could significantly reduce the likelihood of falling victim to such scams, while improving support systems would help mitigate the long-term psychological impact on those who do become victims.

Steps to Prevent Sophisticated Scams

Before Any Potential Scam Occurs

1. Develop a verification protocol

Create your personal verification procedure for any unexpected financial communication. This could include hanging up and calling the official number, checking through official apps, or visiting a physical branch. Make this your non-negotiable habit for all financial matters.

Clik here to view.

2. Familiarize yourself with official communication channels

Know precisely how legitimate organizations like banks, government agencies, and financial institutions typically contact you. Most will never call from mobile numbers, use video calls, or transfer you directly to other agencies.

3. Establish personal security questions

Clik here to view.

For your accounts that allow it, set up personalized security questions that only you and the institution would know. If a caller can’t verify these, it’s likely fraudulent.

4. Enable two-factor authentication

Clik here to view.

Activate this security feature on all your important accounts, particularly those connected to financial services and digital identity systems like Singpass.

5. Register for scam alerts

Subscribe to official scam alert services from police, financial authorities, and banks to stay informed about current scam techniques being used in your area.

Clik here to view.

During a Suspicious Call

6. Pause and breathe

Clik here to view.

When receiving unexpected calls about security issues, take a moment to calm yourself. Scammers rely on creating a panic that clouds judgment.

7. Question the context

Ask yourself: “Was I expecting this call?” “Have I recently applied for this service?” “Does this situation make logical sense?”

8. Verify the caller independently

Clik here to view.

If someone claims to represent an organization, tell them you’ll call back through official channels. Never use the number they provide – look up the official contact information yourself.

9. Be wary of pressure tactics

Clik here to view.

Legitimate organizations will not pressure you into making immediate decisions. If you feel pressured with artificial urgency, it’s likely a scam.

10. Watch for information asymmetry

Be suspicious when someone has extensive information about you but you know very little about them. Request their full name, employee ID, and department – details you can verify later.

Clik here to view.

11. Notice technical inconsistencies

Pay attention to call quality, background noises, or switching between different “representatives” on the same phone number. These often indicate scam operations.

Clik here to view.

Red Flags to Remember

12. Be alert to emotional manipulation

Recognize when someone is trying to provoke fear, urgency, or excitement – these emotional states make critical thinking difficult.

Clik here to view.

13. Question unusual procedures

Be highly suspicious if asked to transfer money to “safe accounts,” purchase gift cards, or download unfamiliar software for “verification.”

14. Guard against authority imposters

Government agencies and banks never demand immediate payments or transfers during the first point of contact.

Clik here to view.

15. Beware of the “hanging question”

Scammers often ask if you’ve recently clicked suspicious links or been involved in unusual activity – designed to make you feel vulnerable and reactive rather than analytical.

Long-term Protection Strategies

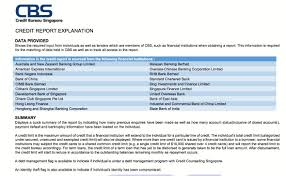

16. Regularly monitor your accounts

Schedule weekly checks of your financial accounts to catch unauthorized activity early.

17. Use credit monitoring services

Consider services that alert you to changes in your credit report or when your personal information appears in unusual places.

Clik here to view.

18. Limit your digital footprint

Regularly audit what personal information is publicly available about you online and take steps to minimize it.

19. Keep learning about new scam techniques

Scammers constantly evolve their approaches. Stay informed about new tactics through official sources.

20. Share knowledge with vulnerable networks

Discuss scam prevention with family members, especially those who might be more susceptible, like elderly relatives or those less familiar with technology.

Remember that even the most vigilant person can be caught off guard by sophisticated scams. The key is creating systems and habits that protect you even when your emotional defences might be compromised.

Clik here to view.

Secure browsing

Clik here to view.

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

By utilising the Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser is a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive web browser market.

The post Mental Health Toll of Scam Victims appeared first on Maxthon | Privacy Private Browser.