AI Upgrades & Innovations

- AI-driven portfolio management: AI systems that can handle investment portfolios with some level of automation

- Automated tax optimization: AI tools that help improve tax efficiency in wealth management

- Data processing automation: AI systems handle data collection and storage tasks, freeing up human resources

Benefits

- Growth catalyst: AI is boosting overall growth in financial services

- Enhanced customer experiences: Enabling more personalized financial services

- Operational efficiency: Streamlining processes and reducing manual workloads

- Better time management: Helping professionals manage their time more effectively

- Streamlined decision-making: Supporting faster and potentially better financial decisions

- Value reallocation: Reducing repetitive tasks for junior bankers and research teams, allowing them to focus on analysis and higher-value activities

Bathwal emphasizes that while AI offers significant benefits, human intellect remains essential in the financial sector, particularly for portfolio management. She doesn’t endorse complete reliance on AI for wealth management, suggesting a balanced approach where AI complements rather than replaces human expertise.

She also notes that the type of AI tools a company can effectively use depends on the specific asset classes it handles and its particular innovation goals.

AI Upgrades & Innovations

- AI-driven portfolio management: AI systems that can handle investment portfolios with some level of automation

- Automated tax optimization: AI tools that help improve tax efficiency in wealth management

- Data processing automation: AI systems handle data collection and storage tasks, freeing up human resources

Benefits

- Growth catalyst: AI is boosting overall growth in financial services

- Enhanced customer experiences: Enabling more personalized financial services

- Operational efficiency: Streamlining processes and reducing manual workloads

- Better time management: Helping professionals manage their time more effectively

- Streamlined decision-making: Supporting faster and potentially better financial decisions

- Value reallocation: Reducing repetitive tasks for junior bankers and research teams, allowing them to focus on analysis and higher-value activities

Bathwal emphasizes that while AI offers significant benefits, human intellect remains essential in the financial sector, particularly for portfolio management. She doesn’t endorse complete reliance on AI for wealth management, suggesting a balanced approach where AI complements rather than replaces human expertise.

She also notes that the type of AI tools a company can effectively use depends on the specific asset classes it handles and its particular innovation goals.

The article discusses how traditional banks are facing challenges from digital competitors and AI advancements. According to Isaac Tan from Boston Consulting Group:

- Value migration is occurring as digital players take market share from traditional banks. The example given is Nubank in Brazil, which now has a larger market capitalization than all traditional banks there combined.

- Upcoming “Basel IV” regulations will impose stricter capital requirements on banks, potentially hurting profitability.

- Geopolitical risks are creating additional uncertainty that banks need to factor into their long-term strategies.

- AI is described as a “game changer” that will enable conversational banking, allowing customers to interact with banking services through natural language.

- Workforce upskilling will be crucial for financial institutions to successfully navigate this transition.

Tan suggests that to remain competitive, financial institutions should focus on human elements like ethical banking while embracing technological advancements such as AI.

The article appears to be from Asian Banking & Finance, with advertisement sections at the bottom promoting related content and advertising opportunities.

AI Transformation in Banking: Analysis

Current State of AI Transformation in Banks

Traditional financial institutions are undergoing significant AI transformation across multiple domains:

- Customer-Facing Applications

- Conversational AI/chatbots for customer service (reducing call center volume by 15-30%)

- Personalized financial insights and recommendations

- Voice banking interfaces are becoming more sophisticated

- Digital onboarding with biometric verification and automated KYC processes

- Middle and Back Office Operations

- Automated loan underwriting and credit decisioning

- Algorithmic trading and portfolio management

- Risk assessment and fraud detection systems

- Regulatory compliance automation (RegTech)

- Document processing and data extraction from unstructured sources

- Strategic Adoption Patterns

- Large banks creating dedicated AI innovation labs and partnerships with fintech

