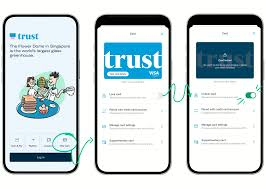

Trust Bank is introducing a feature that allows users to lock specific amounts in their bank accounts, requiring additional steps to transfer money out. This includes:

Image may be NSFW.

Clik here to view.

- Logging into the Trust Bank app

- Tapping a physical debit/credit card on an NFC-compatible phone

- Entering a six-digit personalized key

- Waiting 12 hours after unlocking before funds can be withdrawn

This security measure is a response to Singapore’s significant scam problem. In 2023, victims lost a record S$1.1 billion (over S$3 million daily).

The feature is being presented as a “market-first” tool that adds security without sacrificing convenience. While other banks have account locking features, they typically require customers to visit ATMs or bank branches to access locked funds.

Image may be NSFW.

Clik here to view.

The article also notes that modern scammers often trick victims into downloading malicious apps that give scammers remote control of phones, allowing them to drain bank accounts. Another tactic involves convincing victims they’re under investigation and need to transfer money to “aid investigators.”

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.

Image may be NSFW.

Clik here to view.

Image may be NSFW.

Clik here to view.

Image may be NSFW.

Clik here to view.

The post Trust Bank’s new security measures appeared first on Maxthon | Privacy Private Browser.