- Mid-sized institutions often pursue strategic vendor relationships

- Regional banks focusing on specific high-value use cases to compete

AI Ethical Banking

The intersection of AI and ethical banking creates both challenges and opportunities:

- Fairness and Bias Concerns

- Algorithmic bias in lending decisions remains a significant challenge

- Credit scoring models must be continuously evaluated for disparate impact

- Demographic and historical data can perpetuate existing financial inequalities

- Transparency Initiatives

- “Explainable AI” becoming a regulatory expectation

- Growing demand for model interpretability in high-stakes decisions

- Challenge of balancing sophisticated algorithms with understandable outputs

- Privacy and Data Governance

- Tension between personalization and privacy protections

- Data minimization principles competing with AI’s data hunger

- Regional regulatory differences (GDPR, CCPA, etc.) creating compliance complexity

- Financial Inclusion Applications

- Alternative data sources to extend credit to “thin file” customers

- Microlending platforms using AI to reduce costs for underserved communities

- Digital identity solutions to expand banking access

Recent Advancements in AI Technology

The financial sector is benefiting from several key technological advancements:

- Large Language Models (LLMs)

- Enabling truly conversational banking interfaces

- Improving document understanding and processing

- Supporting more sophisticated customer service automation

- Enhancing compliance monitoring through a better understanding of regulations

- Federated Learning

- Allowing AI model training across institutions without sharing sensitive data

- Supporting privacy-preserving financial analytics

- Enabling cross-border collaboration while maintaining data sovereignty

- Specialized Financial AI Systems

- Advanced time-series forecasting for market prediction

- Graph neural networks for detecting complex financial fraud patterns

- Reinforcement learning for portfolio optimization

- Integration Capabilities

- API ecosystems enabling modular AI adoption

- Cloud-native AI solutions reducing implementation barriers

- Increasing integration between traditional banking systems and AI platforms

![]()

Strategic Considerations

For banks navigating this transformation:

- Competitive Positioning

- Digital-only banks have structural advantages (no legacy systems, data-first architecture)

- Traditional banks have advantages in customer trust and regulatory experience

- The gap in AI capabilities between early adopters and laggards is widening

- Talent and Organizational Challenges

- Acute shortage of AI/ML specialists with financial domain knowledge

- Cultural resistance to algorithmic decision-making in risk-averse institutions

- Need for cross-functional teams spanning technology and business units

- Implementation Roadmap

- Most successful transformations start with targeted high-value use cases

- Data infrastructure modernization often precedes advanced AI applications

- Hybrid approaches combining rules-based systems with AI for critical functions

Banks that successfully navigate the ethical, technological, and organizational aspects of AI transformation are positioned to maintain relevance in an increasingly competitive financial landscape.

Comprehensive Approach

The guide correctly emphasizes that no single method provides complete protection. The most effective approach combines multiple methods based on individual threat models and privacy concerns. The recommended combination of tools addresses different aspects of privacy:

- Data in transit (VPNs, secure email)

- Data at rest (antivirus, updates, backups)

- Authentication (password managers)

- Behavioural practices (mindful sharing)

- Existing data exposure (data removal tools)

This layered approach is consistent with cybersecurity best practices and provides defense in depth against various privacy threats.

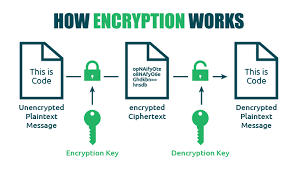

How Encryption Works

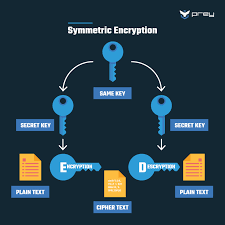

Encryption uses mathematical algorithms to convert plaintext (readable data) into ciphertext (scrambled data). Only those with the decryption key can convert the ciphertext back into usable information. There are two main types:

- Symmetric Encryption: Uses the same key for both encryption and decryption. It’s efficient but requires a secure key exchange.

- Asymmetric Encryption uses a pair of keys—a public key for encryption and a private key for decryption—to allow secure communication without prior key exchange.

Key Encryption Applications for Privacy

Device Encryption

- Full-disk encryption: Protects all data on your computer or smartphone (BitLocker for Windows, FileVault for Mac, built-in encryption for iOS and Android)

- File-level encryption: Protects individual files and folders

Communication Encryption

- HTTPS: Secures website connections (look for the padlock icon in your browser)

- End-to-end encryption: Used in messaging apps like Signal, WhatsApp, and others to ensure only you and your recipient can read messages

- Email encryption: Options include PGP (Pretty Good Privacy), S/MIME, or encrypted email services

Network Encryption

- VPNs: Create an encrypted tunnel for all your internet traffic

- Wi-Fi encryption: WPA3 is the current most substantial standard for wireless networks

Cloud Storage Encryption

- At-rest encryption: Protects stored data

- Zero-knowledge encryption: The provider has no access to your encryption keys

- Client-side encryption: Data is encrypted before leaving your device

Implementing Encryption in Your Digital Life

- Enable device encryption on all your computers and mobile devices

- Use encrypted messaging apps for sensitive communications

- Verify HTTPS connections when sharing personal or financial information

- Consider encrypted email for sensitive communications

- Choose cloud services with strong encryption policies

- Use a VPN when connecting to public Wi-Fi networks

- Password-protect and encrypt sensitive files and backups

Limitations to Consider

- Encryption can’t protect against malware already on your device

- Weak passwords can undermine even the strongest encryption

- Encryption doesn’t hide metadata (who you’re communicating with, when, how often)

- Some countries have laws limiting encryption use or requiring backdoors

Encryption is a fundamental aspect of digital privacy that works best as part of a comprehensive security strategy. By understanding and implementing appropriate encryption methods, you can significantly enhance your online privacy protection.

.

Identity Theft

Identity theft is a pervasive form of fraud that can have devastating consequences for victims. In this crime, the perpetrator steals an individual’s personal information to assume their identity. This stolen information can often be gathered from discarded documents such as bank statements, utility bills, or even phishing scams.

Once armed with this data, the criminal may choose to open accounts in the victim’s name, a process known as application fraud. They might apply for credit cards, loans, or utility services under pretences, leaving the unsuspecting victim to deal with the aftermath.

The emotional toll of identity theft can be immense. Victims often face financial losses and damage to their credit scores, which can take years. In today’s digital age, account takeovers have become a prevalent threat to unsuspecting victims. Criminals typically employ tactics such as phishing, vishing, or smishing to manipulate individuals into revealing their personal information.

Phishing often involves deceptive emails that appear to come from legitimate sources. These emails may prompt the victim to click on malicious links or provide sensitive details under the guise of verifying their identity.

Vishing, or voice phishing, involves phone calls in which scammers impersonate bank representatives or trusted entities to extract confidential information directly from the victim. Similarly, smishing involves text messages that lure individuals into divulging critical data.

Once armed with this personal information, the criminal can easily convince a bank to change the account holder’s address. This deception allows them full access to the victim’s financial accounts and resources.

Additionally, some criminals are skilled enough to bypass bank interaction altogether. They can use the obtained credentials to log into online accounts directly, executing unauthorised transactions without needing any further verification.

The consequences for victims can be devastating, leading not only to financial loss but also emotional distress as they recover their stolen identities and secure their accounts. Consequently, individuals must remain vigilant and understand these risks to protect themselves against potential account takeovers for repair. Additionally, they may find themselves tangled in legal disputes as they try to prove their innocence.

Recovering from such a violation requires diligence and time, making it crucial for individuals to safeguard their personal information vigilantly. Implementing measures like shredding sensitive documents and monitoring credit reports can help prevent these types of crimes before they occur.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.

The post AI as a supplement for professional bankers appeared first on Maxthon | Privacy Private Browser.